New Structural Changes in China’s Electric Vehicle Market

By Edward Tse and Rachel Hu

November 2022

A recent Gao Feng Advisory Viewpoint authored by CEO Dr. Tse and Senior Consultant Rachel Hu.

Already the world’s largest electric vehicle (EV) market and the largest EV exporter, China’s automotive industry continues to maintain its momentum. In the first half of 2022, EV sales in China rose to almost 18% of total car sales, while in comparison, EV sales made up only 11% in Europe and just over 5% in the US, of total car sales.

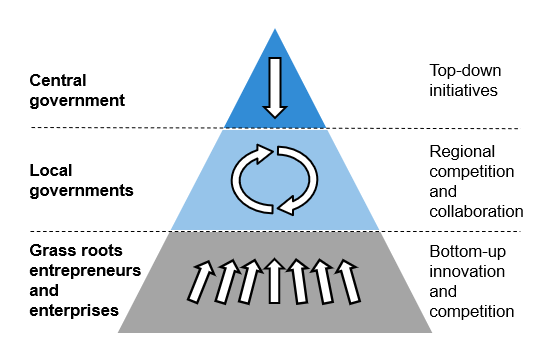

Industry Development and the Governance Model Behind It

Development of the EV industry in China has not been a coincidence. The Chinese governance model is the fundamental reason why the industry has developed so successfully and so fast. The structure of the governance model (Exhibit 1) responsible for the extraordinarily fast growth of EVs comprises of three layers. The top layer is the central government which has made the transition to EVs a key strategic component of China’s long-term development. Financial subsidies (such as the 2012 “Interim Measures for the Management of Financial Incentive Funds for Technological Innovation in the New Energy Vehicle Industry”) have been a major policy initiative to promote the development of EVs over the past decade. Going forward, the central government aims to have charging infrastructure for more than 20 million cars in place by 2025. It has set the goal of increasing the share of EVs in sales of all vehicles to 40% by 2030.

Exhibit 1

China’s Governance Model – a Three-layered Approach

Source: Gao Feng analysis

In alignment with the central government’s policy, local governments provide specific support to qualified businesses in respect of land and other infrastructure facilities, besides financial support. Given policy guidance and government support, businesses strive to innovate throughout the EV value chain for competitive advantages.

Hefei (capital of Anhui province in the Yangtze River Delta region), is a good example of this. The city is now becoming a hub for EV development in China. It is planning to build a national innovation center for EVs and launch self-driving demonstration and operation zones, besides allowing EVs to use dedicated bus lanes and have free access to highways around urban areas. By the end of 2025, all buses and taxis and postal services, logistics and sanitation vehicles in Hefei will be electric. In 2019, NIO, a key local EV OEM which was a “start-up” not long ago, made Hefei its new base due to the favorable treatment the province provided. The City made a 7 billion RMB strategic investment in NIO and by 2021, the venture had started building a smart electric vehicle industrial campus in cooperation with the Hefei government, to integrate R&D, manufacturing, pilot demonstration and applications, and industrial support services.

The Shanghai government and its various districts and special economic zones have also made similar moves to build EV ecosystems. Lingang Special Area in the municipality has unveiled around 50 preferential policies related to administrative approvals, finance, taxation, industrial development, and housing to make it a more friendly place for business and attract talent to the EV industry. Tesla is of course the prime example of the kind of support the government is willing to provide. Tesla has received cheap land, low-interest loans from state-owned banks and tax incentives from the Shanghai and Lingang governments. Tesla was provided over US$207 million in subsidies in 2019 and 2020, in cash and in the form of assets and services. Led by Tesla, Lingang Special Area has built a "safe, autonomous and controllable" EV industrial ecosystem, covering automobile chips, driving systems, interiors, body, new materials, and precision machinery.

In a similar vein, the Jiading District in Shanghai has continued to build an ecosystem that focuses on intelligent vehicle software in particular, the goal being to develop it into a leading automotive software center. Not only has it been a key hub for testing autonomous driving for the past couple of years, it has also opened China’s first intelligent vehicle software park in September 2022, and has set a revenue target of over RMB 50 billion (US$7 billion) for 2025.

