Chinese Consumers Go for Value

Some China observers say that Chinese consumers are fickle and lack brand loyalty, while others say that Chinese consumers are by nature patriotic and prefer domestic brands over foreign brands. In this article, Gao Feng Advisory Company’s team examined five consumer-facing sectors and found that Chinese consumers, by and large, go for value over all other considerations. They conclude that companies need to go back to basics: Focusing on customer centricity, innovation, speed and agility.

For years, some business pundits would say, “Chinese consumers prefer foreign brands,” while others would argue, “The Chinese are so patriotic that foreign consumer brands don’t have a chance in their market.”

So, who’s right?

As usual, neither one is entirely right nor entirely wrong. Any analysis of China in general - and China’s business environment in particular - requires a more nuanced and careful examination.

Let’s take a look at a few consumer-facing sectors.

Source: Internet

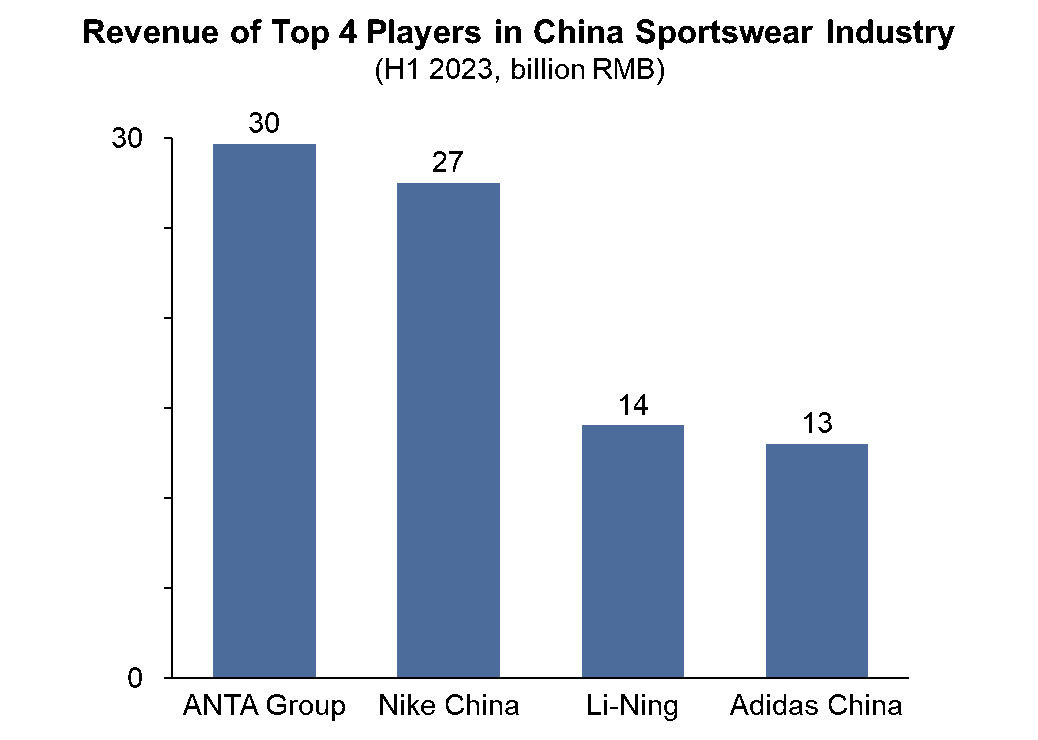

SPORTSWEAR

While China’s performance sportswear market saw a robust gain in 2023, the see-saw battle for market share between Chinese brands like Anta and Li-Ning and global players such as Adidas and Nike continued to intensify. In the first half of 2023, Anta celebrated record-high revenues of RMB 29.65 billion (US$4.07 billion), surpassing both domestic rival Li-Ning and global giants Adidas and Nike in Greater China. Although it was outpaced by Anta, Nike still had a better-than-expected performance in the region, with a 16% year-on-year growth to US$1.81 billion in Q4 2023. In the first half of 2023, Li-Ning reported RMB 14.02 billion (US$1.92 billion), achieving double-digit sell-out growth in both wholesale and retail channels.

