GF Viewpoint | Shenzhen: China's Success Story

By Edward Tse, Rachel Hu, Mandy Lin

November 2021

A recent Gao Feng Advisory Viewpoint authored by CEO Dr. Tse and Senior Consultants Rachel Hu and Mandy Lin.

Introduction

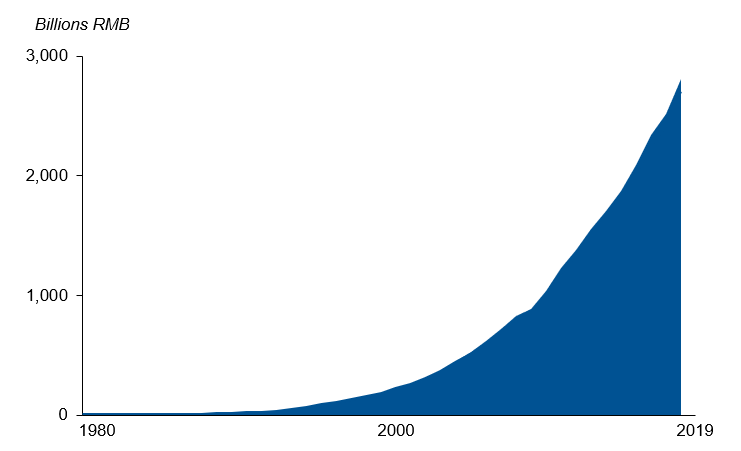

Over the past 40 years, Shenzhen has become a landmark in China's reform and opening-up drive. Home to some of China’s most well-known companies such as Huawei, Tencent, Ping An and BYD, it generates over 2.7 trillion RMB (US$420 billion) in GDP (see Exhibit 1). If it were a country, it will rank 31st in the world, right behind Norway.

Exhibit 1

Shenzhen’s GDP Growth from 1979-2019

Source: CEIC Data

Shenzhen has been able to grow from a small fishing village to being viewed as a leading technology hub not only in China, but also in the rest of the world. Nowadays, regions and cities across the world are eager to benchmark the lessons from Shenzhen’s growth and to replicate its experience.

Ascending the Global Industrial Value Chain

Shenzhen’s story has evolved in several phases. When China’s reform and opening up began in the early 1980s, Shenzhen was designated as one of the first special economic zones. This meant it could experiment with new ways of development without having to strictly follow the rest of the country. Its main focus during this period was to become an export base for labor-intensive products catering mostly to the western markets.

Shenzhen’s proximity to Hong Kong gave it a convenient and well-funded launch pad for such ventures. As such, its companies began to take over industrial activities, hitherto performed by Hong Kong companies. Over time, while sectors such as apparel, shoes and toys continued to grow, the consumer electronics sector began to stand out and companies in Shenzhen started broadening their horizon to cover other Asian and Western countries. These companies were attracted to policies of the special economic zone that ensured a low-cost pro-business environment, rapid industrialization and infrastructure building in Shenzhen. Cheap labor was also flocking in from the rest of the country.

Along the way, two important policies helped. First, the Shenzhen government began to sell (or long-term lease) parcels of land to real estate developers, a revenue generation method it learned from Hong Kong. This way, it began to accumulate an income that funded the construction of basic infrastructure such as transportation and telecommunications systems at a swift pace, an important enabler for Shenzhen’s industrialization.

Proactive and Swift Re-Positioning

Around the early to mid-2000s, labor-intensive processes started to move elsewhere within China or to other Asian countries as rising costs in Shenzhen began to dampen its competitiveness. The local government realized Shenzhen needed to evolve and started to prepare the city for the next stage of development. The chosen focus area at this stage was high-technology industries, most of them the first of their kind in China. There was a new push for development of industrial parks. The favorable business conditions and the on-going restructuring of the global industrial value chain in advanced electronic products promoted a new wave of investment in capital and technology-intensive manufacturing. This saw Shenzhen move up the global industrial value chain, especially in electronics. Of course, the foundation was its existing electronics manufacturing heritage, which prepared Shenzhen for this shift.

Massive investments by foreign and local enterprises boosted local innovation in advanced electronics manufacturing as well as logistics and financial services. As a result, a web of supply chains for advanced electronics and an ecosystem of designers, engineers, parts suppliers, manufacturers and testing facilities emerged in Shenzhen. An environment where hardware innovations could be rapidly prototyped came into being.

One well-known example of this is the mobile phone. The likes of Nokia, Motorola and Samsung in the early 2000s and later Apple with its smartphone, all chose to manufacture at least some parts of their products in Shenzhen. A mobile phone could be produced cheaply and quickly in Shenzhen and numerous inventors and innovators continuously improved on the products and developed new capabilities. It was from this environment that the likes of Huawei, Oppo and Vivo (all companies born from the Shenzhen area) began to produce innovative new phone products.