Quickly Shifting Competitive Landscape

With sharply increasing demand and many new entrants, the competitive landscape in the EV industry of China has become highly intensive and fluid. Local players such as BYD, GAC, Chery and Geely, as well as a Sino-foreign joint venture (JV) SAIC-GM-Wuling have taken significant positions in the market, with Tesla being a standout among the foreign players.

Leading the pack is Chinese EV and battery giant BYD, which has captured the demand for moderately priced EVs. BYD sales of EVs ranked first in China and second globally in Q3-2022 when sales were up 182% to 258,610 EVs. Its Han model was the bestselling among medium-to-large size segment in October 2022. Its premium EV brand Yangwang is slated to be launched in 2023. BYD also produces batteries and after overtaking LG Energy, it has now become the second largest producer of vehicle batteries, next only to CATL. Its “Blade” battery set is considered by many as an innovative product. It now supplies batteries to many of its “competitors” in the auto market, including Tesla, Ford, Toyota, PSA group, Daimler and Dongfeng.

SAIC-GM-Wuling, a JV between General Motors (GM) of the US and China’s SAIC and Wuling, has found great success in the mini car niche. Its Hongguan Mini model was the top selling EV model in China in 2021, selling almost 400,000 units. Chinese consumers have been attracted by its affordability (priced around US$4,500) and it has become popular particularly among the younger consumers.

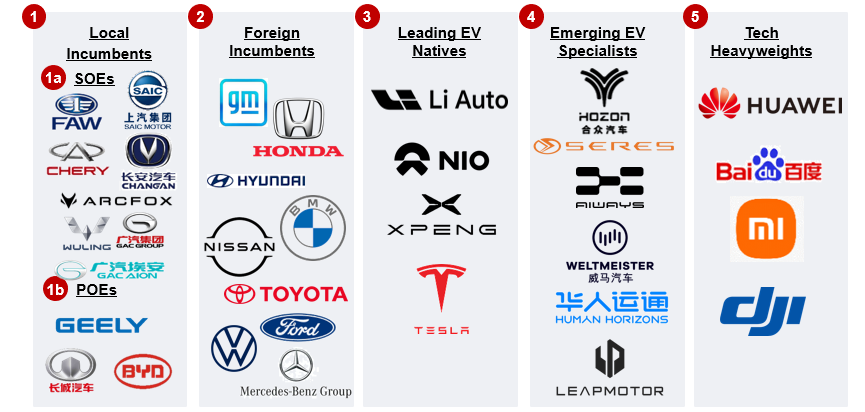

The so-called “New Forces” trio of NIO, XPeng and Li Auto who appeared around 2014-2015, now represent a new generation of Chinese homegrown “EV native” players who have been able to build a broad brand awareness in the market. In the same vein, a range of other new players have emerged. The list of EV natives is rather long. The emerging names include the likes of Hozon Auto, Seres, WM Motor and Aiways. Some are EV subsidiaries of incumbent OEMs like GAC’s Aion and BAIC’s Arcfox while some are players from other tech industries, like Huawei and Xiaomi. Of course, foreign OEMs like BMW, Volkswagen and Ford are also investing significantly in the Chinese EV market (see Exhibit 2).

