What Can We Learn from Xiaomi’s Entry into the EV Sector?

Xiaomi’s recent launch of a new electric vehicle (EV) SU7 has drawn much attention in the market. A smartphone and internet-of-things (IOT) products manufacturer, Xiaomi’s move into the EV sector was considered bold and uncertain. Some people did not believe Xiaomi would be able to make it.

However, Xiaomi did. And it did it in three years. There are plenty of lessons one can draw from Xiaomi’s attempt. In this article, we describe the key observations on Xiaomi’s strategy and draw implications for other businesses.

When my book China’s Disruptors came out in 2015, the subtitle of my book was How Alibaba, Xiaomi, Tencent and Other Companies are Changing the Rules of Business. At that time, the most often mentioned Chinese innovative companies were the so-called “BAT” (i.e., Baidu, Alibaba and Tencent). Many people who saw my book’s subtitle asked me, “Why Xiaomi?” In fact, on one occasion, a prominent Hong Kong economist, looking at my book’s cover, said something like, “Oh, Xiaomi! They only know how to copy others’ products!”

A Company with DNA in Customer Centricity

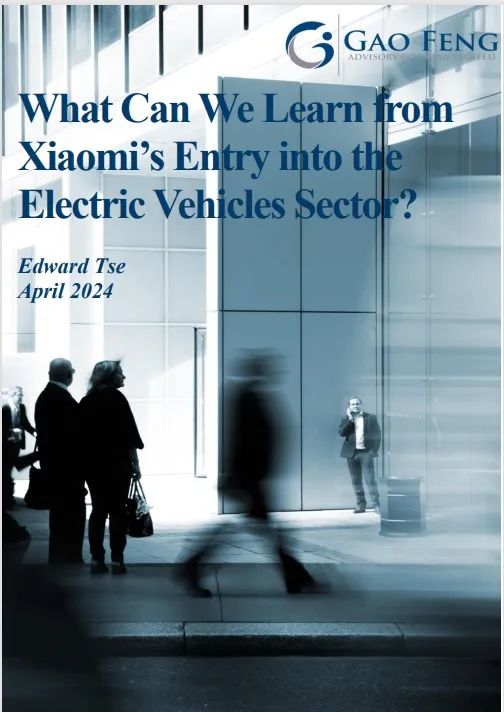

Sure enough, there was a time when Xiaomi was known for “copying”. However, as a smartphone company, Xiaomi was able to sustain its position as one of the leading smartphone players in the global market. In the first quarter of 2024, the global smartphone market had shipments totaling approximately 289.4 million units, with Xiaomi securing a 14.1% share of the market, making it the third-largest player.[1]

Exhibit 1: Market Share by Shipments of Worldwide Smartphone Manufacturers in Q1, 2024 (%)

Source: IDC Research, Gao Feng analysis

Xiaomi does well in the mass market, offering affordable products that are “good enough” for consumers. It has established sound positions in many overseas markets where Xiaomi or Mi has become a well-known brand.

Leveraging its capability in making smartphones, Xiaomi later entered into the internet-of-things (IoT) products businesses. It makes smart appliances, including smart lighting, smart thermostats, smart locks, smart TVs, smart speakers, etc. It has also established a strong position in global IoT sectors in which Xiaomi has established itself as the world's largest consumer-grade IoT platform, with the number of connected devices reaching 655 million. According to its own data, Xiaomi has 13 million users who own five or more IoT devices. Xiaomi's IoT ecosystem is currently the most comprehensive in product categories, featuring over 200 major types of smart home appliances and covering more than 95% of everyday living scenarios.[2] To many people, the Xiaomi brand equates value for money, innovation and customer-centricity.

Xiaomi is also well known for its customer community. These are followers of the Xiaomi brand, often called “Mi fans.” These fans and Xiaomi interact mostly online, through which the fans feel that the company places importance on their inputs, and in turn, the fans show their loyalty to the company.

Exhibit 2: Mi Fans on Xiaomi Fan Festival

Source: Xiaomi Website

Xiaomi’s founder and leader, Lei Jun, has been a serial entrepreneur, having started and run several other businesses before starting Xiaomi. When Xiaomi was first formed, many people didn’t give it much hope of surviving in the already pretty cutthroat smartphone sector. However, time has proved that Xiaomi and Lei Jun have not only been able to survive but, to a large extent, have been able to grow, and jump over sector boundaries.

Making the Hard Decision

Many people expect Lei Jun, a multi-billionaire, to stop taking on more risks and play safe. In Chinese, people would call this mindset 躺平 “lying flat”.

However, Lei Jun decided to pursue the electric vehicles (EV) sector. With its capital-intensive nature and a highly competitive environment in China, some people say anyone who wants to get into this field would be “burning money.” And it would, as some people would say, take the order of CNY10 billion (USD 1.43 billion) to burn.