Anta and Nike are, as they say, “neck-and-neck” and the same can be said for Li-Ning and Adidas. All the previous hypotheses regarding Chinese consumers buying only domestic or imported brands don’t hold true anymore. In the current market, Chinese consumers will chase whomever offers them the best value and the most appealing products. The “nationality” of the brands, if we can use this word, matters somewhat for Chinese consumers but is rarely the deciding factor determining their purchases. While patriotic fervor may temporarily impact purchasing decisions - as was seen briefly in the Xinjiang cotton incident during which Chinese consumers and celebrities boycotted international clothing brands after they refused to use Xinjiang-produced cotton in their garments - Chinese consumers will, in general, make rational, well-informed choices.

Exhibit 1: Revenue of Top 4 Players in China Sportswear Industry, H1 2023

Source: Companies’semi-annual reports, Gao Feng analysis

Take Anta, for example. While some believe Anta’s momentum stems from the “Guochao” phenomenon (which refers to Chinese consumers’ preference for anything infused with Chinese elements), the real driver behind its outstanding performance and competitiveness is that Anta understands that Chinese consumers are value-oriented. Anta has carefully built its brand portfolio to target specific consumer groups, thereby capturing theirgrowing interest in athleisure and lifestyle and offering products with realvalue to consumers. Foreign brands like Nike and Adidas have also demonstratedtheir emphasis on local customers over political rhetoric. For example, Adidashas granted China’s local management teams more autonomy to decide which globallaunches will take place in China’s mass market. Additionally, the brand nowplans to have 30% of its products designed by local Chinese teams in order toensure their domestic offerings are specifically tailored to the needs of localChinese consumers. Similarly, Nike has collaborated with Chinese designers tobuild an eco-friendly basketball court while partnering with AntChain - ablockchain division that sits within the Chinese fintech group Ant Group - topilot cutting-edge digital solutions.

Most businesses have understood that product functionality, innovation, and consumer centricity are now essential for good branding and sustainable growth in China’s sportswear market, regardless of the brand’s national origins. Prominent Chinese brands like Anta and Li-Ning have mainly achieved parity with the technologies of multinational companies and have made significant efforts in innovation and customer-centric approaches. At the same time, foreign brands have also realized that Chinese consumers go for value. Regardless of where they are from, all leading global companies follow a similar strategic approach: They focus on product, service quality, innovation, and adopting consumer-centric approach to compete in the vast Chinese market.

Source: Internet

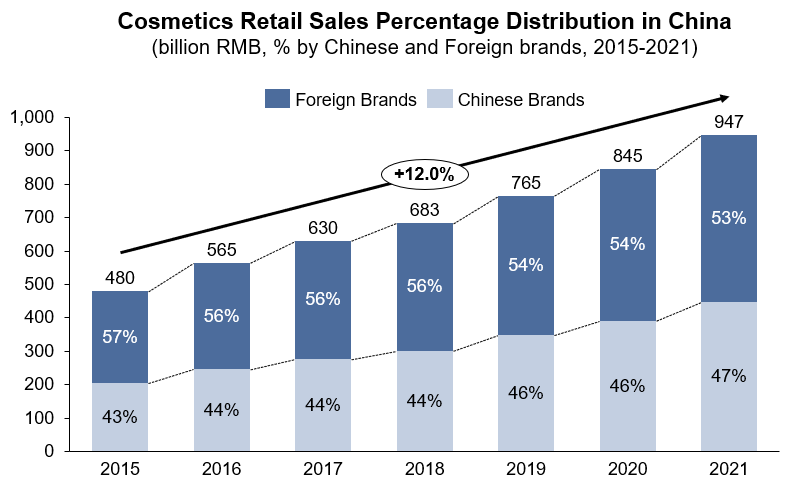

COSMETICS

China’s cosmetics market has seen impressive growth in recent years, withlocal brands’ retail sales rising for seven consecutive years. However, thelandscape remains fragmented and highly competitive, and the top 5market players are dominated by international cosmetics giants such asL’Oreal and Estée Lauder, which collectively held a 22% market share in 2021.

