China’s Intensifying Tech-Enabled Innovations

作者介绍:谢祖墀博士 为香港国际金融学会创会理事、高风咨询创始人兼CEO

Is China Innovative? Why and How?

It is now almost universally acknowledged that today’s China is innovative. However, views differ on how “innovative” China really is and how long the phenomenon will sustain.

Tearing off the “copycat” label, China has developed a thriving internet and technology sector which has grown twice as fast as the overall gross domestic product over the past decade. According to the Hurun Global Unicorn List 2020, six of the world’s top ten unicorns (unlisted companies valued at 1 billion US dollars or more) are in China.

For a long time, Chinese (tech) companies were seen by their western counterparts as copycats who simply copied business models or products. However, a legion of companies like Alibaba, Tencent, ByteDance, Huawei and consumer drone maker DJI have continuously shed the stigma and showed the rest of the world that the Chinese too are innovative – not just in products but also in business models, concepts and philosophy.

A case in point is the way 5G has developed in China. The country is constantly extending its lead. The number of 5G users in China surpassed 88 million by the end of July – nearly 80 percent of users worldwide – and Huawei continues to be the world’s 5G trailblazer.

In fact, western companies are beginning to copy what these Chinese companies are doing. In a bid to copy the ByteDance-owned short-video platform TikTok, Facebook has launched through Instagram its own short-video feature “Reels”. It is the second time that Facebook has tried to clone the Chinese social media app, after it shut down Lasso, the failed standalone app that intended to compete with TikTok.

The shift in epicenter of business innovations from the West to China is significant because it is not only about the tangible aspects of innovations (products and features that people can touch and feel) but also increasingly intangible aspects, such as strategic thinking, organizational culture and business model design.

China has demonstrated its ability to innovate, notwithstanding the contrarian beliefs of many pundits who for a long time, have insisted that lack of political freedom, a state-controlled command economy, rote learning education and inadequate intellectual property protection constitute the reasons why China cannot be innovative. Some people have even cited the small number of Nobel laureates China has had in natural sciences as proof of the innate inability of the Chinese to innovate.

Reasons for China’s Innovations

So what has caused China’s innovations, and the entrepreneurship that goes with it, to take off? I think it’s because of the following reasons:

1. “Why not me?”: At the end of the 1970s, with the onset of China’s era of reform and opening-up, the Chinese discovered that not only was their economy backward and underdeveloped compared with developed nations, but the gap between the Chinese economy and those economies too was vast. Against this background, Chinese entrepreneurs were spurred by a new sense of purpose and the desire to strive for success and show the world that they, too, could succeed. Although it’s been 40 years since China’s opening-up began, this question of “why not me?” is still the key driver behind the Chinese entrepreneurial spirit.

2. Market opportunity provided by the State economy: For a very long time, China’s economy was dominated by state-owned enterprises. On the other hand, the market was witnessing increasingly fast changes, intense competition and the need for innovation. SOEs are usually slower to react and therefore many private sector companies sensed the opportunity to fill the gap and were able to achieve extraordinary growth.

3. Transformative and intense competition: The process of shifting from a planned economy to a market economy is gradual and will take time. A wide range of sectors have opened up and the allure of the massive China market has resulted in arrival of players from all over the world, igniting intense competition. This state of hyper competition forces companies to innovate in order to stay ahead.

4. The pain points: In the process of transformation, several pain points that had previously remained hidden are now in plain sight. Entrepreneurs considered these pain points as golden opportunities for innovation. Many innovations came about for the specific purpose of solving societal ills or easing the pressure created by societal pain points.

5. The rise of technology: With wireless internet, smart devices and social media becoming a core part of everyday life of Chinese consumers, technology has been a key enabler of disruptions triggered by innovators and entrepreneurs alike.

6. The massive scale of the Chinese market: The size and fast-changing nature of China’s market allow companies to rapidly scale up. At the same time, it provides a platform for innovators and entrepreneurs to learn via trial and error. Leading Chinese companies are also benefiting from high valuations that provide the capital needed to support growth.

