A COVID-19 Induced Acceleration of Robotics and Automation

By Edward Tse, Alexander Loke, Rachel Hu and Mandy Lin

July, 2020

As China begins recovering from the COVID-19 pandemic, a big part of this recovery will be addressing the long-standing societal challenges which has been exacerbated by the outbreak. While many businesses are being challenged by the pandemic, new business opportunities have also emerged. In particular, robotics and automation technology-related industries stand to benefit from these opportunities due to a growing need to address incumbent labor-related issues and a desire to decrease human-to-human interactions.

The pandemic will be a catalyst in the uptake of automation across numerous industries. For example, in areas such as manufacturing and autonomous vehicles, there will be an increasing number of human-to-machine and machine-to-machine interactions as automation becomes integrated into business models.

Driving Forces

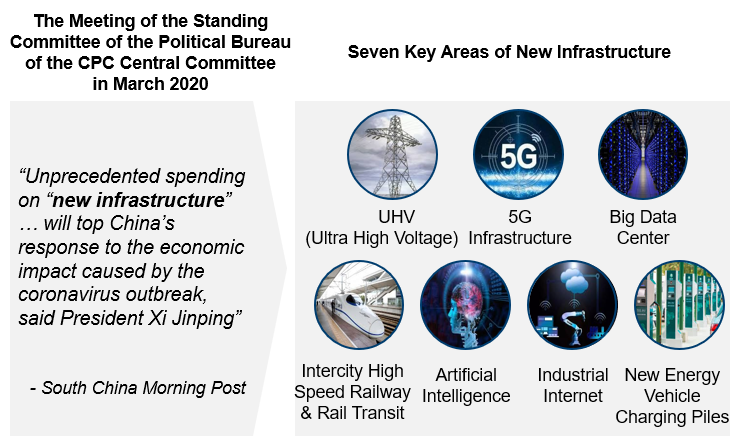

There are a number of forces driving this catalysis in automation technologies. Firstly, the government and its policies are playing a central role, stemming from a growing awareness for more effective public management, especially in health and safety. China looks to not only boost its economy but also to focus on entire industries improving its public management agenda. This will be particularly reflected in the “unprecedented spending on “new infrastructure”” (see Exhibit 1) announced by President Xi Jinping in March 2020, as a response to the pandemic. Wu Hao from the National Development and Reform Commission defined new infrastructure as consisting of three dimensions: information-based infrastructure such as 5G and IoT; converged infrastructure such as smart transportation and smart energy; and innovative infrastructure that enables research and development[1]. This new infrastructure will provide the foundation for China’s next generation of smart cities where automation will play a big role, driving developments in areas such as intelligent manufacturing and smart mobility.

Exhibit 1

China’s “New Infrastructure”

Source: China Daily, South China Morning Post, Gao Feng Analysis

Secondly, the technologies and related-industries targeted by the government’s new infrastructure agenda, such as 5G Infrastructure, Artificial Intelligence (AI), Big Data Centers and the Industrial Internet, are critical components towards the enabling and development of automation and robotics, opening up new opportunities and areas for innovation and eventual adaptation with existing businesses.

Finally, there has also been a swift acceleration of changes occurring with consumer demands and business needs. Consumers’ demands are becoming increasingly digitalized and shifting from offline to online, thereby reducing human-to-human interactions. Companies in food delivery services such as JD Fresh and Missfresh experienced a surge in users due to the pandemic’s impact, with Missfresh’s orders rising 400% year-on-year during the peak of COVID-19 in China[2]. Meanwhile, companies are looking to upgrade their resiliency and tackle labor-related challenges, especially as COVID-19 has been affecting global supply chains and hindering the ability of employees to return to workplaces. Building greater flexibility into their supply chain and reducing reliance on manual labor are key priorities for companies as they pursue the integration of automation into their business models.

A Future Vision of Intelligent Manufacturing

The impact of COVID-19 has changed many manufacturers’ attitude towards digital transformation. During the pandemic, with a massive lock down situation, manufacturers previously relying on human labor for production found themselves unable to restart their factories due to the lack of workers. Coming out of the crisis, manufacturers more readily embraced automation to digitally transform their businesses. “The pandemic has accelerated digital transformation,” said Jack Ma, the Co-Founder and former Chairman of Alibaba[3]. Downstream leading Chinese industrial robot suppliers such as Estun[4] and Topstar[5] are seeing unprecedented increases in inquiries. Industrial robot output, while its growth had plateaued in 2019, also rapidly increased in May[6] against the overall recovering economy.

