Viewpoint | The Landscape of China's Electric Vehicle Industry

The Fast-Evolving Landscape of China's Electric Vehicle Industry

By Edward Tse, Rachel Hu and Zoey Zhang

June 2022

A recent Gao Feng Advisory Viewpoint authored by CEO Dr. Tse, Senior Consultants Rachel Hu and Zoey Zhang.

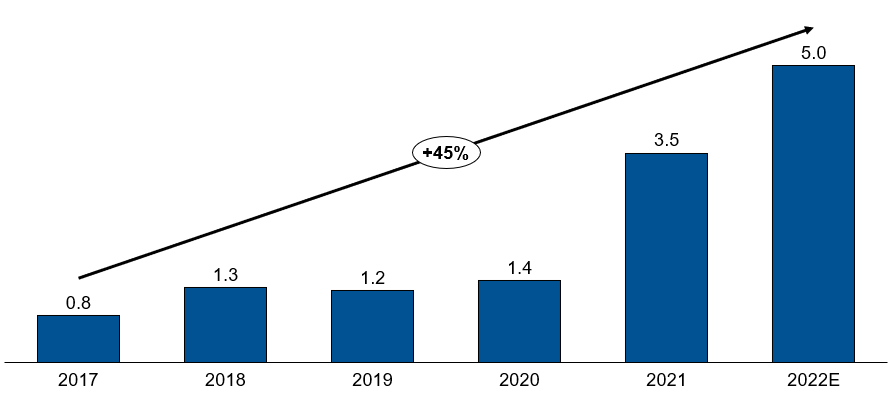

China is in the lead when it comes to global electric vehicles (EV) sales and deployment. Despite the COVID-19 pandemic and reduced government subsidies, production, and sales of EVs in China exceeded 3.5 million in 2021 (see Exhibit 1), making it the seventh consecutive year when China ranked first in the world. Going forward, China’s EV market is predicted to grow 30% year-on-year over the next five years.

Exhibit 1

EV Sales in China (Millions)

Source: China Association of Automobile Manufacturers

The Ever Evolving Playing Field

The already competitive EV market in China has become even more crowded and competitive recently. Incumbent local players and the digital native “new forces” are dominant (see Exhibit 2). Specifically, traditional state-owned enterprises (SOEs) such as SAIC and GAC are cooperating on development and production of electric and intelligent vehicles, auto-related services and exports; likewise, privately-owned enterprises (POEs) like Geely and Great Wall are making similar moves both individually and with other partners. Local digital natives like XPeng, NIO, and Li Auto have more than doubled their sales on a year-on-year basis, selling more than 98,000, 91,000 and 90,000 EVs respectively in 2021. Tesla, another digital native, was the only foreign-owned car maker to be ranked among the top 3 in terms of EVs sold in China last year (BYD ranked 1st and GM’s joint venture with SAIC and Wuling, SAIC-GM-Wuling, ranked 3rd).

Exhibit 2

China’s EV Competitive Landscape

Source: Gao Feng Analysis

Foreign incumbents such as the US automaker General Motors (GM) also continue to make headway in China’s EV market. The Hong Guang MINI EV, a car produced by SAIC-GM-Wuling, is now the top selling EV model in China.

In addition to the incumbents and the new forces are tech heavyweights such as Baidu, Xiaomi and Huawei, who have all started to make moves in the EV space. Joining them are emerging EV specialists such as Human Horizons, Aiways, NETA Auto, WM Motor and Leapmotor, who make China’s EV market even more complex.

Despite the fast growth of the Chinese EV market, the large number of players in the market place will lead to more intensive competition. On one hand, that will drive more innovations and more customer-centric product designs. On the other hand, it will most likely lead to some degree of consolidation in the not-so-distant a future. While some will be swept away, the winners will become even more competitive, not only within China, but globally also.

Along the way, different business relationships continue to be formed, some creating new ecosystems. For example, tech player Huawei is undertaking a number of collaborative initiatives with local incumbents such as Chery, JAC Motors and BAIC’s Arcfox.