Exhibit 2: China’sCosmetics Retail Sales by Foreign or Local Brands

Source: Frost & Sullivan, Wanlian Securities, Gao Feng analysis

However, domestic Chinese players - including local cosmetics brands Biohyalux, Proya, and Winona - are building momentum. A good example is Bloomage Biotech, the parent company of Biohyalux (as well as a few other popular skincare brands in China), which has established itself as a dominant force in the research and development of hyaluronic acid, a critical ingredient for skincare products. Bloomage’s capabilities now cover the entire industrial chain, from raw materials to the end products. Headquartered in the “World Hyaluronic Acid Valley” in Shandong Province, China, and with six research platforms and over 570 worldwide patents, Bloomage generated approximately RMB 6.36 billion in revenue last year, up 28.53% from the previous year. Bloomage is now considered the world’s largest and most successful hyaluronic acid manufacturer.

As previously mentioned, many Chinese brands have benefited from the “Guochao” trend, which often connects with local consumers and amplifies brand value by evoking Chinese national pride. Local brands, especially those in the color cosmetics sector, such as Perfect Diary, Flower Knows, and Maogeping, have grown their market share rapidly due to this approach. According to a recent report, the market share of Chinese color cosmetics brands increased by about 8% from 2018 to 2020 and achieved a 28.8% market share in 2021. However, relying too heavily on this trend and not focusing enough on the overall value proposition of a product to consumers is risky. Case in point, there was recently a high-profile exchange between live-streaming star Li Jiaqi and a viewer who openly criticized the affordability of a local, made-in-China eyeliner brand, Florasis. The controversy led consumers to question the brand’s value and underscored the need for brands to authentically engage with consumers and build a value proposition that went beyond mere patriotism.

Source:MAOGEPING Website

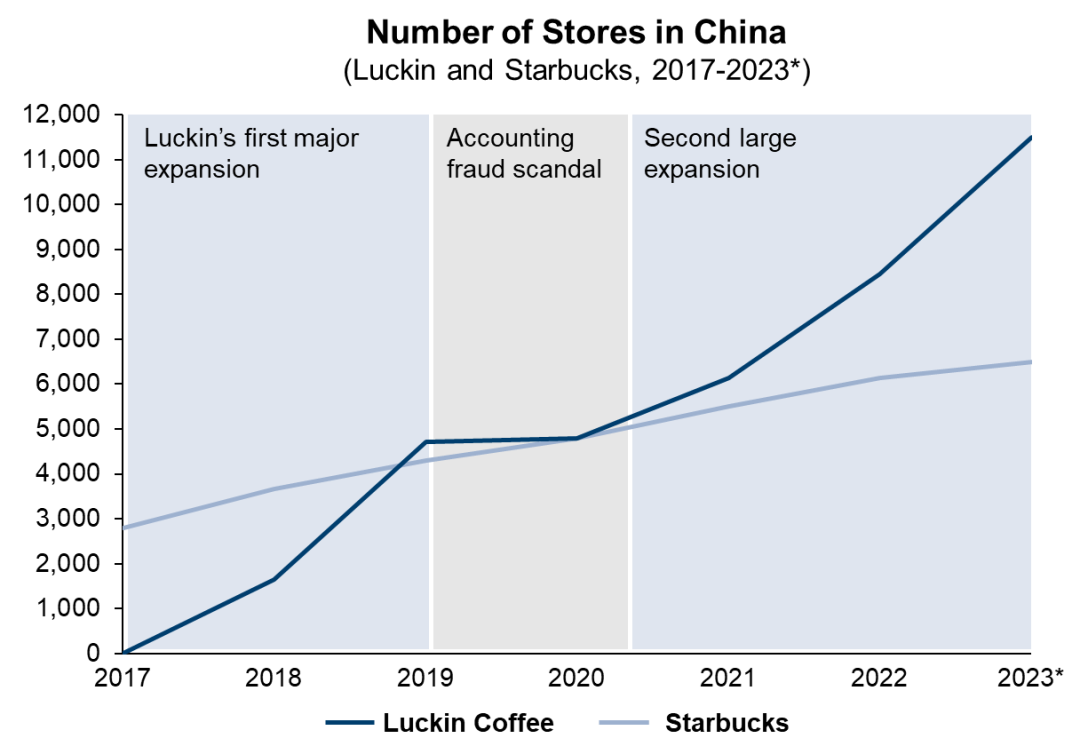

COFFEE HOUSE CHAINS

The same principle holds true in the coffee house chains industry.