Looking forward, automation will provide the building blocks for manufacturers to use digital means in optimizing production and manage their supply chains. New trends are also emerging for the future of manufacturing. With the pandemic strengthening consumers’ online purchasing habits, companies now have abundant data to guide them in product designs, production scheduling, and supply chain management, allowing their production to be more flexible and resilient than ever. Using predictive AI, they will be optimizing their entire production processes. Moreover, “shared manufacturing[7]” will be the next step coming into reality for these manufacturers. When multiple companies have automated their production lines and leveraged the Industrial Internet to manage their production processes, they are simultaneously joining a potential ecosystem where intellectual resources, production tools and equipment, logistics, or even the facilities can be shared between manufacturers, ultimately uplifting efficiency and reducing idle capacity for the whole manufacturing sector.

Leading companies are actively investing into these future trends. Haier, a Chinese appliance maker, has built its COSMOplat platform based on the newest developments in 5G, the Industrial Internet, and Big Data to provide services for small and medium-sized enterprises (SMEs) in China. Through digitally integrating the entire factory process and supply chain, including design, procurement, manufacturing, logistics, and other areas, COSMOPlat[8] is leading the transformation in building an open, multilateral and interactive co-creation and sharing platform that can realize cross-industry and cross-field collaboration for those in its ecosystem.

Haier is just one example of the players who are leading the change and investing into the future of the manufacturing sector. With China’s vast number of entrepreneurs who are eager to experiment and compete, we will see more companies evolving their business models to join the game. It is not just the manufacturing incumbents who will lead and benefit from this transformation. To realize the vision of “shared manufacturing”, players with capabilities in software, hardware, algorithms, and other related areas all need to participate towards this common goal.

Autonomous Vehicles’ Next Leap

COVID-19 has also provided new opportunities for businesses to test their autonomous vehicle (AV) technologies, particularly in goods movement. As demand for food delivery increased exponentially during the height of the pandemic in China and companies struggled to meet that demand due to labor shortages, it highlighted the benefits of using AVs in goods movement. Not only could AVs help decrease reliance on manual delivery, it also reduced the amount of human-to-human contact that occurred with each delivery.

Source: Internet

Major e-commerce providers have been leading the charge to experiment in using AVs in delivery. For example, Meituan tested their AVs on Beijing’s public roads for the first time in February this year to help alleviate driver shortages in delivering groceries. Similarly, JD.com and Alibaba Group’s Ele.me also experimented with AVs for delivery purposes during the period. These major e-commerce platforms are becoming driving forces in shaping the autonomous good movement ecosystems in China. Multiple ecosystems are likely to emerge, each potentially orchestrated by players such as Alibaba or JD.com, who have the ability to coordinate the technology at a city level, since AV technologies are a vital part of China’s next generation of smart cities.

More prevalent commercialization of autonomous goods delivery in China is predicted to happen around the next two years with China’s Intelligent Connectivity Research Institute estimating some companies will achieve mass production of autonomous delivery vehicles from 2020 to 2022[9]. Chinese companies will continue to experiment as the technology moves towards commercialization, and a number of areas still need to be developed in support of this. Regulations will need to be formed and tailored for the production, sales and operations of AVs. Support for further innovation and deployment of key technologies and infrastructure including charging facilities, vehicle stop areas and “vehicle-to-everything” (“V2X”) facilities are also needed, especially for key hardware such as semiconductor chips, where China still lags behind other leading nations.

Development of AV technology for people movement in China follows closely on the heels of goods movement. An acceleration in its deployment is similarly expected due to rising concerns regarding public transport in reaction to the pandemic. Seven Chinese cities are currently trialing “robotaxis” with passengers, and by the end of 2020, over 300 robotaxis will be deployed in these cities[10]. Current examples of trials include start-up AutoX’s roll-out of 100 robotaxis in Shanghai since April 2020 and Baidu’s plan to run 100 robotaxis in Changsha by the end of 2020[11]. Ride-hailing giant Didi Chuxing has set even loftier goals, expecting to operate a million robotaxis by 2030[12].

Implications for Businesses

Intelligent manufacturing and autonomous vehicles are just two areas out of many in China, where business landscapes are changing rapidly as incumbents and emergent players are jostling to find their positions in the face of major upheavals in their industries. Chinese companies such as Haier, Meituan and JD.com are leading the charge in innovation in their respective areas. For players that emerge as manufacturing and delivery become increasingly automated, such as those based in software algorithms or new business models, they must experiment in order to find a path towards monetization. Indeed, all players will need to build new capabilities outside of their core businesses, through a combination of internal initiatives and partnerships, which could lead to wider ecosystems.

China’s public agenda priorities will also open the door to more opportunities for businesses in the form of public-private partnerships (PPP). For Chinese local governments, PPPs will be essential in their initiatives to address central government mandates, since they will need to be supplemented with capabilities from the private sector. Thus, players will need to understand what roles they can play in the building of “new infrastructure” and the next generation of smart cities.

For those in manufacturing and autonomous vehicles, China is a critical piece of the puzzle in designing what the next generation of businesses incorporating automation will look like for these areas, making this assessment of their roles in China essential for their future development.

