GF Viewpoint | Social Commerce in China

Social Commerce in China: From Humble WeChat Posts to a Multibillion-Dollar Market

By Edward Tse, Rachel Hu, Mandy Lin

April 2020

A recent Gao Feng Advisory Viewpoint co-authored by CEO Dr. Tse and Senior Consultants Rachel Hu and Mandy Lin.

In China’s rapidly evolving consumer goods landscape, social commerce, essentially a subsector of e-commerce, has become increasingly prevalent. An estimated 11.6% of all e-commerce sales in China in 2020 were through social commerce, and 30.6% of China’s population constitutes social buyers.

Social commerce has been developing ever since the launch of WeChat, a major Chinese multi-purpose messaging, social media and mobile payment app developed by internet giant Tencent. The increasing prevalence of key technological tools such as the smartphone and other Internet-of-Things (IoT) products riding on 4G internet has enabled social commerce to accelerate its penetration into China’s general population.

Now as social commerce has turned into a powerful distribution channel for many businesses to reach their target consumers, understanding it has become crucial for companies, especially for those focusing on consumer products.

What is Social Commerce?

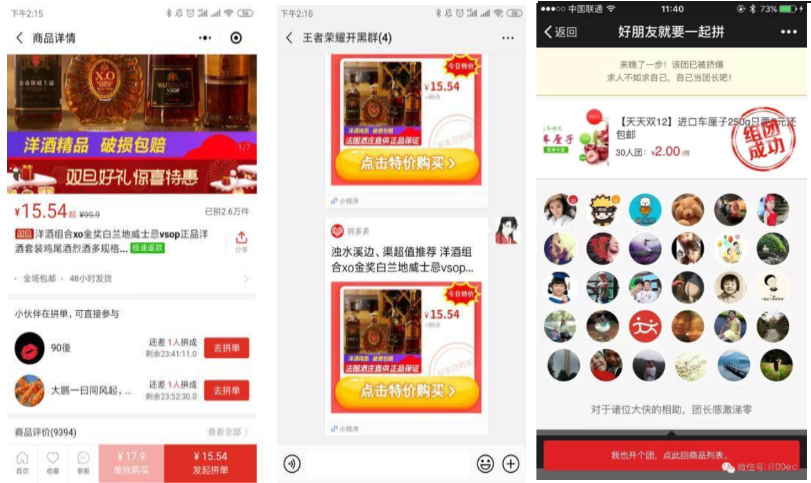

Social commerce relies on endorsement through sharing messages. There are two key types of social commerce. The first relies on a social network to disseminate product information. Message receivers may initiate purchase because they trust the sharer. Leading companies in this category include WeChat social commerce and the e-commerce giant, Pinduoduo.

WeChat is one of the earliest social commerce platforms in the Chinese market, with gross market transaction value totaling more than RMB 5000 Bn (around US$ 720 Bn) in 2019. Most of sellers and buyers are young women such as stay-at-home mothers. Beauty, diapers and other products that tend not to have a (short) warranty period are mostly sold through WeChat social commerce. Some Chinese consumers do have concerns about the quality and authenticity of distribution channels of these products, but the affordable pricing and the implicit endorsement intrigue them enough to make a purchase.

Pinduoduo built an e-commerce empire centered around social commerce. Consumers may acquire significant discounts by sharing merchant information with friends through social media, such as WeChat. Many of Pinduoduo’s users are very price sensitive, and are willing to leverage their social networks for a better price. Such marketing strategy, low prices and highly personalized promotion are the key factors behind success of Pinduoduo.

Source: Baidu

The second type of social commerce relies on KOLs (key opinion leaders) who have strong credibility in a certain field. Users base their purchases on the trust they have in a KOL, and Xiaohongshu is a prime example of that.

Xiaohongshu started as a small online community of young Chinese shoppers to share shopping know-how and product reviews, and has since grown to be an important KOL marketing platform. Most of Xiaohongshu’s users are young women, so products promoted on it are mostly cosmetics, tourism and restaurants. Companies usually cooperate with KOLs who post promotional information to their fans. Strong stickiness between Xiaohongshu and KOLs and between KOLs and their fans are the key factors behind success of Xiaohongshu.

Competition of Video-Based Platforms

KOLs in particular have become a major aspect of video-based platforms which in turn, have led to a huge surge in social commerce on video platforms such as Douyin, Kuaishou and Bilibili. Particularly after breakout of the pandemic, consumers turned to online shopping formats in increasing numbers, leading to emergence of a younger generation of consumers.

Tiktok, known in China as Douyin, is a video-sharing social networking app owned by Chinese company ByteDance. It combines livestreaming and KOLs’ influence to promote products through social commerce. Luo Yonghao, a Chinese entrepreneur, previously sold products worth RMB 110 Mn (US$ 16 Mn) in 3 hours of his first Douyin livestream, covering everything from Xiaomi smartphones and Gillette razors, to food and beverage and beauty products.

Source: Baidu

Kuaishou, another short-video platform often considered a competitor to Douyin in China, shares many similarities with Douyin in the use of livestreaming and KOLs to generate social commerce revenues. However, demographics of audiences of the two platforms have evolved quite differently. While Douyin’s users are primarily from top-tier cities, Kuaishou’s users are usually from lower-tier cities. Because of this, Kuaishou’s users focus much less on brands and they are more inclined to purchase due to strong community affinity.

