China's Health Services Sector's Post-pandemic Evolution

How will China’s Health Services (“Big Health”) Sector Evolve in the Post-pandemic Era?

By Edward Tse, Jackson Zhu, Charlson Tang

October 2020

A recent Gao Feng Advisory Viewpoint authored by CEO Dr. Tse. It was co-authored with Jackson Zhu and Charlson Tang. This is the English version of orginal in Chinese with title "后疫情时代,大健康产业将如何发展?"

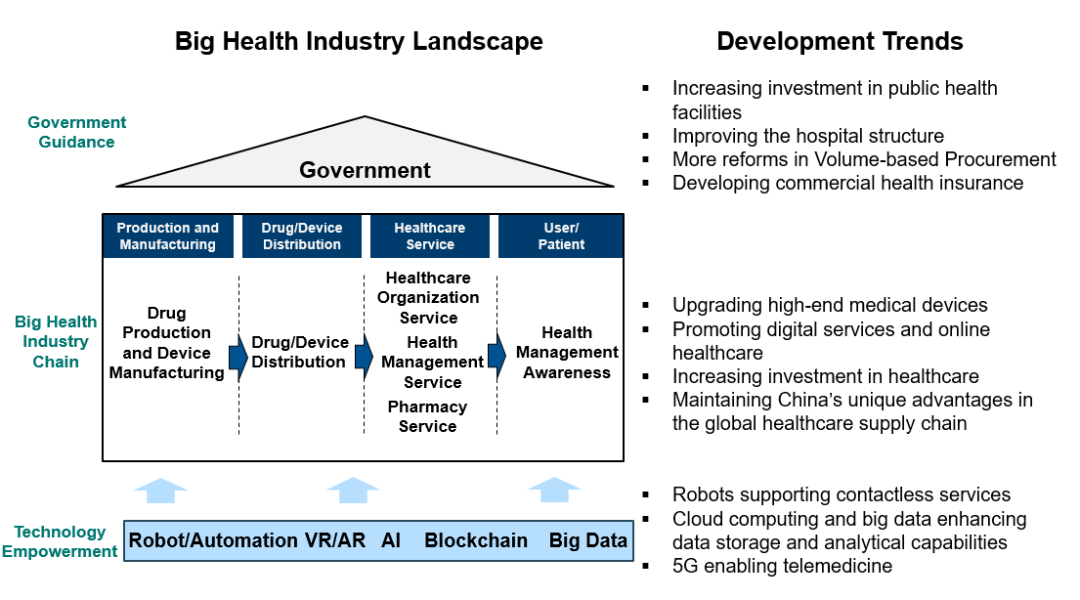

COVID-19 has become a global pandemic and the public health issues have received widespread attention from all sectors of society and local governments. In China, the virus has been contained in merely one half of a year through effective government control and recovery of economic and social order is already on track. As an industry directly related to the pandemic, the health services industry in China (often referred to as “Big Health”) has been developing at a high speed, driven by China’s “Big Health” government policy and technology development. A number of new trends and opportunities have emerged upstream and downstream of the sector’s value chain (see Exhibit 1).

Exhibit 1

China’s “Big Health” Industry Landscape

Sources: National Health Commission, National Bureau of Statistics of China, Gao Feng analysis

1. Increasing Investment in Public Health Facilities

The pandemic has exposed shortfalls in public health services, especially in disease prevention, control and treatment, and will continue to be a significant driver of more government investment and spending in this sector. Ou Xiaoli, Chief of Social Development at the National Development and Reform Commission, has announced that the central government will double investment in the public health sector over last year’s figure. Furthermore, he said, “in the near future, the central government will focus on upgrading public health facilities to reinforce seven capabilities and improve three guarantees.”

