Recalibrating Your China Strategy for the Post Pandemic World

By Edward Tse

July, 2020

After a sharp contraction in the first quarter of the year due to the COIVD-19 pandemic, China’s economy is picking up steam as businesses and production resume with caution. The official PMI climbed to a three-month high of 50.9[1] and the services PMI – a barometer for the most impacted sector, accounting for 50% of the GDP – hit a decade-high in June at 58.4[2]. However, despite these upbeat figures, the longer-term outlook is less clear. According to Deutsche Bank’s chief economist, Michael Spencer, even with a V-shaped domestic recovery, China’s growth will still be constrained by the double-digit declines in its trade partners and the continued surge in new cases around the world[3]. Significant challenges aside, the pandemic brought in an inflection point in China’s development for which companies will need to recalibrate.

Changing Business Climate after the Pandemic

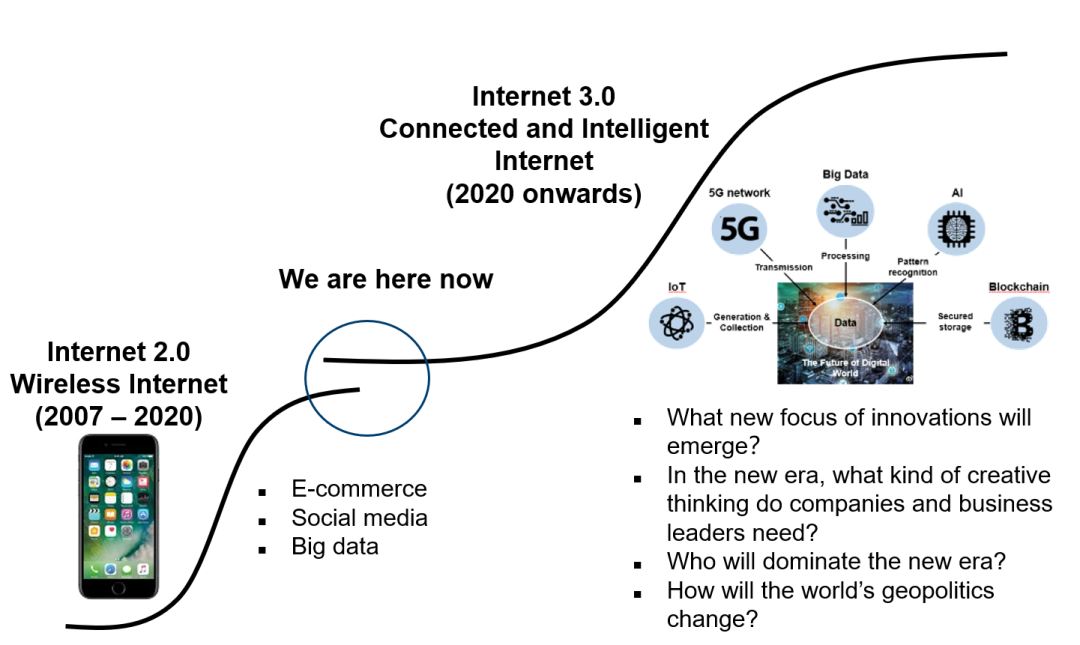

During this time, there has been a surge in new consumer demands across a number of important sectors. An explosive increase of the work-from-home population led to a boom in social media and remote office platforms; from Alibaba’s DingTalk to Tencent’s WeChat Work, work productivity apps gained over 308 million new users nationwide[4]. Similar growth has also been seen in the edtech (education technology) sector, with 423 million students turning to edtech platforms such as Yuanfudao and VIPKid. The edtech sector is estimated to reach US$63.6 billion in 2020, according to iiMedia Research. Gaming and video streaming platforms also witnessed exponential growth. Retailers and restaurants were reimagining human-machine symbiosis, as JD.com fulfilled over a million orders per day through automated warehousing and Keeno, a robotics startup in Shanghai, developed an autonomous vehicle to disinfect public spaces. These events collectively suggest China is entering a new era of technology revolution, as the commercial applications of several new disruptive technologies have reached their respective inflection points more or less at the same time (see Exhibit 1)

Exhibit 1

Cusp of a New Technology Era

Source: Gao Feng Analysis

The pandemic also gave the much-needed push to China’s public health infrastructure. President Xi Jinping, who had earlier declared biosecurity a “cornerstone of national security,” urged an all-around improvement in disease prevention, emergency response, government accountability as well as healthcare research and education. As with many major policy changes in China’s recent past, the gravitation towards health, or public welfare in general, will be catapulted by technology-enabled solutions, especially those associated with the development of China’s smart cities.

