Rise of the Low-Altitude Economy and UAM Opportunities in China

As innovation and urbanization accelerate in China, the low-altitude economy is emerging as a key driver of growth. By utilizing low-altitude airspace, this sector is transforming urban transport and logistics while driving innovation across industries. At its core, Urban Air Mobility (UAM) is revolutionizing urban transportation.

This article explores the rise of the low-altitude economy and UAM in China, outlining market opportunities, technological advancements and the challenges related to technology, policy and infrastructure. It highlights the importance of Hong Kong-Chinese mainland cooperation, leveraging mutual strengths to accelerate growth. For businesses and investors, it provides insights into potential risks and opportunities, emphasizing the need for technological innovation, policy anticipation and alignment, as well as the exploration of new business models in securing a first-mover advantage in the UAM market.

The low-altitude economy is becoming a high potential growth area in China driven by technological advancements and increasing urbanization. This emerging sector taps into the underutilized airspace below 1,000 meters, with general aviation as its cornerstone, encompassing a wide range of areas, including low-altitude flights, aviation tourism, regional passenger transportation, and research and education. As this industry develops, it could not only create an extended industrial chain but could also produce substantial economic benefits. At the heart of this evolution is Urban Air Mobility (UAM), which could reshape urban transportation.

The low-altitude economy represents a comprehensive economic ecosystem with an extended industrial chain capable of boosting investment, generating consumer demand, and fostering urban innovation. Its growth is fueled by technological advances, evolving market demand, and robust policy support. As cities grow and ground transportation congestion intensifies, the low-altitude economy offers a compelling solution through the use of underutilized airspace. This new mode of transportation holds the potential to revolutionize urban mobility, logistics, and tourism, creating transformative changes across multiple sectors.

This article explores into the key factors driving the rise of the low-altitude economy, examines UAM’s current landscape and future trends, and highlights the challenges and opportunities ahead.

Source: Jun Tong Capital Company

UAM: A Potential High-Growth Sector

UAM stands out as a core component of the low-altitude economy, providing short-distance, on-demand air mobility solutions for passengers and goods using helicopters and electric vertical take-off and landing vehicles (eVTOL). When compared to traditional 5-6 seat helicopters, eVTOL brings significant advantages, particularly in terms of purchase cost, cost-effectiveness, and efficiency:

Purchase Cost: Currently, the purchase cost of traditional helicopters ranges between USD 5 and 12 million (RMB 35 and 85 million). According to industry forecasts, by 2027, the purchase cost of eVTOLs is expected to drop to between USD 0.7 and 1.4 million (RMB 5 million and RMB 10 million), representing a reduction of more than 80%.

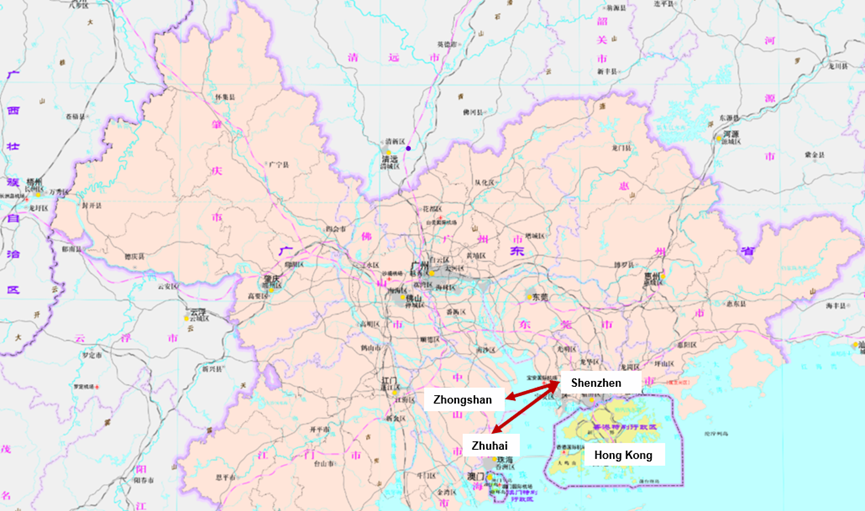

Travel Pricing: For example, on the route from Shenzhen to Zhongshan within the Greater Bay Area, the current per-trip price for traditional helicopters is approximately USD 5714 (RMB 40,000). Industry forecasts predict that by 2027, the per-trip price for eVTOLs on similar routes will decrease to around USD 286 (RMB 2,000), a reduction of about 95%, significantly lowering travel costs and making it more accessible to the mass market.