According to Ou Xiaoli, the seven capabilities are the capability for patient reception and diagnosis of fever clinics, patient reception and treatment by clinics converted for the pandemic, ICU-convertible treatment, lab testing, pandemic screening, medical waste disposal and emergency treatment. The three guarantees are as follows. First, the government will improve treatment of the critically affected by the pandemic, supporting each province to upgrade one to three of treatment bases for handling critical pandemic situations. Second, the government will improve inventory of medical supplies for emergency situations by directing healthcare institutions to store sufficient medical facial masks, protective suits and goggles and other materials. Third, the government will prepare a back-up plan that ensures sufficient medical supplies and each local government should clearly know the distribution of emergency facilities including designated hospitals, mobile cabin hospitals as well as the order to use them.

2. Improving the Hospital Structure

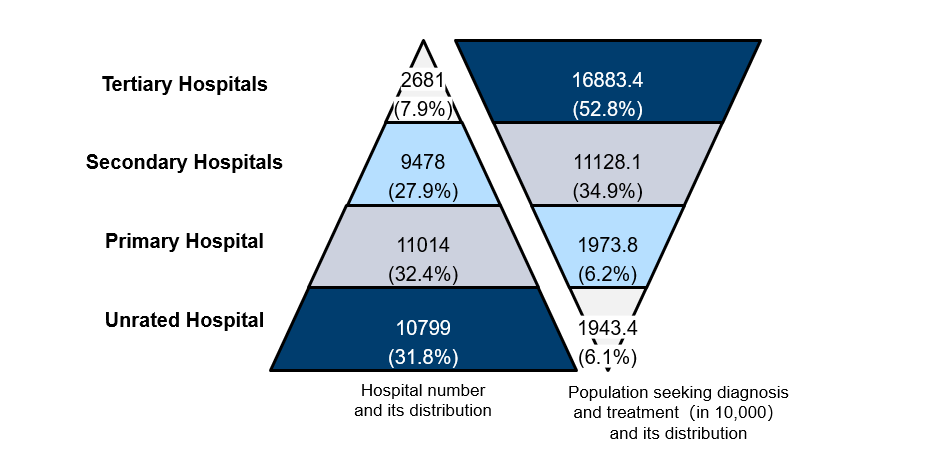

In terms of the healthcare system as a whole, we have noticed that the Chinese government is further improving its hierarchical hospital structure. Still at its early stage, China’s hospital system is unable to fully utilize current medical resources to meet medical needs (see Exhibit 2). As of November 2019, the number of tertiary hospitals, i.e. hospitals providing high-level specialized medical and health services, accounted for about 8% of all hospitals in China but they actually accounted for more than half of the medical treatment provided in the country. The pandemic also exposed the cracks in emergency treatment capacity that are attributable to this imbalance. Therefore, the government will actively promote the implementation of the hierarchical hospital structure.

Exhibit 2

Supply-and-Demand Imbalance of Medical Resources

Source: National Health Commission, National Bureau of Statistics of China, CN-HEALTHCARE, Gao Feng analysis

Primary Hospitals, Unrated Hospitals

3. More Reforms in Volume-based Procurement

The Volume-based Procurement (VBP) scheme allows companies who have passed the Generic Quality Consistency Evaluation (GQCE) to bid for up to 60-70% market share in designated drugs in pilot cities. The successful bidder will be the one offering the lowest price. GQCE is used to ensure that generic drugs have quality and efficacy equivalent to that of branded drugs. VBP aims to effectively reduce the market price of the designated drugs. For example, comparing quotations of the 25 VBP drugs in 11 cities in 2019 with their lowest purchase price in 2018, the average drop was 59% while the highest drop was 96%. Since China’s 2020 first-quarter GDP has experienced an year-on-year decline of 6.8% and expenditure on pandemic prevention and control nationwide has reached 116.9 billion RMB, we anticipate that the medical supplies procurement budget will be further reduced, which will accelerate the development of VBP.

4. Developing Commercial Health Insurance

Meanwhile, the Chinese government should move toward a healthcare system that centers on basic health insurance and is underpinned by medical aid and commercial health insurance. To improve the current healthcare system, the Communist Party of China Central Committee and the State Council unveiled on March 5th a guideline on deepening the reform of China’s medical system (hereinafter the Guideline). The Guideline aims at establishing a multi-layered healthcare system by providing a sound critical illness insurance and medical aid, and boosting mutual complementarity and coordination of various healthcare tools and systems. It has also proposed more clearly plans to accelerate the development of commercial health insurance and diversifying the range of health insurance products to alleviate the healthcare burden of people. Considering the surge of online healthcare services during the pandemic, the Guideline also makes sure that online healthcare expenditures could also be covered by the national health insurance.