Capturing Upcoming Opportunities in Future Smart Cities

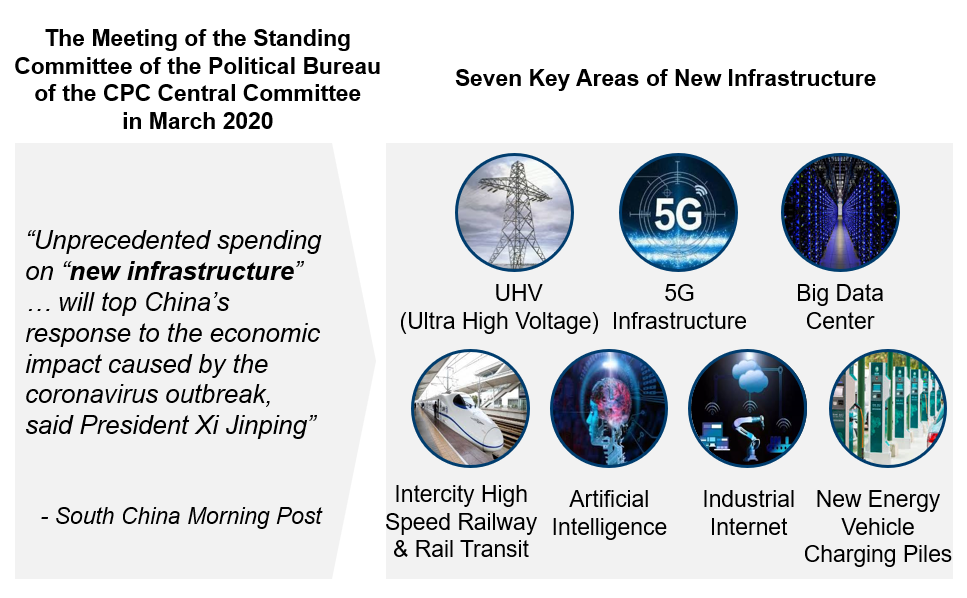

In parallel to this need, the Chinese government has laid out plans for the so-called “New Infrastructure,” consisting of three components: information-based infrastructure such as 5G and IoT; converged infrastructure such as smart transportation and smart energy; and innovative infrastructure that enables research and development. New Infrastructure is set to form the backbone of China’s new digital economy (see Exhibit 2). It is expected to generate US$2 trillion investment over the next five years[5], while paving ways for the next generation smart cities.

Exhibit 2

China’s “New Infrastructure”

Source: China Daily, South China Morning Post, Gao Feng analysis

Since as early as 2011, with rapid urbanization and the ambition to become a technology superpower, China has been investing heavily in several hundreds of “smart cities” across the country. These initiatives aim to empower urban management through advanced technologies such as the Internet of Things (IoT), 5G, big data, artificial intelligence (AI), and blockchain. Whereas most smart cities have made significant progress towards security and traffic goals, they seem to have missed out on public health imperatives like COVID-19. For instance, though announced as a pilot smart city in as early as 2012, Wuhan still has experienced tremendous difficulties as the epicenter of COVID-19.