Travel Time: For example, on the route from Shenzhen to Zhuhai, traditional cars take approximately 120 minutes to complete the journey, whereas eVTOLs will only require 28 minutes, reducing travel time by almost 80%.

With these advantages, eVTOL not only addresses the demand for short-range transport in high-density cities but also provides a viable solution to urban traffic congestion. As technology becomes more mature, eVTOL could fundamentally alter the urban transportation landscape.

Map of the Guangdong-Hong Kong-Macao Greater Bay Area.

Source: Standard Map Service of China, Map Content Approval Number: GS(2019)4342

The UAM Industry: A Rapidly Developing Opportunity in China

Industry projections suggest that China’s UAM will enter a high-growth phase between 2024 and 2027, with a compound annual growth rate (CAGR) of over 300%[1]. By 2027, the commercialization of large-passenger eVTOLs is anticipated, marking the official launch of the UAM market. With continued technological progress and strong government backing, eVTOL is set to become the primary mode of short-range urban travel, with the Chinese UAM market expected to reach USD 50 billion (RMB 350 billion[2]) by 2035.

Key Drivers of UAM Development

Policy Support: The Chinses central government has integrated the low-altitude economy into its national strategic initiatives. Since 2023, airspace reforms have gradually opened up low-altitude resources, while both central and local governments have introduced policies to support UAM commercialization.

Technological Advancements: The deployment of commercialized large-passenger eVTOL is expected to take place within the next two years. Current advancements in electric propulsion technologies, especially in solid-state and semi-solid-state batteries, are overcoming range limitations.

Economic Viability: Compare to helicopters, large-passenger eVTOLs offer higher cost-effectiveness and operational efficiency, reducing travel costs and significantly improving urban travel efficiency. Additionally, eVTOL is a greener alternative to traditional helicopters, aligning with the increasing demand for sustainable transportation solutions.

Infrastructure Development: The deployment of robust low-altitude infrastructure, including air traffic management systems and communication networks, is essential for UAM’s safe and efficient operation. The introduction of systems like the Smart Integrated Low-Altitude System (SILAS) will enhance airspace management and ensure safe eVTOL operations.

Source: ChatGPT

Lessons from Chinese Mainland for Hong Kong's UAM Development

As policies governing the low-altitude economy continue to evolve, Hong Kong is actively exploring opportunities to develop its low-altitude airspace. The Hong Kong Special Administrative Region (SAR) government is drawing from successful mainland experiences, particularly in drone logistics and transportation. In a recent speech, the Secretary for Transport and Logistics of the Hong Kong SAR, Lam Sai-hung, highlighted the importance of leveraging this policy shift, calling for closer cooperation with China to accelerate low-altitude economic development and bring innovative transportation solutions to Hong Kong.

Meanwhile, the official formation of the Greater Bay Area Low-Altitude Economy Joint Committee marks a crucial step in regional collaboration. This committee will drive cross-border cooperation in the low-altitude economy, offering a powerful policy coordination and resource-sharing platform. For businesses operating in the Greater Bay Area, this opens up new market opportunities, promoting innovation and enabling the integration of supply chains across the region.

In the Chief Executive’s 2024 Policy Address, delivered on 16th October, Hong Kong SAR Chief Executive John Lee Ka-chiu announced the formation of a "Task Force for Developing the Low-Altitude Economy", to be led by the Deputy Financial Secretary. The task force will develop strategies and action plans focused on regulatory reforms and infrastructure development. These initiatives reflect the government’s commitment to fostering cross-sector collaboration and leveraging policy support to integrate Hong Kong into the expanding low-altitude economy, unlocking new opportunities for regional growth.

