GF Viewpoint | Changing Context of China’s Automotive Sector

Changing Context of China’s Automotive Sector Requires Re-examination of Strategy for Businesses

By Lu Zhang, Charlson Tang, Rachel Hu and Melody Mao

September 2021

A recent Gao Feng Advisory Viewpoint co-authored by Project Manager Lu Zhang, Senior Consultants Charlson Tang, Rachel Hu and Melody Mao.

Evolving Sales and Segment Dynamics in the World’s Largest Current State of the Automotive Market

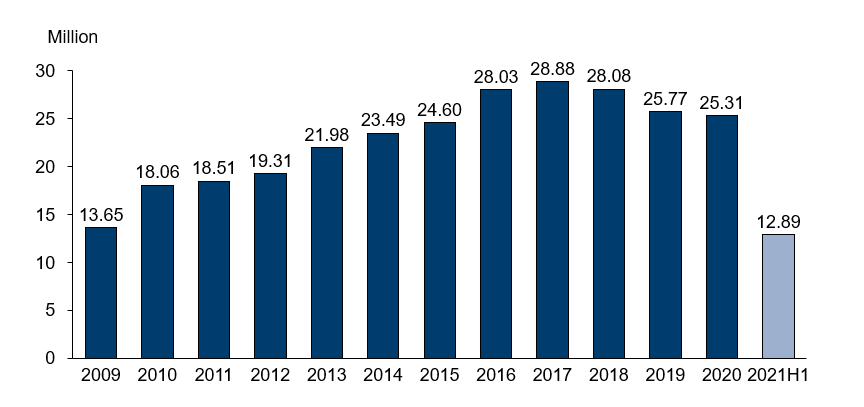

China’s automotive industry continues to undergo fast and major changes. Though still below the pre-pandemic levels due mainly to a shortage of semiconductor chips, automotive sales in China rose 25.6 percent year-on-year to over 12.89 million units in the first half of 2021,【1】 making it the largest automotive market in the world for 12 consecutive years (see Exhibit 1). The impact of the chips shortage on China’s automotive production is expected to persist throughout 2021 and 2022.

Exhibit 1

China’s Total Automotive Sales (2009-2020, 2021H1; by Number of Vehicles)

Source: China Association of Automobile Manufacturers

Given the continued policy support by the government, new energy vehicles (NEVs) continue to grow at the expense of vehicles with internal combustion engines (ICE). According to the New Energy Vehicle Industry Development Plan (2021-2025) issued by the Ministry of Industry and Information Technology (MIIT), China’s NEV sales will jump from 10 percent to 20 percent of overall new car sales by 2025.

Along the way, developments in battery technology, charging methods, software and hardware will continue to evolve and competition in these segments shall become more intense. With battery shortage becoming a serious problem, competition among battery suppliers in terms of product development and geographical expansion continues to intensify. CATL, China’s homegrown lithium-ion battery leader, announced a sodium-ion battery on July 29th this year, aiming to ease lithium shortages. Geely, a leading Chinese automaker, unveiled its new joint venture (JV) plan with US battery manufacturer Farasis Energy in May this year for the research and development, as well as production and sale of lithium-ion batteries for electric vehicles (EVs) in China.

On the other hand, the Chinese government is actively investing in hydrogen energy also. Incentivized by government subsidies, 35 projects related to fuel cells, fuel-cell vehicles and hydrogen refueling stations, worth a combined 110 billion RMB (17 billion USD), have been initiated in China in the first five months of 2021.【2】 According to a report published by China Hydrogen Alliance, annual demand for hydrogen will reach 60 million tons by 2050 and hydrogen energy will account for over 10% of China’s energy consumption.【3】

New Shifts in the Competitive Landscape

The industry's competitive landscape is changing rapidly, partly driven by the market and partly by policies and technology.