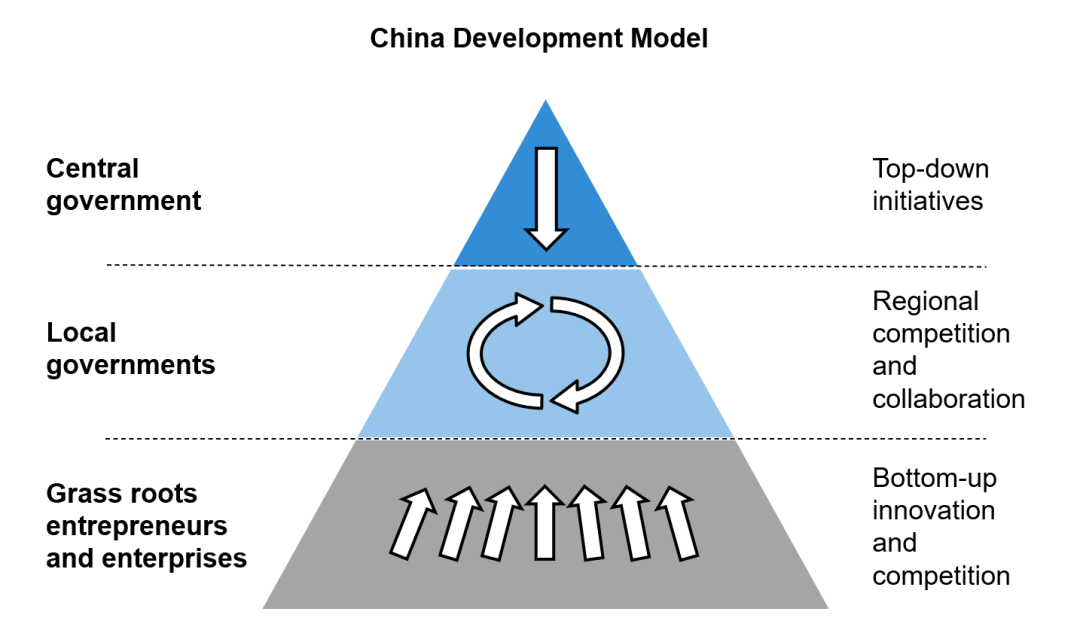

Governments across the country have realized the need to broaden their areas of focus for smart cities, in relation to public management and in particular public health. In June, Shanghai published a three-year plan to boost the health system – consisting of emergency response mechanisms and monitoring networks – in conjunction with more sophisticated, tech-enabled governance apparatuses. The primary mode of rebuilding urban governance will be through public-private partnerships (PPP), where local governments and businesses, both state- and private-owned including foreign companies, collaborate to deliver public projects. PPPs also reflect China’s unique development model which it has evolved into since the 1980s. Specifically, at the top, the central government sets the national agenda, providing clear directions for the rest of the country. At the grass-roots level, fast-growing and highly dynamic entrepreneurs drive China’s growth and innovation. In the middle, local governments compete and cooperate to form regional clusters, and function as the key joint between the central government and grass-roots businesses (see Exhibit 3).

Exhibit 3

China Development Model

Source: Gao Feng analysis

For example, Tencent, a long-time partner with Wuhan’s smart city workforce, helped the government launch its digital governance platform through WeChat, generating health code and providing up-to-date pandemic statistics for citizens. After the pandemic, Tencent is to establish an online education center with offline bases in Wuhan, and replicate the model across the country. The tech giant will also join forces with Dongfeng Group, a major Chinese automotive OEM, in building the Tencent Mobility College – aimed at developing human capital and incubating entrepreneurship in smart mobility technologies. As a whole, Wuhan will become a pilot WeCity project in which Tencent will fully explore cloud computing, big data, and AI technologies in their applications for digital governance and decision-making[6].

Along with the evolution of future cities, new business models catering to the changing modes of interactions will arise. Smart technologies will unleash an array of business opportunities, from surveillance, law enforcement, supply chains, autonomous driving, online finance, education, entertainment, and healthcare as well as community life.

What does the new business landscape after the pandemic mean for global businesses in China? For most, it signals a time to recalibrate their China strategy and adapt to these changes. Many proactive enterprises have already been working closely with local authorities and leveraging existing resources and capabilities to empower the transformation of the city and its industries. In this process, these companies are also elevating their economic value-add and extracting further synergies from adjacent industries. As an example, through the PPP model, China Fortune Land, a property developer, is establishing industrial cities across China, assisting the city in infrastructure and industrial development as well as integrated supporting services. The Japanese workplace technology provider Ricoh, under the support from local government, rezoned its core Shenzhen site for city’s emerging industries that focus on R&D, design and innovation, pilot testing and pollution-free production. Tsinghua Unigroup, a leading Chinese electronics manufacturer, established a smart city arm that seeks to build IT industry clusters around the group’s core chip and cloud businesses, hence fostering innovation and reinvesting the profits in its core businesses.

Takeaways for Companies

China in the post-pandemic world will look quite different. The International Monetary Fund expects China to contribute more than a quarter of global growth by 2024[7], and hence its exporting and manufacturing capacity will be critical for the world economy. In addition, China will attempt to take on more responsibilities in the new era, since public management is a common challenge to developed and developing countries alike, and tackling it means closer collaboration between China and the rest of the world.