7. Capital resources: Over the past 20 years many venture capital companies and angel investors have earned exceptional returns on their investments in China. Regardless of whether these investors came from abroad or were homegrown, Chinese companies have benefited greatly from the vast sums of capital these investors have provided over time.

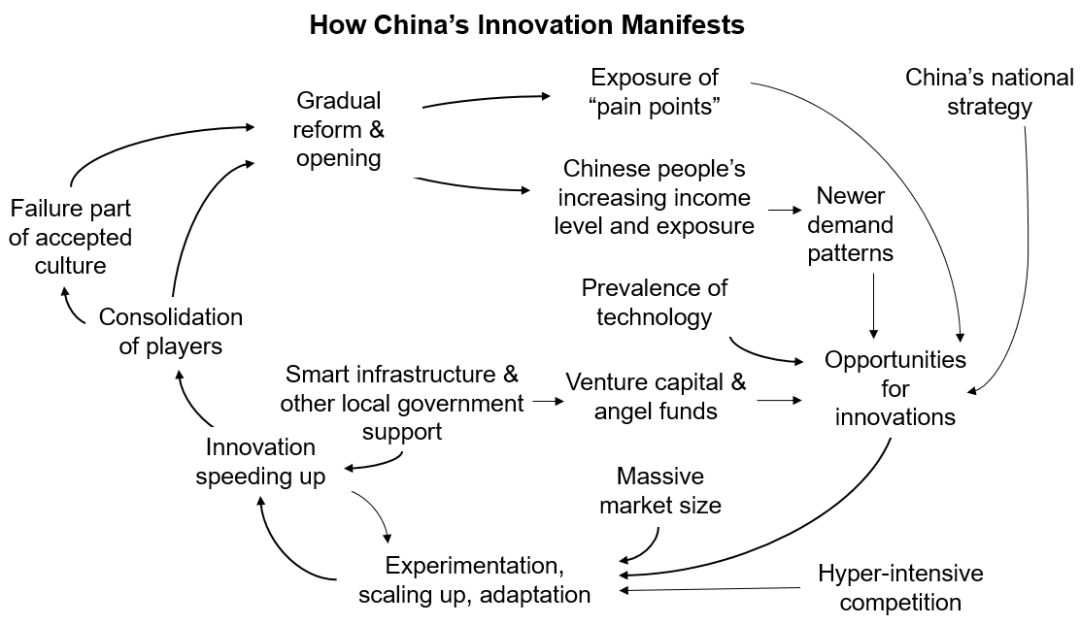

These factors interact with each other, creating an “innovation flywheel” that has propelled the momentum of innovation in China over the years.

Exhibit 1 China’s innovation flywheel

Source: Gao Feng analysis

Chinese entrepreneurs have also been inspired by government policies designed to encourage entrepreneurship. In 2014, Chinese Premier Li Keqiang officially proposed “mass entrepreneurship and innovation” as a national priority, based on achievements of Chinese entrepreneurs in innovation. That, in turn, stimulated more interest from more people to become entrepreneurs and to pursue innovative endeavors.

Does China Have a System Advantage in Innovations?