Since entering China in 1999, Starbucks has achieved remarkable growth through solid branding, product localization, and by creating unique Chinese customer experiences. Instead of merely transplanting its Western model, Starbucks meticulously crafted its brand narrative. This narrative was not only about coffee; it was about creating a “third place”, an ideal sanctuary between office and home. Their branding strategy helped convey a high-end image, positioning Starbucks as a tangible symbol of upward mobility that was particularly appealing to China’s middle-class and affluent sectors. Another aspect of their strategy was to customize the Starbucks menu by adding, for example, mooncakes, which catered to Chinese taste preferences and helped to drive loyalty. Finally, targeted expansion in tier-one cities enabled Starbucks to tap into an upwardly mobile urban population with discretionary income to spend on premium beverages. As a result of all these efforts, China became a pivotal market for Starbucks, rivaling even its home market in the US.

While Starbucks’ strategy offers an excellent example of brand localization, the emergence of indigenous Chinese chains like Luckin Coffee sheds light on another crucial dimension - showing how local brands can succeed via a different path by combining domestic offerings, technology and affordability to make their coffee products more localized and accessible while offering better value. Through pricing and performance incentives for franchises and a large tech-enabled, online-to-offline model, Luckin has, in just six years, surpassed Starbucks as China’s top coffee house chain in overall sales. Luckin’s App, for example, streamlines ordering and helps build customer loyalty. Localized offerings such as Coconut Latte and Thickened Latte, each of which has sold over 100 million cups, demonstrate how Luckin has tapped into Chinese consumer preferences by understanding local tastes rather than providing typical, readily available coffee products.

Exhibit 3: Number ofStarbucks and Luckin Coffee stores in China

*Note: Data collected from Jan 2017 to August 2023

Source: Geohey, Canyandata, Starbucks, Luckin Coffee, Gao Feng analysis

The success of both Starbucks and Luckin in China underscores that Chinese consumers are highly value-oriented. Starbucks’ “third place” narrative demonstrates that consumers respond to an aspirational, lifestyle-oriented brand image. At the same time, Luckin’s hyper-localized offerings and affordability resonate with the value perception of mainstream consumers. The success of these differentiated positioning strategies highlights that Chinese consumers make purchasing decisions based on maximized perceived value, either through emotional branding or more practical benefits. In order to succeed in this competitive market, brands must study the ever-evolving behaviors of Chinese consumers and identify new trends and untapped value propositions. Capturing additional shares in the coffee house chains industry in China requires data-driven, customer-centric strategies that take Chinese consumers’ core values and preferences into account.

Source: Internet

APPLIANCES

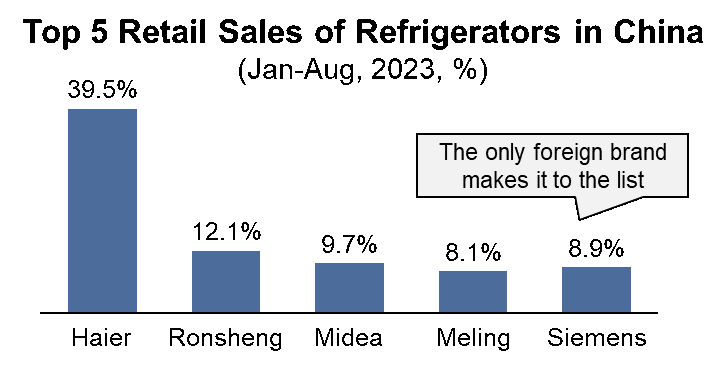

In the 1990s and 2000s, as China’s consumer market opened up, foreign appliance brands like Siemens and General Electric dominated the landscape while local players lagged behind. However, after just a few decades of rapid development, local Chinese companies like Midea, Haier, and Hisense have aggressively expanded their market share through heavy investments in R&D and acquisitions. These moves have enabled them to catch up quickly and even surpass foreign rivals in both technology innovation and smart features. As a result, Chinese manufacturers now command over 70% of the market share across significant appliance categories like air conditioners, refrigerators, and many other smart appliances, with just a handful of foreign players clinging onto some of the niche segments.