Technology Accelerating Industry Innovation

We have also observed the important role played by technology in boosting “Big Health” amid this pandemic. The integrative innovation which encompasses artificial intelligence (AI), big data and cloud computing will advance further in the future.

1. Robots Supporting Contactless Services

In this pandemic, robots effectively alleviated the burden of medical personnel in diagnosis, operations and medical supplies, and reduced the infection risk, by facilitating contactless diagnosis and treatment. For example, the intelligent guidance robots can offer services that include hospital guided tours, pre-checks, health awareness education, hospital introduction and others. This could effectively reduce the workload of the medical staff when there is a sudden increase in the number of people required to be served. Every medical supply transportation robot can take on transportation work for 2-4 people with its advanced sensation and route design technology. Remote fever detection and decontaminating robots also contributed a lot to pandemic control.

2. Cloud Computing and Big Data Enhancing Data Storage and Analytical Capabilities

Cloud computing and big data can significantly improve data storage and analytical capabilities in the healthcare system. The main application scenarios include data-sharing platforms, electronic medical records and drug development. The information-sharing platform can report how the pandemic is evolving, update on regulations for pandemic prevention and control, guide on pandemic prevention and treatment, and other similar functions. The platform could also collect relevant data on people entering certain regions and conduct holistic analysis to help the government fully track the demographics of returning citizens. This truly realizes “efficient information collection, real-time analysis and precise report.” During the drug and vaccine development period, viral genome sequencing, viral isolation, drug screening, new drug development all require enormous data analysis, literature screening and scientific super-computing. Cloud-computing could provide stable and efficient computing support for that.

3. 5G Enabling Telemedicine

As China has become a global leader in 5G technology, scaled commercialization is about to come. By June 6th, 2020, telecommunications infrastructure companies have constructed more than 250,000 5G base stations that have been installed in China. By the end of 2020, China is expected to build more than 600,000 5G base stations, covering all the prefecture-level and above cities. Meanwhile, in the annual Central Economics Work Conference, it was proposed that China should speed up the pace of 5G commercialization and convert 47% of the total mobile users to 5G users by 2025. Featuring low latency and broad band, 5G can improve the current telemedicine that is yet to mature or even push it to a breakthrough. Unlike the medical consultation which is limited to text or videos, medical consultations in the 5G era will incorporate virtual reality and augmented reality to upgrade the visual and tactile sensation during the consultations and will even enable real-time operations for patients in remote areas by operating the medical devices remotely. Although the technology is still at an early stage, it will unleash great potential opportunities in the future.

Emerging New Trends

Driven by policies and technologies, there are several major trends in China’s Big Health sector, including upgrading of high-end medical devices, promoting digital services and online healthcare, increasing investment in healthcare and maintaining China’s unique advantage in the global healthcare supply chain.