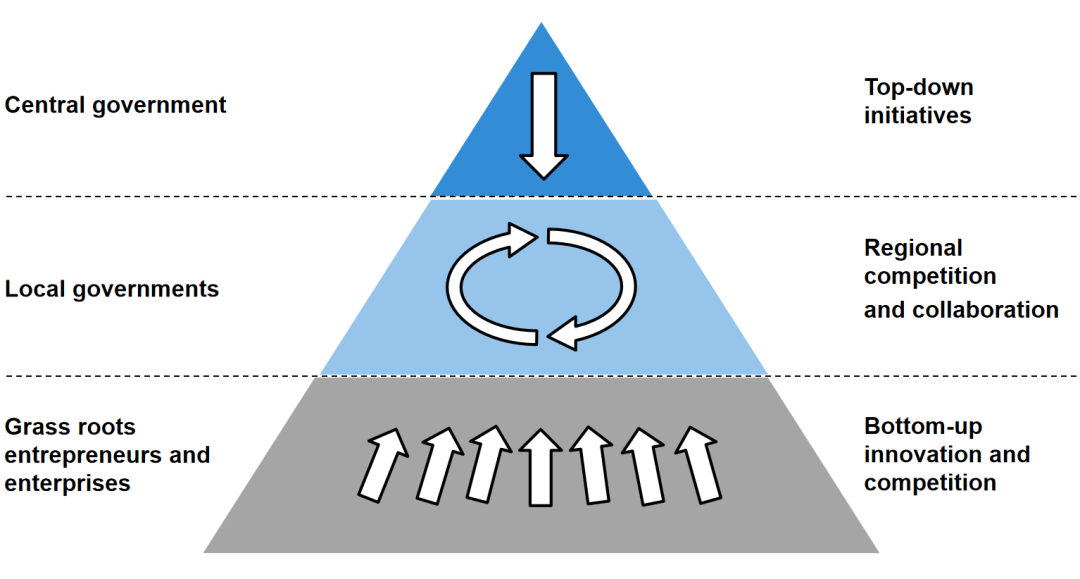

Deng Xiaoping started reform and opening up in China at the end of the Cultural Revolution and took an experimental approach, using various trials and adjustments along the way. Today China’s “three-layered duality” development approach is the key to the resilience China has displayed in the process of its transformation (see Exhibit 2). At the top, the central government has set the country’s overarching strategy – developing it into a technologically advanced and innovative society. At the grass-roots level, private sector entrepreneurs have re-emerged (since the end of the Cultural Revolution) and become a major force driving the country’s economic growth. And in the middle, many of China’s local governments channel their resources to push national and local priorities, often in close collaboration with entrepreneurs. Leading local governments provide funding to start-ups, as well as incubation infrastructure to support their ventures. While local governments often compete with each other to optimize the utility of innovation to people living in their jurisdictions, some also cooperate within regional clusters, such as the “Greater Bay Area” consisting of nine cities in Guangdong Province, including Shenzhen and Guangzhou, together with Hong Kong and Macao.

The dual structure of enterprise ownership in China, comprising state-owned enterprises (SOEs) and privately-owned enterprises (POEs), is a definitive feature that impacts its economy. While there were – and are – glitches between these two types of enterprises, they have also developed a symbiotic relationship. SOEs take on initiatives related to the country’s mission-critical projects, such as the high-speed railway, which was built from virtually nothing to the world’s most extensive system over slightly more than a decade. Meanwhile, POEs, owned and operated by private entrepreneurs, have become the main drivers of market-driven innovations, often enabled by technologies such as the wireless internet. According to the data provided by the Evergrande Research Institute, Chinese POEs have achieved an admirable feat often described as “456789” (using around 40% of the country’s bank loans, contributing more than 50% of tax revenue, producing more than 60% of GDP, accounting for more than 70% of industrial upgrades and innovation, providing more than 80% of urban employment and owning more than 90% of enterprises).

Because this approach is experimental in nature, by definition, it would evolve as the overall context evolves. And, while it has enabled China to achieve impressive growth over the last several decades, it has also created some problems along the way. Repeated investments by local governments have happened in sectors like photovoltaic products, cement plants, steel making and others, leading to overcapacity. However, overall speaking, this approach has served China well and it will continue to be a source of effectiveness and resilience to the country.

Exhibit 2. China’s Three-Layered Development Model

Source: Gao Feng analysis

Manifestation of Innovation

As Washington keeps expanding its technology “blacklist” which restrains Chinese companies from developing competency in areas like semiconductor chips, companies from large to small and private to state-owned are pushing R&D and commercialization of these technologies. Many such attempts can and do end up in failures, but a small number will eventually make it over the next five to ten years.

The recently announced Five-Year plan also entails massive investment in third-generation semiconductors, with a suite of measures to boost research, funding and education in this critical and strategically important sector.