Exhibit 2

Categories of EV Players in China

Source: Gao Feng Analysis

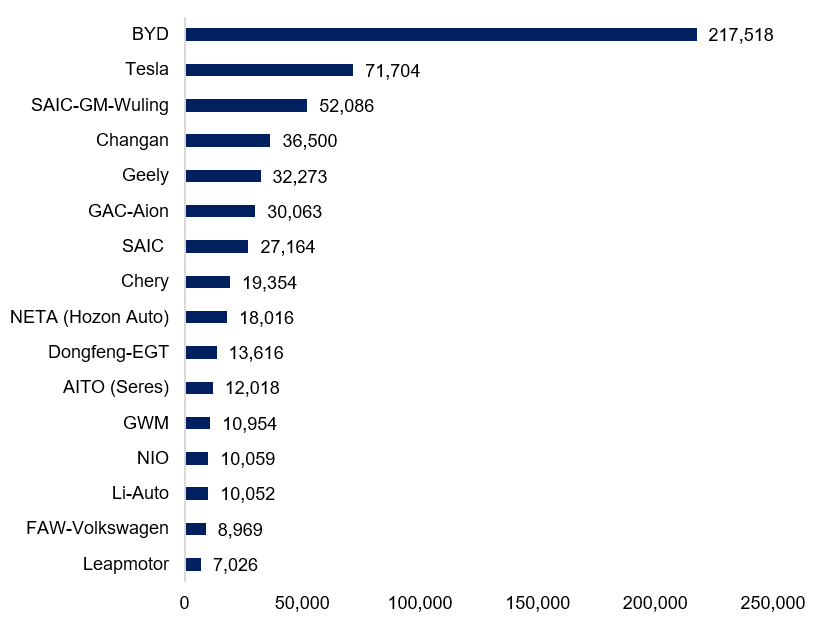

While BYD and Tesla are leading the EV market, others are fighting hard for the rest of the market. Drastic shifts in sales of different EV players are happening every day. EV sales of major players like GAC Aion, NETA (Hozon Auto) and AITO (Seres) in October 2022 are depicted in Exhibit 3.

Exhibit 3

China's NEV Sales Ranking in October 2022 (Top 15)

Source: CPCA

International Ambitions

It’s not just the local market Chinese players have set their sights on; many Chinese OEMs are beginning to gain ground overseas also, particularly in Europe. In the first half of 2022, China’s EV exports to Europe reached 20.7% of the total. Europe is open to imports of EVs from China and constitutes a huge opportunity as it is the second largest market for EVs in the world. Lower costs in China offset much of the cost of shipping to the Continent.

BYD aims to sell four million vehicles in 2023, doubling estimated sales in 2022. To achieve this goal, BYD has started selling three of its passenger EV models in Europe. Deliveries to Germany and Sweden began in Q3 2022. In addition, Sixt (a large German car rental company) has agreed to purchase 100,000 EVs by 2028 from BYD. This deal not only means sales and further opening up of future collaboration opportunities, but also brings the BYD experience to many more consumers who could eventually become buyers of BYD vehicles down the line.

Many other OEMs too are looking to ship China produced vehicles to Europe. SAIC shipped 10,000 of its model MG4 EVs from Shanghai to Europe in September, which constituted the largest single shipment of EVs from China.

NIO has also entered the markets in Norway, Germany, the Netherlands, Denmark and Sweden, with three models. It will expand its battery swap network to all European markets, with 20 stations due to open by the end of this year and growing to 120 by the end of 2023.

As Southeast Asia moves towards electrification, Chinese EV makers are poised to change the landscape of the auto industry here. Southeast Asia is currently one of the main export destinations for Chinese EVs. China shipped 362,200 EVs in the first half of the 2022 to SE Asia, more than double the quantity shipped in the same period last year.

Lower manufacturing costs are prompting many Chinese players to set up manufacturing facilities in the SE Asia region. BYD will set up a facility in Thailand with an annual capacity of 150,000 EVs per year in 2024. Great Wall Motor has created a subsidiary in Malaysia and will continue to expand its Malaysian market operations by increasing investment in the country and carrying out localized assembly in cooperation with domestic companies. Wuling has unveiled its micro EV produced in Indonesia in August, which is the brand's first electric vehicle to be produced and sold outside of China.

Because of the sterling growth, the EV supply chain in China is becoming increasingly sophisticated and upstream players continue to expand beyond the domestic market. Battery maker CATL will invest 7.34 billion euro (US$7.5 billion) to build a 100 GWh EV battery plant in Debrecen, Hungary to better cope with European demand. This venture is expected to improve its global production network and help accelerate e-mobility and energy transition in Europe. CATL will also partner with PT Aneka Tambang and PT Industri Baterai Indonesia for a nearly US$6 billion project that spans from nickel mining to battery materials and recycling in Indonesia.