But it didn’t deter Lei Jun, who said that he would enter the EV sector three years ago. Sure enough, he created Xiaomi’s first EV model, SU7, three years later.

Exhibit 3: Xiaomi SU7

Source: Xiaomi Website

Some pundits would say Lei Jun just copied the Porsche Taycan while some others would say there is little original technology in the new car. Xiaomi was known as a copycat in smartphones. Xiaomi must be a copycat in EVs.

But is it?

A Copycat or an Innovator?

Of course, there are many resemblances between the SU7 and Porsche Taycan. However, SU7 offers several different features. These features include the likes of LiDAR, eleven high-definition cameras, three millimeter-wave radars, and twelve ultrasonic radars. Also, the car’s interior, had a 16.1-inch 3K central console, a 7.1-inch rotating dashboard, and a 56-inch HUD (heads-up display).[3]

Lei Jun emphasized Xiaomi's transition into the automotive sector as a pivotal move toward closing the loop of the “Human x Car x Home smart ecosystem.” This move is interpreted as Xiaomi's bid to integrate its technological prowess with a human-centric design philosophy, thereby enriching its ecosystem. The company has earmarked over CNY10 billion for the initial research and development phase, assembling more than 3,400 engineers and over a thousand technical experts from around the world. As such, significant advancements in five core technologies (E-motor, battery, die-casting, pilot autonomous driving, and smart cabin).[4] Some of these innovations are claimed to be first-of-their-kind at a global or national level. The emphasis on human-centric technology within Xiaomi's automotive strategy reflects a broader trend in the industry towards vehicles that are more responsive to the needs and preferences of their users, potentially influencing how other companies approach the development of smart vehicles and ecosystems.

A Highly Competitive Market with Significant Ecosystem Capability

China has been at the forefront of developing smart and connected new energy vehicles (NEVs, of which EV is one type and a major one) for over a decade. A large number of companies coming from the private sector, state-owned sector and foreign-owned OEMs participate in this sector, trying to out-compete each other. Some of these companies are offshoots of incumbent auto OEMs, while some others are start-ups. Before the NEVs initiative started, China has been undergoing a wave of intense and rapid development of the wireless internet sector. The way in which internet businesses were run has just left a huge imprint in the minds of many Chinese entrepreneurs. The notions of ubiquitous connectivity with people, interactivity between companies and customers, as well as customer community building have all become core beliefs in B2C businesses. At the same time, technologies such as battery tech, sensors, semi-conductor chips, LIDAR and ADAS were surfacing quickly.

Local Governments Playing Key Role

Knowing that NEV development is a national priority, many financially capable local governments have prioritized supporting companies in the NEV sector. In Xiaomi’s case, it received support from the Beijing Municipal Government in securing automotive manufacturing qualifications through a streamlined special approval process. The Beijing Municipal Government played a role here. In contrast, many other NEV start-ups would subcontract their manufacturing with established automotive manufacturers for a short cut.

Xiaomi’s “gigafactory” was put together fast. Phase 1’s groundbreaking took place in April 2022 and it was completed in June 2023. Official mass production was achieved in the first half of 2024.[5] The support provided by the Beijing Municipal Government was instrumental. This support spans critical aspects such as site selection, environmental impact assessment approval, and attainment of requisite production qualifications. Beijing has been lagging behind Jiangsu Province in the Yangtze River Delta region for years in developing NEVs. With Xiaomi, Beijing now has a program to show for, which is significant.

Also, along with the building of smart cities across the board, “digital infrastructure” was built by numerous cities across China, which would embed connected and intelligent devices. These local governments’ support accelerated the growth of many NEV players and their support ecosystems. Scores of hardware and software players emerged, often with support from local governments as well as private sector investors.

Of course, these companies often leverage the capabilities and resources built all along in the sectors of auto, smartphones, IoT products, batteries, and the internet. China’s ability to organize large-scale activities, high quality and extensive infrastructure (both physical and digital) as well as a strong sense of entrepreneurship all contributed to the rapid development of the NEV industry. Today, the future of the incumbent internal combustion engine (ICE) is being questioned.

A Tough Decision to Enter the EV Sector

In a recent interview, Lei Jun recounted how he decided to make EVs.

In January 2021, Xiaomi was put onto an “entity list” by the US Department of Defense for its alleged support of the Chinese military (in May of the same year, Xiaomi was taken off that list). In an emergency board meeting, one board member asked if Xiaomi should consider making cars (since selling smartphones wouldn’t be easy anymore.). In his recount of the situation, Lei Jun said he made the reluctant decision to go into the car sector knowing that he had to learn everything from afresh. It has been a tough road to take, but with perseverance, he and his team were able to make it, and they made it only in three years.