According to official records, China spent nearly US$324 billion in R&D last year alone, which is roughly 2.23 percent of the country’s GDP. Besides, the concept of what constitutes innovation is getting constantly refined, as now people focus on “real performance”, instead of “paperwork” (e.g. publications, degrees and awards).

Consequently these areas are drawing China’s best and brightest minds. More Chinese scholars studying science and engineering are returning to China after completing their studies in the West, especially the US. According to official records, in 2018, about 44% of Chinese students returning after studies abroad were STEM majors, i.e. including sciences and engineering.

Let’s take a look at some examples of how tech-enabled innovations are growing in China.

1.A Future Vision of Intelligent Manufacturing

COVID-19 has changed many manufacturers’ attitude towards digital transformation. During the pandemic, because of the massive lockdown, manufacturers previously relying on human labor for production found themselves unable to restart their factories due to lack of workers. After coming out of the crisis, manufacturers more readily embraced automation and digitalization of their businesses. “The pandemic has accelerated digital transformation,” said Jack Ma, former Chairman of Alibaba. Leading Chinese industrial robot suppliers such as Estun and Topstar are seeing unprecedented increases in inquiries. Growth of output of industrial robots had plateaued in 2019 but production increased by more than 20% year-on-year in the first ten months of 2020 while the overall economy was still recovering.

Looking forward, automation will provide the building blocks for manufacturers to use digital means for optimizing production and managing supply chains. New trends are also emerging for the future of manufacturing. With the pandemic strengthening consumers’ online purchasing habits, companies now have abundant data to guide them in respect of product designs, production scheduling and supply chain management, allowing production to be more flexible and resilient than ever. Using predictive AI, they are optimizing their entire production processes. Moreover, “shared manufacturing” will be the next step coming into reality for these manufacturers. When multiple companies have automated their production lines and leverage the Industrial Internet to manage their production processes, they are simultaneously joining a potential ecosystem where intellectual resources, production tools and equipment, logistics, and even the facilities can be shared between manufacturers, ultimately uplifting efficiency and reducing idle capacity in the whole manufacturing sector.

Leading companies are actively investing in these future trends. Haier, a Chinese appliance maker, has built its COSMOPlat platform based on the newest developments in 5G, the Industrial Internet, and Big Data to provide services to small and medium-sized enterprises (SMEs) in China. Digitally integrating the entire factory process and supply chain, including design, procurement, manufacturing, logistics and other areas, COSMOPlat is leading the transformation into building of an open, multilateral and interactive co-creation and sharing platform that can realize cross-industry and cross-field collaboration for those in its ecosystem.

Haier is just one example of those who are leading the change and investing in the future of the manufacturing sector. With China’s vast number of entrepreneurs who are eager to experiment and compete, we will see more companies tweaking their business models suitably to join the game. It is not just the manufacturing incumbents who will lead and benefit from this transformation. To realize the vision of “shared manufacturing”, players with capabilities in software, hardware, algorithms, and other related areas all need to participate in the move towards this common goal.

2.Autonomous Vehicles’ Next Leap

COVID-19 has provided new opportunities for businesses to test their autonomous vehicle (AV) technologies, particularly in goods movement. Demand for food delivery increased exponentially during the height of the pandemic in China and companies struggled to meet that demand due to labor shortages. This highlighted the benefits of using AVs for goods movement. Not only can AVs help reduce reliance on manual delivery, but they can also reduce human-to-human contact that occurs in each delivery.

Major e-commerce companies have been experimentally using AVs for delivery of merchandise. For example, Meituan tested their AVs on Beijing’s public roads for the first time in February this year to help alleviate driver shortages in the process of delivering groceries. Similarly, JD.com and Alibaba Group’s Ele.me also experimented with AVs for delivery purposes during the period. These major e-commerce platforms are becoming driving forces in shaping the autonomous goods movement ecosystems in China. Multiple ecosystems are likely to emerge, each potentially orchestrated by players such as Alibaba or JD.com, who have the ability to coordinate the technology at a city level, since AV technologies are a vital part of China’s next generation of smart cities.