Foreign Companies Tapping into China’s Auto Innovation

While Chinese players develop new markets, major foreign players are looking to invest more in China. These investments often fall into two categories.

In the first category, OEMs are increasing capacities in the auto value chain. BMW has invested US$2.2 billion in a new electric vehicles plant in Shenyang and is reported to have moved its electric MINI’s production from the United Kingdom to China. Tesla is mulling a second “Gigafactory” in Shanghai. Volkswagen will invest more than 140 million euro (US$164 million) to build 150,000 battery systems a year factory in Hefei, for Volkswagen Anhui’s all-electric models.

In the second category, OEMs are now looking to build new capabilities for innovation in China. Daimler is expanding its R&D in China with a new investment of over $US154 million. Volkswagen is not adding manufacturing capacity in Hefei but has inaugurated a R&D center for e-mobility. It will be a global center for competence and e-mobility hub for the group, and there are plans for expansion of local R&D competence in pure-electric models. BMW will invest a further RMB 10 billion (US$1.38 billion) to expand its high-voltage battery production center in China. Toyota, somewhat of a latecomer in the battery EV game, has built a JV with BYD for EV battery R&D in 2020. The Japanese carmaker expects to leverage BYD’s expertise in batteries as well as the Chinese EV market, while sharing its expertise in vehicle safety and quality technology.

The focus of many of these investments is software technology, as the trend increasingly sees tier-one OEMs shifting to becoming tier-two suppliers in the intelligent vehicle supply chain. Software is fundamentally restructuring the value chain and that will give rise to a new breed of players in the new space, i.e., new players shall be able to integrate systems to cater to the needs of the new generation of vehicles. Existing OEMs in this scenario are likely to lack software capabilities and shall look to form new corporate partnerships to acquire new capabilities through software leaning startups.

Volkswagen for example, has announced it would invest 2.4 billion euro in a JV with Horizon Robotics to develop best-in-class autonomous driving capabilities. Chinese self-driving startup Momenta has seen investments from the likes of GM and Daimler. Specifically, GM has invested US$300 million to accelerate the development of next-generation self-driving technologies for future GM vehicles in China in cooperation with Momenta. Another partnership between a foreign OEM and a Chinese tech player is that between Mercedes-Benz and Tencent, which shall establish a joint lab to speed up the development of self-driving technology in China.

Surviving China’s EV Race

Overall, the EV landscape in China is still at a relatively early stage and it is quite fragmented, with many players in the fray. While some players like BYD have started to lead, many are still fighting to carve their own positions.

With a large number of players in China’s EV industry, incumbents and new players included, the structure of the industry will probably be quite fluid for some time. Industry consolidation will likely take place going forward. The top set will likely consist of a handful of local and foreign players and a couple from “digital natives” and tech companies from adjacencies. This setting is likely to further narrow as the life cycle of the industry advances. Some foreign OEM players are likely to be phased out as they shall be fighting for an increasingly smaller share of the market. As such only a few of the foreign OEMs will remain, who are willing and committed to reinventing themselves in terms of technology, innovation, customer centricity, as well as ability and willingness to work with others to build a stronger capability base for more competitive advantages. They will likely include those who are continuing to invest in China. On the other hand, a large number of Chinese OEMs are likely to be phased out, meaning many of the new EV startups are unlikely to sustain in the long-term.

Some believe OEMs with backing of tech giants (for example, tech companies being investors) have a natural advantage in the EV game. They cite “digital DNA” of the investors and by inference, the ability to exercise “data monetization” as a reason. However, data monetization in the auto game is yet to be truly realized, and the impact of being connected to the “ecosystem” of a tech giant is probably a lot more limited than many assume. Also, some have been quick to predict that the incumbent auto OEMs, especially the foreign originated, have little chance to compete in China’s EV space. Whether that’s the case remains to be seen as the battle is still wide open. Many foreign auto brands have built strong brand equities in China. That heritage still has quite a bit of steam. The Chinese EV landscape is rather fluid in which many companies are working hard to come out ahead. Incumbent OEMs will need to learn, and where appropriate, re-invent themselves, to play the new game. But the incumbents can bring depth of experience and capabilities that often the start-ups don’t have.