Right around the same time as Xiaomi announced the launch of the SU7, Apple decided to stop its car project after spending some USD 10 billion in ten years.[6]

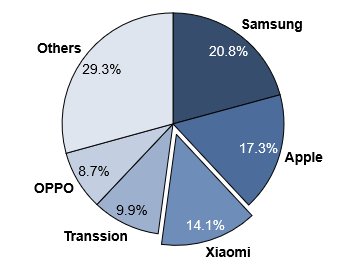

While Apple decided to terminate its car project, Xiaomi launched a new EV after only three years. Time will tell who made the right decision, but it’s clear that China’s EV ecosystem can enable an entirely new player to create a marketable product in no time. That’s the core of China’s innovation capability and capacity — complicated and extensive tech-capable ecosystems built on large-scale organizational skills and abilities.

Exhibit 4: Xiaomi SU7’s Key Suppliers

Source: Xiaomi Website, Jiemian News, Gao Feng analysis

Unlike many other Chinese EV start-ups which plunged into EVs before, Xiaomi’s Lei Jun decided to build its own manufacturing. It’s a steeper hill to climb but once you get there, you could create your closed-loop, a much better defense for your business.

Exhibit 5: Xiaomi Automobile Gigafactory

Source: Xiaomi Website

Xiaomi’s story of making EVs epitomizes how the Chinese entrepreneurship spirit continues to manifest. While pundits have been saying Chinese entrepreneurs have been “lying flat”, people like Lei Jun and many others didn’t slow down at all. In March of this year, I participated in the China EV 100 Forum in Beijing and heard and witnessed how diligent the companies in the Chinese NEV sector are trying hard. I felt a sense of “I want to succeed”.

The governments, in general, have supported relevant companies by building relevant ecosystems as well as providing high-quality and extensive infrastructure.

Xiaomi is among the leading disruptors in the auto sector along its entire value chain. Time will tell whether Lei Jun or Tim Cook is correct, but regardless of what, China continues to strengthen and extend its capabilities and ecosystems in high-tech intelligent manufacturing. This set of capabilities will be further rooted in China, where supply chain ecosystems will be built and radiate.

Xiaomi Taking on the Third Way of Business Strategy

According to its own announcement, Xiaomi SU7 received 88,898 firm orders within 24 hours following the launch.[7] That’s an incredible achievement, especially as the Chinese EV market has entered a period of highly intensive competition. What can we learn from this?

Xiaomi’s boss, Lei Jun, took it upon himself to become the KOL in promoting the car. In Chinese, that is known as 带货 (Dai Huo),which is using live commerce to “carry the goods”.

Exhibit 6: Lei Jun Presents SU7 Model at Launch Event

Source: Getty Images

He did a great job. He was meticulous in describing the car’s features and seemed to know how to connect with the consumers. Xiaomi and Lei Jun come from a smartphone heritage, and as such, they know how to connect with consumers using similar tactics.

Meanwhile, Xiaomi's GTM (go-to-market) strategy in pricing is a textbook-level demonstration. Xiaomi has long been synonymous with good value, but with the debut of SU7, Lei Jun repeatedly conveyed to the public that "it is the best sedan to drive for under 500,000 RMB", "the price of SU7 will not be cheap" and "it won't sell for 199,000 RMB," creating suspense for months and consistently raising public expectations regarding its price. The chain reaction brought about by this strategy was evident, as since 2024, various brands including BYD had begun to lower prices of their products.

Xiaomi, in the meantime, adjusted its final selling price a few times by observing the market and consumers' reactions on social media. Furthermore, Xiaomi kept benchmarking SU7 against other models in the market with high price and advanced configuration, thereby reinforcing market expectation on its price. However, the prices announced eventually in the product launch were significantly different from previous speculation, once again igniting discussion and interest on social media while fully showcasing SU7's cost-effectiveness. It can be said that Xiaomi not only knows how to acquire traffic but also know how to control and leverage that traffic to its own advantage.

It appears that the latest marketing approach of EVs has now transcended the traditional definition of product segments. Price and features matter, but marketing in the social media era is also essential.

Can Xiaomi sustain its presence in the highly competitive Chinese EV space? Different people may have different views. I know where I stand.