One example that illustrates how Chinese firms have built commanding positions in the appliance sector by creating customer loyalty is Xiaomi, a Chinese-labeled brand. Xiaomi has built a loyal user base since the start of its smartphone business. Its loyal user base passionately promotes its brand through an online community of engaged followers participating in early product testing and providing feedback. After years of development, Xiaomi further expanded its ecosystem across a range of smart, app-enabled devices - from phones to scooters to rice cookers - achieving remarkable “mindshare,” which means the first brand that “comes to mind” when a Chinese customer thinks about buying a new appliance. Many other Chinese brands are now following similar approaches. By building strong communities, adopting ecosystem strategies and pursuing global expansion, these companies have grasped consumer values. They are currently dominating the appliance industry in China and setting their sights on the whole world.

Exhibit 4: Top 5 Retail Sales Distribution of Refrigerators and Air Conditioners in China from January to August 2023

Source: All View Cloud Database, Gao Feng analysis

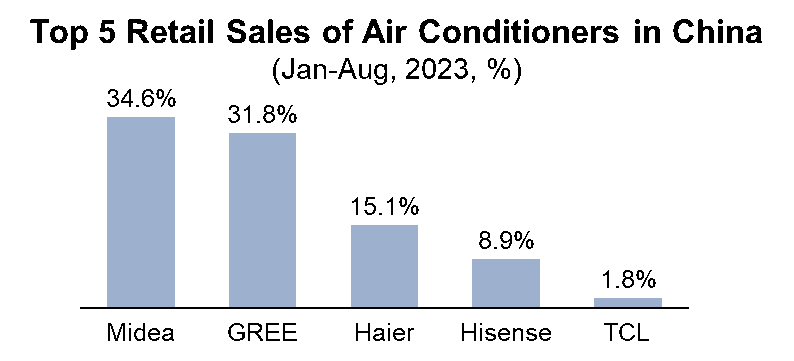

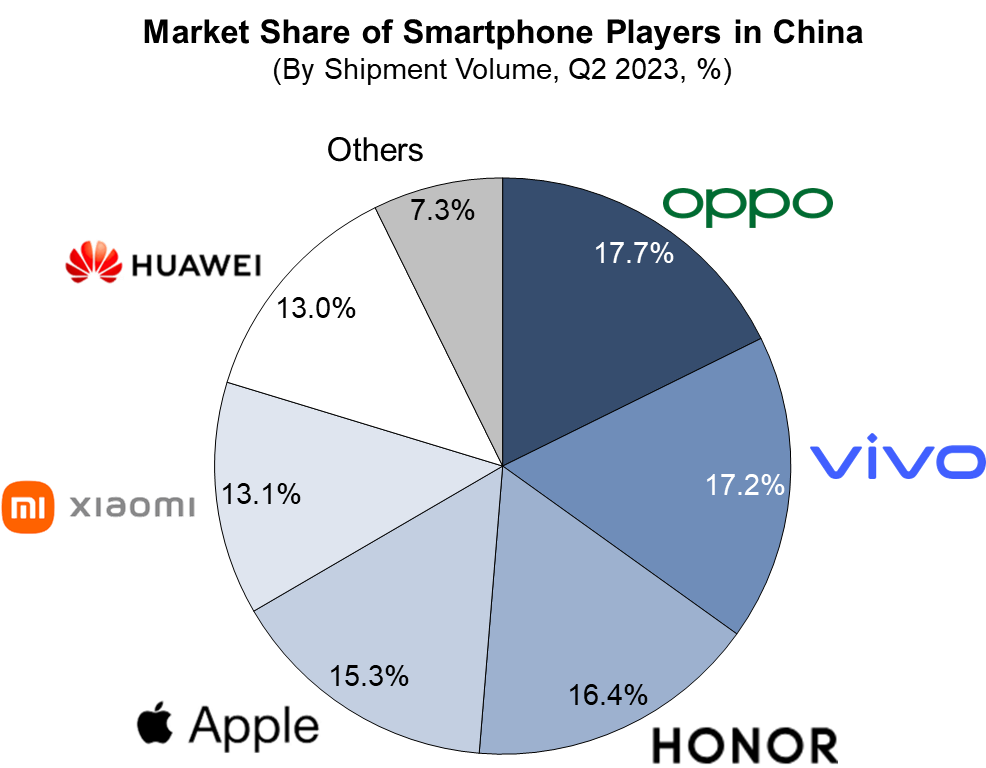

SMARTPHONES

In China’s smartphone industry, homegrown brands have captured the dominant market share, with Apple enjoying a good margin, according to the IDC report. On one hand, local brands like Oppo, Vivo, Honor, and Xiaomi have been able to meet consumer expectations with strong product features while also being highly competitive in price. On the other hand, these Chinese players benefit from large-scale supply chain advantages and have aggressively built out offline retail channels. Despite the fierce competition between local brands in the mid and lower-end markets, the competition between Apple and Huawei in the high-end market has intensified with time. The growth of the middle class, with its increased spending power, has been a major factor in the high-end smartphone wars.