Evolving Picture of New Corporate Relationships

Until recently, China’s auto industry was highly regulated. Foreign OEMs were required to form JVs with local OEMs if they wanted to manufacture vehicles in China and the foreign equity could not exceed 50%. In 2018, foreign ownership restrictions for NEVs were removed and foreign OEMs were allowed to run their businesses in China on a wholly owned basis. Since then, there has been a five-year transition period over which regulations for foreign companies were relaxed for all types of vehicles. Tesla took advantage of this and formed a wholly owned operation headquartered in Shanghai. Many people expected other foreign OEMs to follow suit. However, this didn’t materialize. Instead, a plethora of new corporate relationships emerged with different combinations of different types of players. Volkswagen has entered into a JV with Horizon Robotics while BMW has increased its stake in its JV with Brilliance Auto. Toyota has its new JV with BYD for battery technology and to make a new EV, while the JV between local players Huawei, Changan Auto and CATL has produced the new Avatr EV brand.

These new corporate relationships have emerged as different players are searching for new sources of competitive advantages in the new game. As the industry is gravitating towards electrification with intelligence and connectivity, the value chain is being re-defined and new capabilities are required to compete effectively. It would be difficult for any single player to possess all the capabilities needed in the new game, so the formation of new corporate relationships has become imperative.

This in turn drives more innovation. As such China is further reinforcing its position as the platform for innovation in the automotive sector. And the winners could be a mixture of different players whose “national identity” may not be as sharply defined as today.

With the auto industry now undergoing a series of new fundamental changes, succeeding in China’s EV industry could look like quite a daunting task. However, for those who can “get it right”, the reward can be extremely satisfying. A holistic understanding of the multifaceted characteristics of the entire auto industry’s development is a prerequisite for carmakers. The “new game” for EVs is not just about the propulsion technology and electrification, but also the nature of the car going from a single transportation facility to an IoT (Internet-of-Things) product. The best companies/strategists will begin to identify ahead of time what capabilities are needed to compete in the new game, and decide on the right investments and corporate relationships.

Acknowledgement

Alexander A. Loke, Associate and Derrick Wang, Consultant, provided support to this article.

About the Authors

Dr. Edward Tse is founder and CEO, Gao Feng Advisory Company. He became one of the pioneers in China’s management consulting industry, by building and running the Greater China operations of two leading international management consulting firms (BCG and Booz) for a period of 20 years. He has consulted to hundreds of companies, investors, start-ups, and public-sector organizations (both headquartered in and outside of China) on all critical aspects of business in China and China for the world. He has also advised the Chinese government organizations at different levels on strategies, state-owned enterprise reform and Chinese companies going overseas, as well as to the World Bank and the Asian Development Bank. He is the author of several hundred articles and six books including two award-winning books, The China Strategy (2010) and China’s Disruptors (2015), as well as the newly published 《变局思维》(Strategic Thinking in the Era of Mega Changes) (2022)

Rachel Hu is a Senior Consultant at Gao Feng Advisory Company based in Shanghai. She has consulted many clients in both China and Australia, focusing on growth strategy, new market entry and business model design. She has worked with clients across many sectors including automotive and connected mobility, semiconductor, healthcare, industrials and technology.

Gao Feng Advisory

Gao Feng Advisory Company is a professional strategy and management consulting as well as investment advisory firm with roots in China coupled with global vision, capabilities, and a broad resources network

Wechat Official Account:Gaofengadv

Shanghai Office

Tel: +86 021-63339611

Fax: +86 021-63267808

Hong Kong Office

Tel: +852 39598856

Fax: +852 25883499

Beijing Office

Tel: +86 010-84418422

Fax: +86 010-84418423

E-Mail: info@gaofengadv.com

Website: www.gaofengadv.com

Weibo: 高风咨询公司