Commercialization of autonomous goods delivery in China is predicted to become more prevalent in the next two years with China’s Intelligent Connectivity Research Institute estimating that some companies will achieve mass production of autonomous delivery vehicles between 2020 and 2022. Chinese companies will continue to experiment as the technology moves towards commercialization, and a number of areas still need to be developed to support this. Regulations will need to be formulated and tailored for governing production, sales and operations of AVs. Support for further innovation and deployment of key technologies and infrastructure including charging facilities, vehicle stop areas and “vehicle-to-everything” (“V2X”) facilities are also needed, especially key hardware such as semiconductor chips, where China still lags behind other leading nations.

Development of AV technology for people’s movement in China is following closely on the heels of goods movement. Acceleration of its deployment is expected due to rising concerns regarding use of public transport because of the pandemic. Seven Chinese cities are currently running trial runs of “robotaxis” with passengers, and by the end of 2020, over 300 robotaxis are likely to be deployed in these cities. Current examples include start-up AutoX’s roll-out of 100 robotaxis in Shanghai for trial operations. Baidu has opened up its robotaxi services to the public in Beijing, Changsha and Cangzhou, becoming the only company with robotaxi pilot operations in multiple cities across China. Ride-hailing giant Didi Chuxing has set even loftier goals, expecting to operate a million robotaxis by 2030.

3.5G Enabling Telemedicine

As China has become a global leader in 5G technology, scaled commercialization is about to come. By September 17th, 2020, telecommunications infrastructure companies had constructed more than 500,000 5G base stations that have been installed in China. By the end of 2020, China is expected to build more than 600,000 5G base stations, covering all prefecture-level and above cities. Meanwhile, in the annual Central Economics Work Conference, it has been proposed that China should speed up the pace of 5G commercialization and convert 47% of the total mobile users to 5G users by 2025. Featuring low latency and broad band, 5G can improve the current telemedicine industry that is yet to mature or even push it to a breakthrough. Unlike the medical consultation which is limited to text or videos, medical consultations in the 5G era will incorporate virtual reality and augmented reality to upgrade the visual and tactile sensation during the consultations and will even enable real-time operations for patients in remote areas by operating the medical devices remotely. Although the technology is still at an early stage, it will unleash great potential opportunities in the future.

Caveats and Risks

While China’s tech-enabled innovations have been developing fast over the last decade or more, inevitably imperfections and risks also arise. As mentioned above, repetitive investments sometimes occur, resulting in overcapacity. This is the result of overzealous attempts by some local governments and businesspeople who want to capture the dividend of policies from the central government.

For “physical economy” initiatives, overcapacity could take some time to dissolve and requires central government initiative to resolve “supply side economics”.

For “virtual economy” initiatives in the internet sector, however, a “winner takes all” situation typically emerges, resulting in one or a few players dominating the sector after a series of intensive competition and consolidation. In case of some trials, almost the entire sector gets wiped out because of significant over-competition and an un-initiated consumer demand. A prime example of this was the shared bicycles phenomenon that rose and crashed within a span of less than five years between 2014 and 2018.

Given the “three-layer duality” approach that China exercises, this burn and crash phenomenon would likely repeat itself over time but the nature of China’s model ensures a high degree of self-correction.

As digital innovations evolved over the wireless internet era, a selected number of “mega platforms” have also emerged. Building on the incredible amount of big data they are able to collect from their users, these platforms have formed a sprawling network of a large number of businesses, whether they are “to consumers” (2C), “to businesses” (2B), or “to governments” (2G). And in many of the areas, there could have a commanding market position.

A natural question to ask would be to what extent these mega tech platforms should be subject to anti-monopoly regulations. And if so, how?

China’s data privacy law has been relatively loose so far and the users have been willing to share their data with tech companies. After over a decade of this development and with the rise of mega platforms, general awareness of users about restraints on how the data can be used by tech companies has grown, calling for the need to review the current data privacy regulations.