1. Upgrading High-end Medical Devices

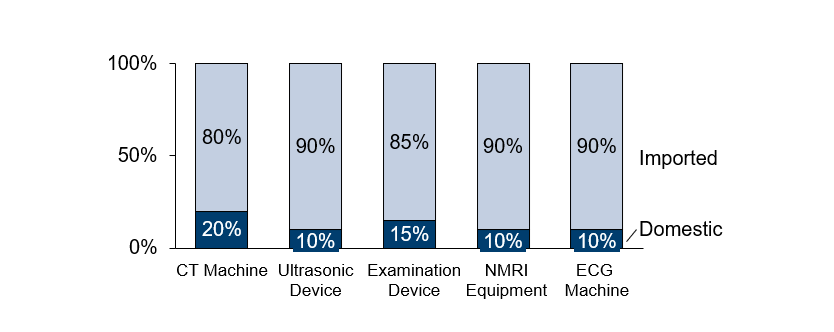

First and foremost, the future Big Health sector will put more emphasis on the country’s strategic reserves of medical supplies and resources and upgradation of high-end medical devices. According to Blue Book of Medical Device Industry in China, more than 80% of certain categories of high-end medical equipment, including CT machines, ultrasonic machines, testing devices and ECG machines are imported from foreign countries (see Exhibit 3). However, according to Made in China 2025 initiative, the Ministry of Industry and Information Technology has already stipulated that local high-end medical devices should account for at least 50% of the total number of devices in county-level hospitals by 2020 and this percentage should increase to 70% by 2025. The shortage of local high-end medical devices came to fore during the pandemic and insufficient independent emergency response will further drive the progress in domestic manufacture of high-end medical devices.

Exhibit 3

Partial Imported/Domestic High-end Medical Devices Proportion

2. Promoting Digital Services and Online Healthcare

Second, digitalization and intelligentization in Big Health is getting increasingly accelerated due to the pandemic. Investment in digitalization of health services industry increased from 37.6 billion RMB to 75 billion RMB in 2019, resulting in a compound annual growth rate of 10.6%. This number is expected to exceed 20% in 2020 and shall keep growing in the following years. 72% of the hospitals have established hospital information management systems and 62% of the hospitals have electronic medical record systems.

Additionally, online healthcare services, especially online medical platforms, have grown exponentially during the pandemic. According to The Economist, the market size of the online healthcare market has surged from 22.3 billion RMB in 2016 to 68 billion RMB in 2019, expected to achieve a breakthrough in 2020. During the 2020 Chinese New Year Festival, the daily active users of Ding Xiang Yuan, a well-known healthcare information sharing website in China, grew by 222.2% on a year-on-year basis due to COVID-19. The number of daily active users of Ding Dang Kuai Yao, an online-to-offline drug purchasing and delivery platform, has surged by 952.6% on a year-on-year basis, while Ping An Good Doctor, a one-stop medical and health services platform, had a 900% increase in its daily average number of consultations among the new users. The public hospitals also offer online medical services. Currently, more than 240 public hospitals offer medical consultation and pandemic prevention information through online platforms such as WeChat and Alipay.

3. Increasing Investment in Healthcare

While the growth in digital healthcare and online healthcare remains robust, China will continue to attract investment in healthcare and supporting industries including biotechnology and health technology. On March 23rd, InnoCare Pharma, a Chinese biopharmaceutical company committed to developing drugs for treatment of cancer and autoimmune diseases, raised $289 million in an IPO, which will be invested in development of drugs for cancer and autoimmune diseases. This April, Akeso Biopharma, a Chinese innovative biotechnology company, announced a $333 million Hong Kong IPO, the largest IPO on the Hong Kong Stock Exchange, with 75% of the fund to be invested in R&D for cancer and autoimmunity product development and commercialization. Qiming Venture Partners, a leading Chinese venture capital firm, has just announced a new $1.1 billion fund for investment specifically in biological and health technology.

4. Maintaining China’s Unique Advantages in the Global Healthcare Supply Chain

The pandemic has led to reshaping of the global supply chain across different sectors. Competition in the global Big Health supply chain will also inevitably become more intense. China’s unique position in the global supply chain will face challenges but is less likely to be replaced due to its unique advantages, including its current manufacturing capabilities, proximity to the huge domestic market, and the agility to respond to market changes. China’s progress in technology and innovation will also be critical to support the rapid growth of China’s supply chain post-pandemic.

Takeaways for Companies

With policies, demand, supply and technology all in play, China’s Big Health is about to embrace more disruptive changes. From the demand side, we will see more diversified consumption patterns. From the supply side, we will see more emerging players entering the market. Some of them are traditional healthcare companies while others will be new players, or even “barbarians”, companies from other industries who see the potential in Big Health.

Driven by technology and capital, these companies will keep devising strategies to build their competitive advantages through innovation. China’s future Big Health sector could be a feast for the players involved. Healthcare companies need to adjust their strategies in time amid the pandemic.