Proactive Role of the Government

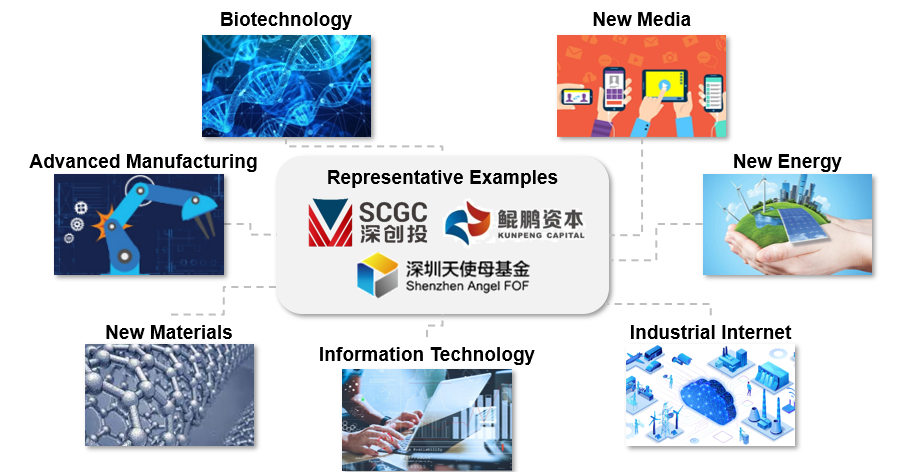

Meanwhile, Shenzhen also started to set up city investment funds for startups in chosen sectors (see Exhibit 2). At the start, the focus was on advanced electronics, where Shenzhen already had proven strengths and this has since been broadened to a number of areas such as new energy, automotive and biotechnology, just to name a few. As one of the earliest governments to start guidance-funds (investment funds that include public capital), not only did this fuel local innovation, it also quickly helped to develop the private equity and venture capital market in Shenzhen.

Exhibit 2

Examples of Shenzhen’s Guidance Funds and their Invested Sectors

Source: Gao Feng analysis

Now, Shenzhen is at the heart of China’s economic development. In 2020, the total value of exports from Shenzhen amounted to 1.7 trillion RMB (US$265 billion), leading the country for over twenty years. Shenzhen is not only a manufacturing base but also a thriving center of technological innovation and disruption, constantly moving towards the high value-added part of the global industrial value chain.

It’s home to some of the most well-known domestic and foreign companies, attracting talent and investment from all over China and the rest of the world. A large number of leading foreign multinational corporations have set up their operations in Shenzhen, such as IBM, Compaq, Xerox, DuPont, all of which have brought additional financial, technological, and human resources. Leading local companies such as Huawei, Tencent, BYD, TCL, Ping An Technology, DJI and SenseTime are also based in the area.

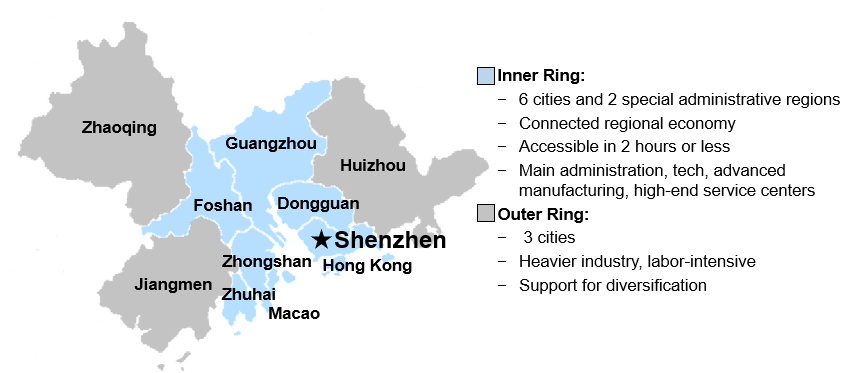

An Engine for the Greater Bay Area

Shenzhen now also takes on an even greater role in the overall context of China as it holds a key strategic position in the Greater Bay Area (GBA), a major city cluster in China’s development (Exhibit 3). As mentioned in the Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area, released in February 2019, Shenzhen is to lead technology and innovation development while cooperating with other cities to ensure comparative advantages are utilized and their full potential can be unleashed. For example, electric battery and automaker BYD is headquarters in Shenzhen but has its battery factory located in Huizhou, while some of Hong Kong’s innovative laboratory breakthroughs are often commercialized in Shenzhen.

Exhibit 3

The Guangdong-Hong Kong-Macao Greater Bay Area

Source: General Office of the State Council of the People's Republic of China, Gao Feng analysis

What Made Shenzhen Succeed?