The Chinese government announced the abolition of foreign ownership restrictions on manufacturing of NEVs and commercial vehicles in 2018 and 2020 respectively, and similar restrictions on passenger vehicles are expected to be done away within 2022.【4】 Previously, foreign OEMs could operate in China only through Sino-foreign JVs, in which the foreign partner could own only up to 50%. Since then, a number of original Sino-foreign JVs have been restructured. Volkswagen restructured its JV with Jianghuai Automobile Group (JAC) to have 75% ownership. Hyundai Motor has transformed Sichuan Hyundai into a wholly foreign-owned corporation - China’s first wholly foreign-owned commercial vehicles (CV) maker. Moreover, BMW has announced plans to increase its stake in its joint venture with Brilliance China Automotive from 50% to 75% in 2022, when all rules capping foreign ownership for all types of automotive ventures are to be lifted.

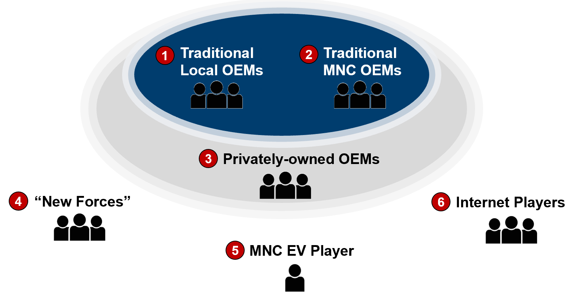

In addition to the traditional state-owned automakers and incumbent foreign players, both of which have been present in the China market for several decades, a range of “newer generation Chinese players”, most of whom are Chinese privately-owned enterprises have come about in the last decade or two. Some of them such as Great Wall, Geely and BYD have become formidable competitors in the market. As the NEV and intelligent and connected vehicles are gaining ground, other new players have also joined the game including Tesla, the Chinese “New Forces” of NIO, XPeng, Li Auto, tech companies such as Huawei and internet players Alibaba, Baidu and more recently Xiaomi (see Exhibit 2). Competition is becoming increasingly intense and is manifesting in many more dimensions than previously thought possible.

The structure of China’s auto industry will continue to be dynamic in nature, with influence of course, from the government. In a recent speech, Minister of Industry and Information Technology, Xiao Yaqing, warned that China has “too many” EV makers and the government will encourage consolidation.【5】 Last year, the national production capacity utilization rate averaged 53%, based on a report from Jiangsu provincial government submitted to the National Development and Reform Commission.【6】 For sure some players (could be both incumbents or new entrants) will win out and they will become highly valuable, while others will become marginalized or even ousted.

Exhibit 2

China’s Shifting Automotive Landscape

Source: Gao Feng Analysis

Xiaomi, for instance, a major Chinese player in smartphones and Internet-of-Things (IoT), has decided to enter the NEV market and is building a new model for disrupting the traditional business model. Its artificial intelligence (AI) voice interaction engine “Xiao Ai Classmate”, which reportedly has over 100 million active monthly users, can be directly applied to its future automotive products, thereby connecting vehicles with all other IoTs with the same AI engine. By recruiting Daniel Povey, an internationally renowned scientist in the field of speech recognition and AI, Xiaomi is working to step up its tech innovation capability in this regard.

Source: Baidu

As companies continue to search for new capabilities to compete in the new game, many have formed new corporate relationships. These relationships transcend the original category of ownership of the companies involved - Chinese state-owned, privately owned and foreign owned.

As such, the range and types of new corporate relationships have quickly diversified and become more sophisticated. Internet giant Baidu has set up an EV JV, Jidu Auto, with one of China’s largest local carmakers, Geely. This JV will leverage Baidu’s artificial intelligence and mapping technology, Apollo’s autonomous driving technology and Geely’s Sustainable Experience Architecture.

Meanwhile, another tech giant Alibaba Group is launching an electric car under a new brand “IM” (Zhiji Motor) in partnership with the major state-owned automaker SAIC Motor. Leveraging Alibaba’s advantage in big data and AI as well as SAIC’s experience in manufacturing, its first model is expected to roll off the assembly line in late 2021. In addition, BMW and Great Wall Motor have formed a 50/50 JV to produce EVs. And China’s three major state-owned automakers FAW Group, Dongfeng Motor and Changan have formed a JV for a ride-sharing platform called T3 Chuxing.