Exhibit 5: Market Share of Smartphone Players in China (By Shipment Volume, Q2 2023)

Source: IDC Report2023, Gao Feng analysis

Recently, the launchof Huawei’s Mate 60 series (on September 25th) and Apple’s iPhone 15series (on September 22nd) has attracted intense discussion. Huawei’sMate series competes well on hardware systems, and its download speeds exceedthose of top-line 5G phones, as buyers on Chinese social media noted. Incomparison, the iPhone 15 series excels at ecosystem integration and long-termsoftware support. In the latest publication, Huawei has achieved the fastest growth among all market players in Q2 2023, growing 76.1% year-over-year on the back of the P60 series and foldable smartphone X3 series, and its new Mate 60 series was gearing up for the growth in Q3. Surprisingly, Apple’s annual growth rate in Q2 was only 6.1% on the other hand. Some industry pundits believe the rationale behind such prominent sales growth for Huawei is that Chinese consumers are showing support for Huawei after believing the company was treated unfairly in the global market. Others, however, believe it is Huawei’s technological breakthroughs and built-in functions that have captured the attention of tech-savvy consumers in the Chinese market. As has already been noted, nationalism can only take a company so far.

With its outstanding tech advantages, there is no doubt that Huawei will continue to be a strong competitor for Apple in the high-end smartphone market for years to come. It’s clear that most Chinese consumers prioritize long-term value and quality when choosing between the two brands. Indeed, a quality-oriented strategy focused on long-term value has already become the consensus among major Chinese smartphone vendors.