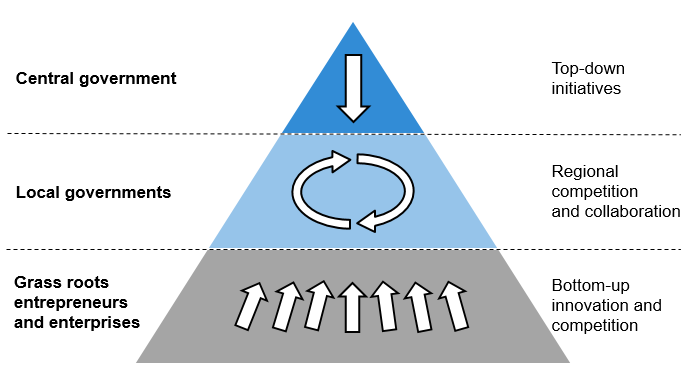

Various factors have enabled Shenzhen to leapfrog and reach its current position. First is the unique governance structure of China, which Shenzhen has fully embodied (see Exhibit 4). This unique structure ensures the alignment of goals of the local and the central government which enables the local government to trigger innovation among grassroots entrepreneurs. Additionally, China’s dual economic structure of SOEs and private sector enterprises means that SOEs help ensure the development of public goods such as infrastructure, sometimes disregarding a narrow definition of economic returns for broader social betterment. Private sector enterprises including both local and foreign ones take advantage of these infrastructures to build their businesses.

Exhibit 4

China’s Three-Layered Governance Structure

Source: Gao Feng analysis

This governance approach draws from the roots of China’s reform and opening up, led by Deng Xiaoping way back in the early 1980s, when market economy experiments were inducted into a planned economy system. The balance between a planned and market economy and synchronization between top-down government directives and bottom-up entrepreneurial pursuits were constantly subject to adjustment, to ensure they cater to the evolving context. In the broader scheme of things, this approach is inclusive in nature as it can accommodate new ideas when they surface and are deemed appropriate. As such, it is consistent with the Chinese culture’s history of inclusivity of multiple schools of thinking, blended in ways that make sense.

Shenzhen has also created a supportive environment from multiple dimensions. Since the 1990s, Shenzhen has established a number of high-tech industrial parks to support continuous development and growth of high-tech industries. Capital continues to flow in, with funding from both public and private sources, pumping money where it is most needed. Moreover, Shenzhen has continued to improve its talent pool. From establishing the “Talent Exchange Service Center” in 1984 to investing more than a billion RMB per year since 2010 are some of the steps taken to cultivate talent. The local government continues to leverage the dynamism and creativity of private sector enterprises to generate innovations.

Implications

Of course, Shenzhen has met with bumps on its way to growth, for instance, its rising housing costs. However, it has become a shining example of the power of China’s governance approach and the role that a government can play in partnership with businesses for transforming a region. The Shenzhen story has valuable lessons that can be adapted by other governments in other countries to their individual situations. Going forward, we expect Shenzhen will play an even more important role in the development of the Greater Bay Area, setting the stage for further development.

About the Author

Dr. Edward Tse is founder and CEO, Gao Feng Advisory Company, a founding Governor of Hong Kong Institution for International Finance, Adjunct Professor of School of Business Administration at Chinese University of Hong Kong , Professor of Managerial Practice at Cheung Kong Graduate School of Business and Member of Advisory Board, Institute for China Business and HKU SPACE Executive Academy. One of the pioneers in China’s management consulting industry, he built and ran the Greater China operations of two leading international management consulting firms (BCG and Booz) for a period of 20 years. He has consulted to hundreds of companies, investors, start-ups, and public-sector organizations (both headquartered in and outside of China) on all critical aspects of business in China and China for the world. He also consulted to a number of Chinese local governments on strategies, state-owned enterprise reform and Chinese companies going overseas, as well as to the World Bank and the Asian Development Bank. He is the author of several hundred articles and five books including both award-winning The China Strategy (2010) and China’s Disruptors (2015), as well as 《竞争新边界》 (The New Frontier of Competition), which was co-authored with Yu Huang (2020).

Rachel Hu is a Senior Consultant at Gao Feng Advisory Company based in Shanghai. She had consulted many clients in both China and Australia, focusing on growth strategy, new market entry and business model design. She has worked with clients across many sectors including automotive and connected mobility, healthcare, industrials and technology.

Mandy Lin is a Senior Consultant at Gao Feng Advisory Company based in Shanghai. She has provided consulting services to many multinational and local clients across many sectors including automotive, industrials, logistics, technology, and healthcare. She specializes in strategy formulation and innovative business model development.

Gao Feng Advisory

Gao Feng Advisory Company is a professional strategy and management consulting firm with roots in China coupled with global vision, capabilities, and a broad resources network

Wechat Official Account:Gaofengadv

Shanghai Office

Tel: +86 021-63339611

Fax: +86 021-63267808

Hong Kong Office

Tel: +852 39598856

Fax: +852 25883499

Beijing Office

Tel: +86 010-84418422

Fax: +86 010-84418423

E-Mail: info@gaofengadv.com

Website: www.gaofengadv.com

Weibo: 高风咨询公司