Bilibili on the other hand is a video sharing community focused on long-form video rather than short-form and livestreaming. It is very popular with Generation Z, and has a highly engaged audience. Since its inception, its video content has rapidly expanded beyond its original “ACM” (anime, comics, manga). It’s more focused on long-form video format, with many KOLs on other platforms such as Douyin now migrating to Bilibili to diversify their user base. Its unique membership program helps create a sense of community among its users. According to its financial report for Q4 2020, it generated the majority of its revenue through membership and subscription services, gaming, and advertising services, while e-commerce services account for only 19% of its total revenue. However, e-commerce revenue is growing rapidly as the company sees opportunities in this space.

Key Approaches in Leveraging Social Commerce

As an increasing number of companies adjust their business strategies to engage in social commerce, companies should be aware of the key approaches to effectively leverage it. They can leverage it through brand personification, carefully choosing the right channel to share brand messages, and adapting to the changing consumer behaviors.

Through brand personification, companies create a brand image that is tied to personality traits, making a brand more familiar to the target consumers. This emotional connection between brands and customers also increases customers’ brand loyalty. One example is Jiangxiaobai, a Chinese light-aroma baijiu brand, which has built itself as a friend of young consumers, and shares emotion and experiences with them. Jiangxiaobai also leverages its personalized brand image in the social commerce space, communicating messages through the personas of young individuals, creating a rapport with young consumers who feel as if they are communicating with a friend.

Moreover, as different social commerce platforms usually serve different target audiences, companies should choose social commerce platforms based on the product and the brand image. Perfect Diary, a Chinese [cosmetics] brand catering to young consumers, for example, promotes its products on WeChat, Xiaohongshu and Bilibili and uses different strategies to target audiences of each of these platforms.

Source: Baidu

Lastly, companies should keep monitoring the rapid evolution of consumer behavioral changes to remain adaptive to consumer changes. In livestreaming, Taobao has previously been the incumbent, but as video platforms such as Douyin and Kuaishou encroached upon live-streaming commerce, it now faces fiercer competition. Players from adjacent sectors are also eyeing this huge opportunity, and Baidu, another Chinese internet giant, is planning to strengthen its own live-streaming platform. Meanwhile, video platforms also want to increase their control over e-commerce transactions and want to build a closed-loop transaction system without involvement of the e-commerce giants. Brands that use KOLs on social commerce platforms should, at the same time build their own in-house content (content commerce) for use on multiple platforms.

Implications

Chinese consumer demand, social media platforms, e-commerce platforms and brands will continue to mutually shape each other. Social commerce, as a key connection between these factors, will continue to grow in importance.

To target the massive consumer market in China, social commerce is becoming a must have and many foreign multinationals are now trying to play catch up. This requires their chief marketing officers to be able to maneuver many moving parts, including their own brand’s products and positioning, the target audience and the careful use of KOLs and social commerce platforms. They should establish collaborative partnerships with local firms with experience in China’s advertising landscape to better adopt social commerce.

The entry into social commerce will generate a vast amount of new user data for brands, which will require new data management capabilities and the consideration of how to ethically leverage and protect that data.

The rise of social commerce also brings to focus the importance of bringing “social” into business models in China. This can be applied beyond just the fast-moving consumer goods brands that have been typical to social commerce. NIO, the Chinese electric car brand, has successfully created a “NIO community” to attract users and increase their loyalty.

On the flip side, as with any fast-developing business model, social commerce, especially livestreaming, faces issues and challenges. There are concerns from consumers about poor quality products and misleading advertising. Recently, China’s regulators have tightened security over e-commerce platforms and issued guidance to help the industry to develop more sustainably and healthily. While regulation still needs to catch up with the pace of innovation, both continue to progress in China.

Acknowledgement

Charlson Tang, Senior Consultant, also contributed to this article.

About the Authors

Dr. Edward Tse is founder and CEO, Gao Feng Advisory Company, a founding Governor of Hong Kong Institution for International Finance, Adjunct Professor of School of Business Administration at Chinese University of Hong Kong and Professor of Managerial Practice at Cheung Kong Graduate School of Business. One of the pioneers in China’s management consulting industry, he built and ran the Greater China operations of two leading international management consulting firms (BCG and Booz) for a period of 20 years. He has consulted to hundreds of companies, investors, start-ups, and public-sector organizations (both headquartered in and outside of China) on all critical aspects of business in China and China for the world. He also consulted to a number of Chinese local governments on strategies, state-owned enterprise reform and Chinese companies going overseas, as well as to the World Bank and the Asian Development Bank. He is the author of several hundred articles and five books including both award-winning The China Strategy (2010) and China’s Disruptors (2015), as well as 《竞争新边界》 (The New Frontier of Competition), which was co-authored with Yu Huang (2020). He holds a SM and s SB in Civil Engineering from the Massachusetts Institute of Technology, as well as a PhD and an MBA from University of California, Berkeley.

Rachel Hu is a Senior Consultant at Gao Feng Advisory Company based in Shanghai. She had consulted many clients in both China and Australia, focusing on growth strategy, new market entry and business model design. She has worked with clients across many sectors including automotive and connected mobility, healthcare, industrials and technology.

Mandy Lin is a Senior Consultant at Gao Feng Advisory Company based in Shanghai. She has provided consulting services to many multinational and local clients across many sectors including automotive, industrials, logistics, technology, and healthcare. She specializes in strategy formulation and innovative business model development.

Gao Feng Advisory

Gao Feng Advisory Company is a professional strategy and management consulting firm with roots in China coupled with global vision, capabilities, and a broad resources network

Wechat Official Account:Gaofengadv

Shanghai Office

Tel: +86 021-63339611

Fax: +86 021-63267808

Hong Kong Office

Tel: +852 39598856

Fax: +852 25883499

Beijing Office

Tel: +86 010-84418422

Fax: +86 010-84418423

E-Mail: info@gaofengadv.com

Website: www.gaofengadv.com

Weibo: 高风咨询公司