At the same time, geopolitics surrounding China will continue to generate uncertainty and ambiguity for doing business in and with China, especially for foreign companies. At the minimum, concerns of politics could make senior executives of global companies bewildered about how they should think about their China strategies. Nevertheless, sufficient knowledge and understanding of China’s commitment to invest heavily to reboot its economic growth, and the opportunities (and challenges) that ensue, will be critical for business decision-makers from all over.

The current moment could be a turning point for businesses in China. There will be both tremendous opportunities and challenges. Some companies will take a careful read on the ensuing landscape both in China and the rest of the world and use that to help make the bets (or not) on China. Sometimes, it may even require some of them to be willing to “jump” – entering into new (adjacent) spaces and crossing sector boundaries. Regardless of tactics, however, businesses decision makers need to develop a confident perspective of the future and act accordingly. Often times, herd’s instinct is not necessarily right.

References:

1. Cheng, J. (2020, June 30). “China’s economic recovery picks up further momentum”. Wsj.com. Retrieved July 8, 2020, from https://www.wsj.com/articles/chinas-economic-recovery-picks-up-more-momentum-11593502340

2. Qiu, S. and Woo, R. (2020, July 3). “China's services sector grows at fastest pace in over a decade in June: Caixin PMI”. Reuters.com. Retrieved July 8, 2020, from https://www.reuters.com/article/us-china-economy-pmi-idUSKBN24405F

3. Huang, E. (2020, July 6). “Deutsche Bank sees China’s ‘V-shaped recovery’ moderating in the second half of 2020”. Cnbc.com. Retrieved July 8, 2020, from

https://www.cnbc.com/2020/07/06/deutsche-bank-sees-chinas-recovery-moderating-in-the-second-half.html

4. Shen, X. (2020, July 7). “The top 10 takeaways from the China Internet Report 2020”. Scmp.com. Retrieved July 8, 2020, from https://www.scmp.com/abacus/tech/article/3092028/top-10-takeaways-china-internet-report-2020

5. Liu, et al. (2020, June 1). China bets on $2tn high-tech infrastructure plan to spark economy. asia.nikkei.com. Retrieved July 15, 2020, from https://asia.nikkei.com/Business/China-tech/China-bets-on-2tn-high-tech-infrastructure-plan-to-spark-economy

6. 武汉重启,数字政府、智慧城市亟需推进,腾讯打响第一枪 (2020, April 8). tech.ifeng.com. Retrieve July 8, 2020, from https://tech.ifeng.com/c/7vV4UMw9dI9

7. China to lead global growth, India to surpass U.S. in 2024. (2019, October 22). News.cgtn.com. Retrieve July 13, 2020, from https://news.cgtn.com/news/2019-10-22/China-to-lead-global-growth-India-to-surpass-U-S-in-2024-KZQQxOV6rC/index.html

About the Author

Dr. Edward Tse is founder and CEO, Gao Feng Advisory Company, a founding Governor of Hong Kong Institution for International Finance and Adjunct Professor, School of Business Administration, Chinese University of Hong Kong. One of the pioneers in China’s management consulting industry, he built and ran the Greater China operations of two leading international management consulting firms (BCG and Booz) for a period of 20 years. He has consulted to hundreds of companies, investors, start-ups, and public-sector organizations (both headquartered in and outside of China) on all critical aspects of business in China and China for the world. He also consulted to a number of Chinese local governments on strategies, state-owned enterprise reform and Chinese companies going overseas, as well as to the World Bank and the Asian Development Bank. He is the author of several hundred articles and four books including both award-winning The China Strategy (2010) and China’s Disruptors (2015) (Chinese version «创业家精神»). He holds a SM and s SB in Civil Engineering from the Massachusetts Institute of Technology, as well as a PhD and an MBA from University of California, Berkeley

Gao Feng Advisory

Gao Feng Advisory Company is a professional strategy and management consulting firm with roots in China coupled with global vision, capabilities, and a broad resources network

Wechat Official Account:Gaofengadv

Shanghai Office

Tel: +86 021-63339611

Fax: +86 021-63267808

Hong Kong Office

Tel: +852 39598856

Fax: +852 25883499

Beijing Office

Tel: +86 010-84418422

Fax: +86 010-84418423

E-Mail: info@gaofengadv.com

Website: www.gaofengadv.com

Weibo: 高风咨询公司