Implications of “Common Prosperity”

On August 17th, 2021, President Xi Jinping explained the concept of “common prosperity” at the Central Finance Committee Meeting. He said, “Common prosperity is an essential requirement of socialism and a key feature of Chinese-style modernization.” The key objective of common prosperity is to reshape the societal structure from a pyramid to an oval shape with the bulk representing the middle class. One can expect continued growth in demand for a wide range of products and services that lead to better health and a better lifestyle.

This is part and parcel of the other major policies that the Chinese government has announced over the last year or so, including “dual circulation” economic policy, focus on technological innovations for technological self-sufficiency, major regional city clusters and revitalization of rural areas, digital currency and carbon neutrality by 2060, and others. Together, they form China’s pursuit of what Dr. Edward Tse, CEO of Gao Feng Advisory Company calls, “modernity with Chinese characteristics.”

What does this mean to China's automotive industry and how should its participants re-think their strategies?

As China pursues technological innovation and eventual self-sufficiency, and as environmental sustainability becomes a major imperative for the country, NEVs no doubt will continue to be a major area of focus for development and investment. Also, the associated digital infrastructure will also become a focus.

The common prosperity policy aims at driving China’s income structure such that the societal structure becomes more oval in shape and to achieve a persistent increase in the average income. As such, the demand in various segments of the automotive market will also continue to evolve. While the Chinese government pursues building of a range of key megacity clusters, it is also embarking on a major initiative for rural re-vitalization. As such, besides the top end of the product-market structure, the lower end will also evolve further.

Additionally, as technology usage continues to expand, Chinese consumers are demanding more innovative applications of intelligence and connectivity as well as assisted driving capabilities in vehicles.

The pursuit of common prosperity means at the most fundamental level, all businesses would be expected to take better care of their employees, with more benefits and more reasonable working hours. To this end, Geely has already proposed a program of offering 350 million new shares (3.56% of total equity) to employees.【7】

Societal impact and contribution will have to be increasingly important considerations for companies. “ESG” (environment, society and governance) and corporate social responsibilities will have to be assigned greater weightage by companies and investors.

Source: Baidu

In this vein, companies across many sectors will need to address some fundamental questions. For instance, global automotive OEMs need to decide how much of their manufacturing and supply chain they should shift into, or out of, China. To what extent should China remain the hub of their supply chains? As China’s automotive industry is becoming more intelligent, connected and autonomous, by definition OEMs will generate and capture data in China. They must find ways to satisfy China’s data security law while foreign-owned companies will need to satisfy their home country’s data security requirements also.

More profoundly, the fundamental nature of some of the businesses will change to some extent. As smart cities which serve the public agenda come up all over China, business models of a range of industries will need to integrate significantly with public infrastructure. China alone has over 300 smart city projects, with wide ranging participation from industry and government organizations. An essential part of a smart city is smart transportation, aiming at decreasing traffic congestion, improving air quality and road safety, and better serving citizens' travel needs.

As such smart infrastructure is being embedded in smart cities to support these ideas. This infrastructure is providing a strong foundation for a cooperative vehicle infrastructure system that will profoundly influence the design of intelligent and connected vehicles and eventually autonomous vehicles.

As this context evolves, private-sector businesses in some sectors shall no longer be able to define strategic and operational parameters entirely by themselves. Close coordination and collaboration with the public sector will become necessary. Intelligent and connected vehicles, autonomous vehicles, as well as mobility-as-a-service will likely be affected.

Perhaps new ventures in the automotive sector taking the form of public-private partnerships (PPPs) and new ecosystems of government, state-owned enterprises and private sector companies will be formed. Automotive players shall have to critically examine the continued vitality of their partnerships and relationships in China.