Looking Forward

In the new Five-Year Plan, the Chinese government has vowed to build the nation into a technology powerhouse by 2035, by “making major breakthroughs in core technologies in key areas,” according to officials.

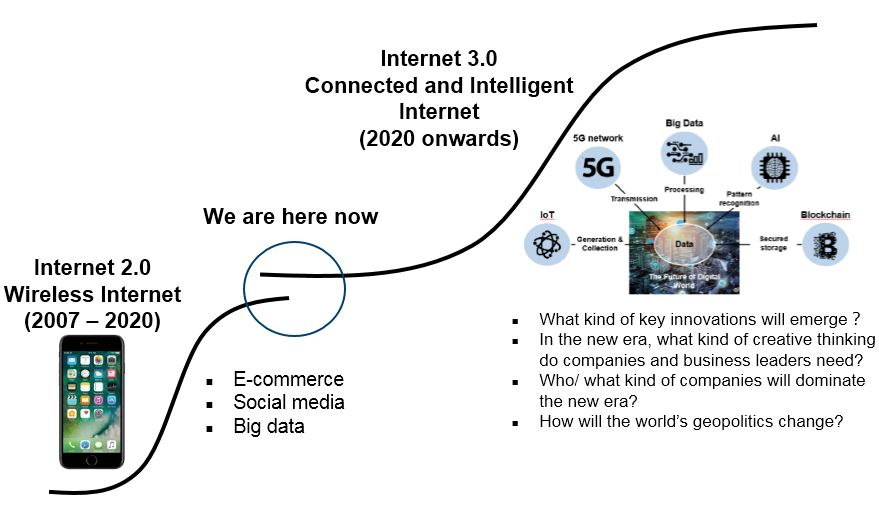

China will be in the front seat witnessing the world entering into the Fourth Industrial Revolution, perhaps ahead of most other countries in the world. As new and emerging technologies like AI, IoT, blockchain and 5G develop, the Chinese are fully ready to embrace them to further enable innovations.

Exhibit 3 Major Emerging Disruptive Technologies

Source: Gao Feng analysis

Many foreign companies and their lobbyists have complained for a long time about the lack of market access in China and have demanded “reciprocity”. While they remain fixated on such issues, they have largely ignored the major shift in China’s innovation performance and have become bystanders on the sidelines. Innovation has become, and will continue to be, a globally prevailing theme, and a country’s future well-being hinges upon its willingness and ability to embrace this trend.

The US-China relationship overhang notwithstanding, China will emerge as a larger and more capable, innovative economy. China’s pathways will inevitably involve many ups and downs, and some of the experiments may not work out as planned and some resources may even be wasted. The lack of core technologies such as cutting-edge microchips has come to the fore but this weakness has also given impetus for the Chinese to catch up. Lots of resources are being invested and many companies of various sizes and backgrounds are working hard in this area to achieve breakthroughs.

Many start-ups would fail, but a small percentage will make it. It would be fool-hardy for anyone to discount China’s will and ability to achieve its goals. Innovations will certainly create social challenges such as job dislocations, education re-configuration and increased wealth disparity but it will also bring about advances in humanity and create major opportunities for companies and individuals who can anticipate the opportunities ahead of time and can figure out ways to capture them. For those who can’t or won’t, they run the risk of being marginalized or even disrupted away.

For western businesses, the message is very clear. China is not merely a large market with significant economic upside. Most importantly, it is becoming a source of inspiration for technology-enabled innovations. Leveraging this platform to generate new knowledge and practices, not only for the China market but also for the global business at large, will be strategically critical for the long-term competitiveness of companies and industries.

香港国际金融学会(HKIIF_)

学会致力于提供一个融贯中西经验的创新平台,研究与孵化多样的政策选择,帮助个人、公司、社团和政府融入国际经济金融的新时代,是一个独立的、非盈利的思想交流、政策研究及领袖培养平台。