References:

1. Shen, T. (2020, April 20). China Defines ‘New Infrastructure’ to Boost Economy. https://www.caixinglobal.com/2020-04-20/china-defines-new-infrastructure-to-boost-economy-101544888.html

2. South China Morning Post. (2020, February 18). China’s delivery workers risk infection as online sales surge amid coronavirus outbreak [Video file]. Retrieved from https://www.youtube.com/watch?v=McZn6niKo0M

3. Wei, H. (2020, July 10). Experts: AI to unleash growth across sectors. https://www.chinadailyhk.com/article/136479

4. 全景网. (2020, June 22). 埃斯顿:目前公司3-5月订单同比增长.

https://finance.sina.com.cn/stock/relnews/cn/2020-06-22/doc-iircuyvi9802344.shtm

5. 互联快报网. (2020, July 6). 疫情期间如何实现订单不降反升?华为云助力拓斯达赋能智能制造. https://tech.ifeng.com/c/7xsntchaw1k

6. 工业网. (2020, July 7). 统计局:5月全国工业机器人产量逆势上扬. http://www.indunet.net.cn/staticpage/20200707/070721359.html

7. Lee, A. (2019, November 1). China to pursue shared platforms to upgrade manufacturing sector after shelving ‘Made in China 2025’. SCMP. https://www.scmp.com/economy/china-economy/article/3035779/china-pursue-shared-platforms-upgrade-manufacturing-sector

8. China Daily. (2020, May 12). COSMOPlat boosts intelligent manufacturing. http://qingdao.chinadaily.com.cn/2020-05/12/c_488396.htm

9. Zhu, L., Jin, Y., & Tang, P. (2020, March). Status Quo and Challenges of Autonomous Delivery Commercialization in China and Its Suggestions. Retrieved July 10, 2020, from Intelligent Connectivity Research Institute, China EV100 website: http://www.chinaev100.com/ShowArticle.aspx?ID=6629

10. BloomberyNEF. (2020, May 28). China Backs Self-Driving Development With Robotaxi Pilots. Retrieved July 14, 2020, from BloombergNEF website: https://about.bnef.com/blog/china-backs-self-driving-development-with-robotaxi-pilots

11. Dai, S. (2020, April 27). AutoX, Alibaba’s AutoNavi roll out robotaxis in Shanghai’s ride-hailing services market. SCMP. https://www.scmp.com/tech/apps-social/article/3081625/autox-alibabas-autonavi-roll-out-robotaxis-shanghais-ride-hailing

12. Sun, Y., & Goh, B. (2020, June 23). China's Didi aims for 1 million robotaxis on its platform by 2030. Reuters. https://www.reuters.com/article/us-china-autonomous-didi/chinas-didi-aims-for-1-million-robotaxis-on-its-platform-by-2030-idUSKBN23U1U4

Abouth the authors:

Edward Tse is founder and CEO, Gao Feng Advisory Company, a founding Governor of Hong Kong Institution for International Finance and Adjunct Professor, School of Business Administration, Chinese University of Hong Kong. One of the pioneers in China’s management consulting industry, he built and ran the Greater China operations of two leading international management consulting firms (BCG and Booz) for a period of 20 years. He has consulted to hundreds of companies, investors, start-ups, and public-sector organizations (both headquartered in and outside of China) on all critical aspects of business in China and China for the world. He also consulted to a number of Chinese local governments on strategies, state-owned enterprise reform and Chinese companies going overseas, as well as to the World Bank and the Asian Development Bank. He is the author of several hundred articles and four books including both award-winning The China Strategy (2010) and China’s Disruptors (2015) (Chinese version «创业家精神»).

Alexander Loke is an Associate at Gao Feng Advisory Company based in Hong Kong and Shanghai. He has consulted numerous multinational and local clients, from areas of business strategy, connected mobility, autonomous vehicles, ecosystem design, to understanding future social, economic and political landscapes.

Rachel Hu is a Consultant at Gao Feng Advisory Company. She has consulted numerous clients in both China and Australia, focusing on growth strategy, new market entry and business model design. She has worked with clients across many sectors including automotive and connected mobility, healthcare, industrials and technology.

Mandy Lin is a Consultant at Gao Feng Advisory Company based in Shanghai. She has provided consulting services to both multinational and local clients, and she is experienced in the industrials, technology, and healthcare sectors, specializing in strategy formulation and innovative business model development.

Gao Feng Advisory

Gao Feng Advisory Company is a professional strategy and management consulting firm with roots in China coupled with global vision, capabilities, and a broad resources network

Wechat Official Account:Gaofengadv

Shanghai Office

Tel: +86 021-63339611

Fax: +86 021-63267808

Hong Kong Office

Tel: +852 39598856

Fax: +852 25883499

Beijing Office

Tel: +86 010-84418422

Fax: +86 010-84418423

E-Mail: info@gaofengadv.com

Website: www.gaofengadv.com

Weibo: 高风咨询公司