Automotive executives and strategists need to evaluate to what extent these changes will impact their business strategies and business models. Common prosperity and other relevant policies will lead to many changes in China’s automotive industry which has already turned into a major but sophisticated market with hyper and emergent competition, constantly experiencing the impact of highly influencing policies, intensive innovations and highly varying and demanding customers, besides change patterns in many other parts of the world. Getting it right won’t be trivial and is highly necessary.

Acknowledgement

The authors would like to thank Dr. Edward Tse, CEO of Gao Feng Advisory Company, and Jeff Lin, CEO of Smart Republic and Managing Director, Gao Feng Advisory Company, for their guidance on the content and thought process.

References:

1. Ministry of Industry and Information Technology Equipment Industry Development Center. (2021, August 26). China Automotive Industry Development Annual Report 2021. Retrieved from http://www.miit-eidc.org.cn/art/2021/9/1/art_88_14076.html

2. Xi, Y. (2021, June 24). China to spend billions on hydrogen vehicles despite a minimal supply of clean H2. Rechargenews.com. Retrieved from https://www.rechargenews.com/energy-transition/china-to-spend-billions-on-hydrogen-vehicles-despite-a-minimal-supply-of-clean-h2/2-1-1030196

3. Xu, J. & Mehta, D. (2021, August 13). Hydrogen energy could be key to carbon neutrality in the People’s Republic of China. Asian Development Blog. Retrieved from https://blogs.adb.org/blog/hydrogen-energy-could-be-key-carbon-neutrality-people-s-republic-china

4. Ministry of Commerce of the People’s Republic of China. (2018, June 28). Special Administrative Measures on Access to Foreign Investment 2018 (“the Negative List”). Retrieved from http://www.mofcom.gov.cn/article/b/f/201806/20180602760432.shtml

5. China to consolidate overcrowded electric vehicle industry. (September 13, 2021). Reuters. Retrieved from https://www.reuters.com/business/autos-transportation/china-has-too-many-auto-companies-now-consolidation-needed-minister-2021-09-13/

6. China Vows to Consolidate the Bloated Electric Vehicle Industry. (September 13, 2021). Bloomberg. Retrieved from China Has ‘Too Many’ Electric Carmakers; M&A to be Encouraged - Bloomberg

7. Geely revs up case for wider employee stock awards. (September 1, 2021) Reuters. Retrieved from https://www.reuters.com/breakingviews/geely-revs-up-case-wider-employee-stock-awards-2021-09-01/

About the Author

Lu Zhang is the Consulting Lead at Smart Republic and a Project Manager at Gao Feng Advisory Company based in Shanghai. She spent over 17 years living and working in the UK, where she held positions at HSBC and Jaguar Land Rover. She returned to China in 2018 to take on the role of Strategy Director at Country Garden, a major property developer, with a focus on the automotive sector, as well as subsequently Head of China Strategy at Canoo Electric, an EV company.

Charlson Tang is a Senior Consultant at Gao Feng Advisory Company based in Shanghai. He has served multiple Fortune 500 companies and leading companies in China. He specializes in market entry strategies, corporate growth strategies and business model design.

Rachel Hu is a Senior Consultant at Gao Feng Advisory Company based in Shanghai. She had consulted many clients in both China and Australia, focusing on growth strategy, new market entry and business model design. She has worked with clients across many sectors including automotive and connected mobility, healthcare, industrials and technology.

Melody Mao is a Senior consultant at Gao Feng Advisory Company based in Shanghai. She has provided consulting services to both multinational and local clients, and is experienced in automotive, real estate, technology and healthcare sectors, focusing on market assessment, growth strategy and new market entry.

Gao Feng Advisory

Gao Feng Advisory Company is a professional strategy and management consulting firm with roots in China coupled with global vision, capabilities, and a broad resources network

Wechat Official Account:Gaofengadv

Shanghai Office

Tel: +86 021-63339611

Fax: +86 021-63267808

Hong Kong Office

Tel: +852 39598856

Fax: +852 25883499

Beijing Office

Tel: +86 010-84418422

Fax: +86 010-84418423

E-Mail: info@gaofengadv.com

Website: www.gaofengadv.com

Weibo: 高风咨询公司