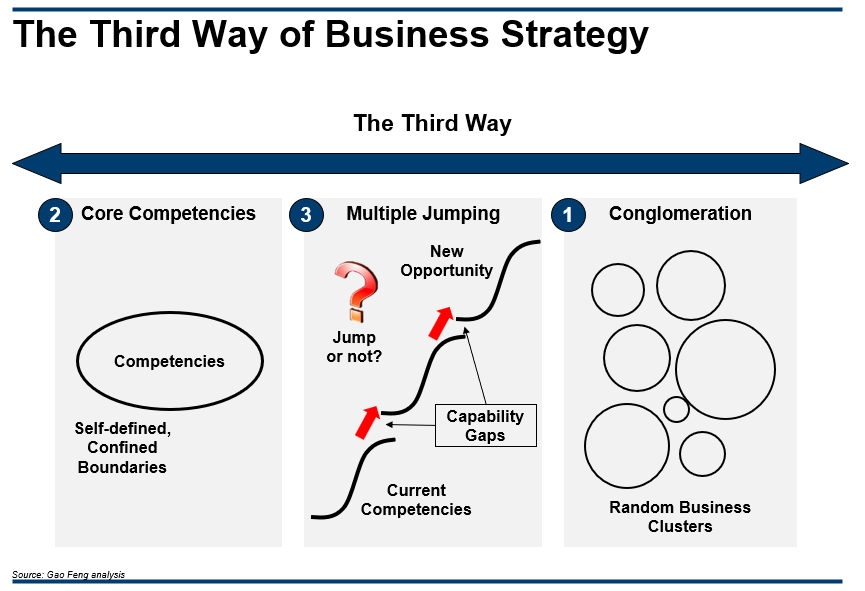

Exhibit 7: The Third Way of Business Strategy

Source: Gao Feng analysis

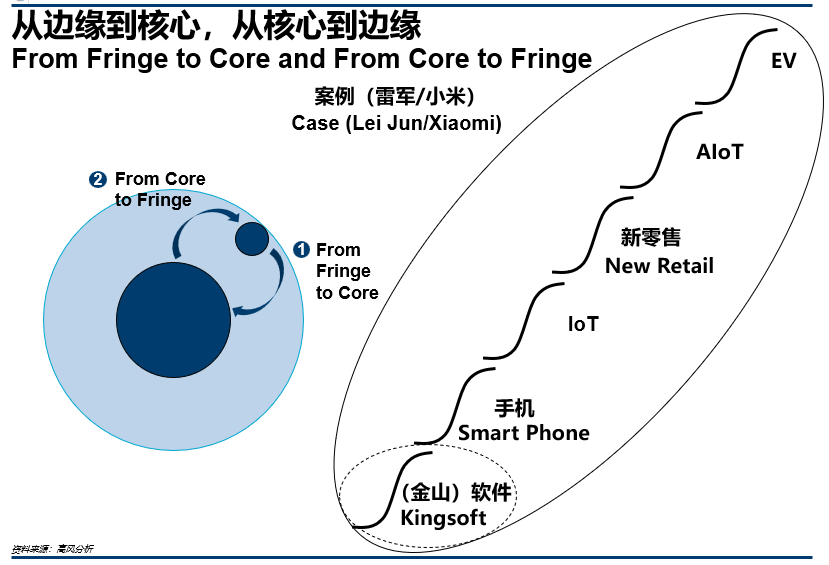

Exhibit 8: From Fringe to Core and from Core to Fringe

Source: Gao Feng analysis

Xiaomi has adopted the Third Way of Strategy by jumping across sector boundaries. It was able to leverage its capabilities built as a smartphone and IoT player, and on top that, it leveraged the capabilities that were available through China’s extensive smart EV ecosystems. Smartly and skillfully maneuvering between these two sources of capabilities enabled Xiaomi to jump across and be able to hang on, at least for now. In contrast, Apple decided not to jump and stayed put. Given the same sort of opportunity, different companies would and could end up with different decisions and often different results down the road.

That’s the beauty of strategy.

Annotation

[1] IDC Research, “Worldwide Smartphone Market Up 7.8% in the First Quarter of 2024 as Samsung Moves Back into the Top Position, According to IDC Tracker” (April, 2024)

[2] Xiaomi Community, “The world's largest IoT platform: 655 million connected devices” (November 2023)

[3] India Today, “Xiaomi launches its first electric car SU7: Price, features and all you need to know” (March 2024)

[4] Automotive Purchasing and Supply Chain, “Xiaomi unveils five core automotive technologies and debuts Xiaomi SU7” (January 2024)

[5] CnEVPost, “Xiaomi's 1st EV model to begin mass production in Dec and hit market in Feb 2024, report says” (November 2023)

[6] Motor1, “Apple Spent More Than $10 Billion On Its Failed Car Project” (February 2024)

[7] CnEVPost, “Xiaomi says SU7 gets 88,898 firm orders in initial 24 hours after launch” (March 2024)

高风管理咨询公司

高风管理咨询公司是一家全球专业的战略与管理咨询以及投资顾问公司,植根于中国,同时拥有全球视野、能力、以及广泛的资源网络

微信公众号:Gaofengadv

上海

电话:+86 021-63339611

传真:+86 021-63267808

香港

电话:+852 39598856

传真:+852 25883499

北京

电话:+86 010-84418422

传真:+86 010-84418423

邮箱:info@gaofengadv.com

官网:www.gaofengadv.com

微博:高风咨询公司