Challenges and Strategic Implications for UAM

While the UAM sector presents potential, it also faces challenges. Key barriers include technical bottlenecks, airspace regulations, gaps in legal frameworks, and delayed infrastructure development. A recent example is the Chinese National Day (1st October 2024) drone show in Hong Kong, which was unexpectedly canceled due to signal interference in the navigation systems caused by a solar storm, highlighting the vulnerability of these systems in extreme electromagnetic environments. To mitigate this issue, enhancing the precision of aircraft positioning systems—by combining GPS with Ultra-Wideband (UWB) technology—and strengthening obstacle avoidance systems such as infrared or visual sensors can ensure stable control and operation in complex environments.

To overcome these hurdles, companies must collaborate closely with governments and regulatory bodies, actively participating in pilot programs to push forward airspace reform. This collaboration will not only enable companies to gain valuable operational experience but also prepare them for full-scale commercialization. Moreover, increased investment in core technologies, particularly flight control systems and safety assurance, will be critical to ensuring future success.

Exploring innovative business models will also be essential. UAM is not just about technological breakthroughs; it requires a fresh approach to business models. Companies can explore new market opportunities in urban logistics, short-range transportation, and aviation tourism, tailoring pricing strategies and operational plans to capture market share. Focusing on the gradual transition to autonomous flight is also essential for designing operational models that bridge the gap between human-crewed and uncrewed flights to prepare for the widespread application of automation technologies.

Conclusion

While the UAM market holds much potential, it also faces significant challenges, as is common with all emerging technologies. Over the next decade, we expect China's low-altitude economy to experience rapid growth, becoming a key player globally in this sector. This transformation will not only represent economic and technological progress but also catalyze major changes in urbanization and modernization.

For companies and investors, this sector is approaching an inflection point, making early positioning worthwhile. By focusing on technological innovation, policy anticipation and alignment, as well as new business models, participants can unlock growth opportunities.

Sources:

[1] [2] National Bureau of Statistics of China, Trip.com.

About the Authors

Dr. Edward Tse is founder and CEO of Gao Feng Advisory Company. He became one of the pioneers in China’s management consulting industry by building and running the Greater China operations of two leading international management consulting firms (BCG and Booz) for a period of 20 years. He has been a consultant to hundreds of companies, investors, start-ups, and public-sector organizations (both headquartered in and outside of China) on all critical aspects of business in China and China for the world. He has also advised the Chinese government organizations at different levels on strategies, state-owned enterprise reform and Chinese companies going overseas, as well as the World Bank and the Asian Development Bank. He is the author of several hundred articles and six books, including The China Strategy (2010), China’s Disruptors (2015) and《变局思维》 (Strategic Thinking in the Era of Mega Changes) (2022).

Yifan Jie, Associate Partner at Gao Feng Advisory Company, has over 12 years of management consulting experience, specializing in strategy and operations. His expertise spans strategic, operational, and digital transformations, with a focus on leading local and multinational companies in sectors such as manufacturing, automotive, and energy. Yifan has a wealth of global and China-based project experience, assisting numerous enterprises in achieving strategic breakthroughs and transformation. Prior to joining Gao Feng, Yifan was an Associate Partner at McKinsey & Company and held management roles at leading domestic firms

Lu Zhang, Senior Manager at Gao Feng Advisory Company, brings over 10 years of experience in strategic financial consulting. Her work focuses on strategy, mergers and acquisitions, and investment, serving clients in industries such as automotive, mobility, aviation, and industrial products. Lu has extensive project execution experience both in China and globally, efficiently translating strategic plans into actionable financial outcomes. She has led strategy teams and projects at several multinational corporations and has entrepreneurial experience in the new energy vehicle sector.

Gao Feng Advisory

Gao Feng Advisory Company is a professional strategy and management consulting as well as investment advisory firm with roots in China coupled with global vision, capabilities, and a broad resources network

Wechat Official Account:Gaofengadv

Shanghai Office

Tel: +86 021-63339611

Fax: +86 021-63267808

Hong Kong Office

Tel: +852 39598856

Fax: +852 25883499

Beijing Office

Tel: +86 010-84418422

Fax: +86 010-84418423

E-Mail: info@gaofengadv.com

Website: www.gaofengadv.com

Weibo: 高风咨询公司

Previous:None