Source: Internet

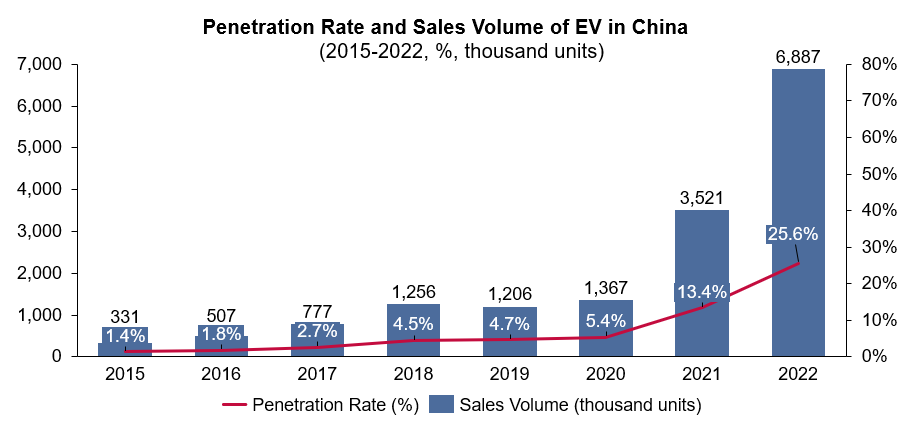

ELECTRIC VEHICLES

The Chinese electric vehicle (EV) market has continued to grow in recent years, becoming the world’s largest market and still maintaining considerable growth. China’s production and sales of EVs have been ranked first in the world for eight consecutive years, with a market penetration rate of 25.64% in 2022. The goal set by the Chinese government of reaching a 20% penetration rate by 2025, as proposed in the national “New Energy Vehicle Industry Development Plan (2021-2035)”, was achieved an impressive three years ahead of schedule.

Exhibit 6:Penetration Rate and Sales Volume of EVs in China (2015-2022)

Source: Wind, Gao Feng analysis

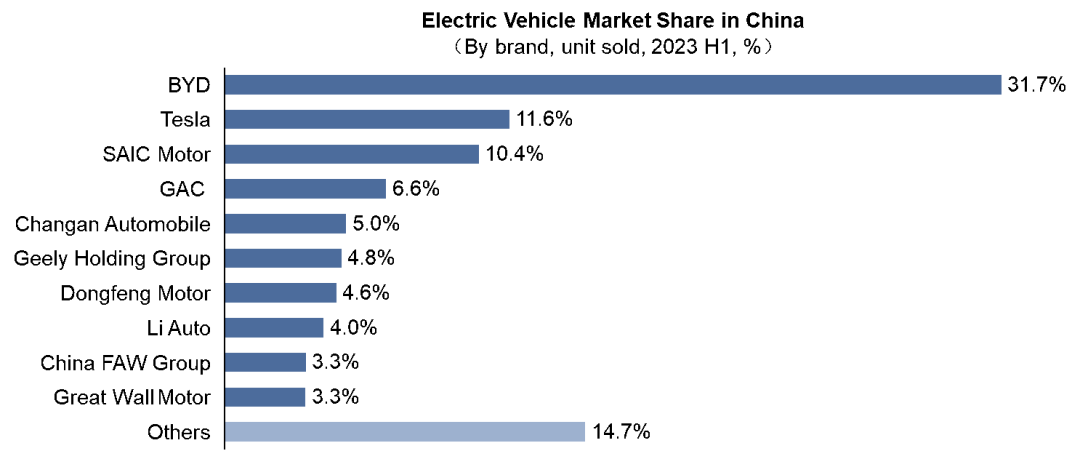

The Chinese EV market is a fragmented landscape with a large number of competitors vying for market share. Among them, Chinese brands have an absolute dominant position, and foreign brands, except Tesla, have had difficulty gaining any real market share. The reason behind such a phenomenon is not, as some have speculated, Chinese patriotism, but rather, consumers’ demand for quality and value. These days, when Chinese consumers decide to purchase a new EV, they don’t spend much time thinking about whether it’s a Chinese brand or a foreign brand. Instead, they look primarily at the more practical considerations such as price, design, and functionality. Given these priorities, why are so many leading foreign automotive brands, such as BMW and Audi, still struggling to appeal to Chinese EV consumers?

Exhibit 7: ElectricVehicle Market Share in China (2023 H1)

Source: China Association of Automotive Manufacturers, Gao Feng analysis

The first reason is the limited availability of their EV products. Most overseas automotive brands entered China through joint ventures, yet these same companies are unwilling to give up their huge competitive advantages in traditional automotive technology (such as engines or power systems), resulting in a limited number of EV models being launched.

Secondly, foreign brands lag in the areas of technology and production of core components of EVs. Taking the cells in car batteries as an example, virtually none of the automakers have the ability to produce cells by themselves, so they all must purchase them from external suppliers. However, China’s BYD, which was originally a battery company, is the one (and only) brand that adopts self-developed and self-produced batteries for all its car models, thus enabling BYD to utilize its own tech in its own cars effectively.