First, they should re-examine their existing products and services, and make strategic adjustments accordingly to deliver the best cost-effective solutions. For example, some companies may have to remove products with limited profitability or adjust the sales model from direct sales to distribution. Foreign multinational companies should consider more localized strategies in China, such as establishing local manufacturing bases and cooperating with more local R&D and manufacturing partners.

Second, healthcare companies should pay more attention to improving online and offline distribution channels. As China has successfully contained the pandemic, traditional face-to-face offline sales have gradually recovered, while online channels will still exist for a long time. However, medical costs have remained high for years due to the profit sharing of offline channel distributors. During the pandemic, more and more healthcare companies are increasing their efforts on direct sales to increase their profitability. Coupled with the government’s series of policies to address this issue, including the Volume-based Procurement program we mentioned above, the traditional distribution model is likely to be completely disrupted.

Third, innovation is critical for healthcare companies. As mentioned above, with digitalization being one of the long-term trends of China’s healthcare system, healthcare companies need to explore relevant technologies to enhance competitiveness. Besides, the National Medical Products Administration also keeps exploring new supervision approaches in order to speed up the development and approval of innovative healthcare products.

Conclusions

The pandemic has driven restructuring of the global supply chain. This means not only crises but also opportunities for multinational companies. The promotion of a hierarchical hospital structure will bring numerous opportunities to cooperate for healthcare companies. Development of commercial health insurance is also expected to inspire more business innovations, and the “New Infrastructure” proposed in this year’s Two Sessions will further enable the landing of more smart healthcare scenarios. There will be more "blue oceans" in the Big Healthcare sector in the future.

For human society, the pandemic is no doubt a crisis. However, just as history always advances at a similar pace, the pandemic also presents many opportunities, and the Big Health sector is one of them. Companies involved shall embrace the changes, increase their capabilities to be able to adapt quickly, and get on the fast-growing train.

About the authors

Dr. Edward Tse is founder and CEO, Gao Feng Advisory Company, a founding Governor of Hong Kong Institution for International Finance and Adjunct Professor, School of Business Administration, Chinese University of Hong Kong. One of the pioneers in China’s management consulting profession, he built and ran the Greater China operations of two leading international management consulting firms (BCG and Booz) for a period of 20 years. Australia’s In The Black magazine calls him, “the Father of Business Consulting in China.” He has provided consulting to hundreds of companies, investors, start-ups, and public-sector organizations (both headquartered in and outside of China) on all critical aspects of business in China and China for the world. He has also advised a number of Chinese local governments on strategies, state-owned enterprises reform and Chinese companies going overseas, as well as to the World Bank and the Asian Development Bank. He is the author of several hundred articles and five books including the award-winning The China Strategy (2010) and China’s Disruptors (2015), as well as 《竞争新边界》 (The New Frontier of Competition), which was co-authored with Yu Huang (2020).

Jackson Zhu is a Shanghai-based senior executive advisor of Gao Feng Advisory Company. He has over 20 years of business management experience in healthcare and consumer healthcare industries, including corporate management, marketing and M&A.

Charlson Tang is a Shanghai-based senior consultant of Gao Feng Advisory Company. He has served multiple Fortune 500 companies and leading companies in China. He specializes in market entry strategies, corporate growth strategies and business model design.

Wechat Official Account: EdwardTse_GF

Dr. Edward Tse

CEO of Gao Feng Advisory

Gao Feng Advisory

Gao Feng Advisory Company is a professional strategy and management consulting firm with roots in China coupled with global vision, capabilities, and a broad resources network

Wechat Official Account:Gaofengadv

Shanghai Office

Tel: +86 021-63339611

Fax: +86 021-63267808

Hong Kong Office

Tel: +852 39598856

Fax: +852 25883499

Beijing Office

Tel: +86 010-84418422

Fax: +86 010-84418423

E-Mail: info@gaofengadv.com

Website: www.gaofengadv.com

Weibo: 高风咨询公司