Finally, Chinese brands have a better grasp on the demands of local consumers - especially young ones - and price is undoubtedly a critical factor. It’s worth noting that Chinese consumers can typically only get entry-level models for around RMB 200,000 if they choose a foreign brand. In contrast, Chinese brands can offer medium-level products with relatively higher configurations for the same price. Even Tesla has had to significantly lower its prices to demonstrate its value to Chinese consumers. Moreover, local customers are well aware of China’s significant progress in intelligent interconnection. Therefore, many Chinese car companies are committed to developing smart internet connectivity functions, and some are even integrating high-end entertainment systems, enabling cars to surpass their old role as just a tool of transportation.

Source: Internet

Excellent performance, appropriate price, intelligent functions, convenient usage and purchase experiences are all factors in the value perception that Chinese consumers have toward auto brands. In light of the continued progress of Chinese technology and expansion, the Chinese EV market is expected to continue to grow rapidly. At the same time, consumers’ pursuit of value will undoubtedly continue to intensify. This will inevitably lead to higher requirements for EV manufacturers - regardless of size and nationality - thereby increasing global market competition.

SUCCEEDING IN THE CHINESE CONSUMER MARKET

Some pundits have posited that Chinese consumers are fickle and lack brand loyalty. But, why should they be loyal? Chinese consumers in 2023 have myriad options, so they can afford to pick and choose which brands offer them the best price-value tradeoff at any given time. This is true across multiple sectors, including sportswear, cosmetics, coffee house chains, appliances, smartphones, electric vehicles, and other consumer-facing industries.

The speed of new product development and service offerings in China is very fast, and this has come about due to the intense competition in China that has stimulated rapid and even revolutionary innovations. As a result, Chinese consumers have plenty of new choices - either from new brands or incumbent brands that innovate - so if customers are going to be loyal, brands will have toearn it.

China is, and will continue to be, one of the world’s leading economic contributors. In 2022, it had the world’s second-largest GDP of US$18.1 trillion, and China’s 2023 projected GDP growth was recently raised to 5.6% by the World Bank. Furthermore, as far back as 2017, China had more than 400 million middle-income group individuals and about 140 million middle-income households. Chinese Economist Li Shi estimated that the number of middle-income group individuals in China had grown steadily to about 460 million by 2022 (up an average of 10 million annually.) Needless to say, succeeding in China has become a strategic imperative for leading and aspiring consumer goods companies.

There is no magic to succeed in the Chinese consumer market. Regardless Chinese or foreign, companies should not be sidetracked by the political rhetoric that is so often generated for other purposes. All companies need to go back to the basic business principles as much as possible: Understand your consumers and their needs, be innovative, and be truly customer-centric. Companies should also be fast, agile and be able to play, as they say, at “China speed.”

Without question, issues such as data security, personal information privacy, and artificial intelligence ethics must also be considered, but companies should not become too distracted by these issues. As much as possible, all companies should stick with core business principles: adopting customer-centricity, focusing on innovations and building true values. These are the paramount factors to achieve lasting success in the Chinese market. As China increasingly leads the world in innovations, success in this market goes even beyond “in China for China.” Worldwide business leaders should recognize that leaning into the dynamic Chinese market and adapting to the demands of its value-driven consumers are now mission-critical to accelerate innovation and catalyze new growth for their businesses globally.

Acknowledgement

Thanks to our Consultants, Gloria Li, William Shi, Derrick Wang and Jocelyn Yu for providing support in writing this article.

Gao Feng Advisory

Gao Feng Advisory Company is a professional strategy and management consulting as well as investment advisory firm with roots in China coupled with global vision, capabilities, and a broad resources network

Wechat Official Account:Gaofengadv

Shanghai Office

Tel: +86 021-63339611

Fax: +86 021-63267808

Hong Kong Office

Tel: +852 39598856

Fax: +852 25883499

Beijing Office

Tel: +86 010-84418422

Fax: +86 010-84418423

E-Mail: info@gaofengadv.com

Website: www.gaofengadv.com

Weibo: 高风咨询公司