Incumbent EV maker BYD is now supplying EV batteries to Tesla, making BYD both a supplier and a competitor of Tesla. In addition, as of June 8, 2022, BYD’s market capitalization has reached US$128.8 billion, which means it has replaced Volkswagen as the world’s third-biggest automaker by market capitalization, while its “NEV” (new energy vehicles which include both BEV (battery electric vehicles) and PHEV (plug-in hybrid electric vehicles)) sales in the first half of 2022 has become the world’s largest. This signifies how the Chinese automakers can become a globally dominant force as the auto industry makes the transition to EVs.

Driving Forces

What differentiates China’s EV market from others? Three main driving forces complement each other in China: policy support, technology innovation and demand pattern changes.

From the policy perspective, as China moves towards achieving carbon neutrality in 2060, transitioning to EVs will be pivotal to the goal. Also, China continues to strengthen its manufacturing. By creating an EV “new lane” in the automotive industry, it not only offers a solution for carbon neutrality but also a way to open up a new arena of manufacturing in which an entirely new ecosystem can be created. With China aiming to have sales of EVs accounting for at least 40% of all auto sales by 2030, automakers will be aiming to increase their EV outputs. While government subsidies have gradually decreased, they still continue and may be further extended. In addition, under the national plan led by the central government, policies have been rolled out to encourage construction of charging infrastructure to serve over 20 million EVs by 2025.

Technological innovations are also playing an important role in driving the growth of sales and brand value of EVs. Chinese enterprises obtained more than 30,000 patents related to new energy vehicles, accounting for 70% of the global total, in 2021. Beyond just EVs, the entire mobility experience is becoming more intelligent and connected. Disruptive technologies such as 5G, artificial intelligence (AI), Internet of Things(IoT), cloud computing and blockchain are being applied to this space, creating newer functions and designs. Important breakthroughs such as 4D millimeter wave radar, high-power autonomous driving chips, and the computing power of AI have further impacted the future of EVs in China.

Chinese consumers have become very digitally-savvy to begin with, and consumer demand patterns are becoming more diversified as mobility continues to evolve. Consumers are looking for more personalized and user-centric experiences in the modern lifestyle. Thus, the nature of cars, especially EVs, is being fundamentally redefined. Beyond being a mere means of transportation, it is increasingly becoming a mobile terminal where people live and work. In China, more EVs will compete in software features and functions in the near future. For example, in-vehicle intelligent cockpits are going to establish high-speed channels for connecting different smart devices to facilitate diverse lifestyles at different places, including traveling, working, and living, which will gradually expand the users’ shared ecosystem for a more digital and intelligent experience within the vehicle. Thus, OEMs are also required to understand and consider various customer needs such as safety and reliability, connectivity, convenience, cyber security and others, when designing the future products.

China’s Role in the Global EV Arena

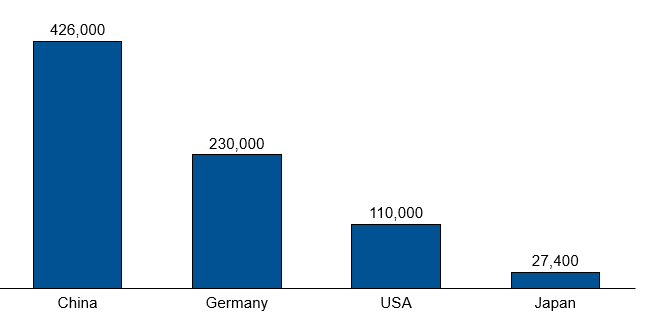

China will shape the design of the EV in the future. Already, it is a manufacturing epicenter and major export base. Today, China accounts for nearly 60% of global EV production; according to the China Association of Automobile Manufacturers, the number of EVs exported in 2021 increased to over 400,000 units (see Exhibit 3). In particular, China’s EV exports to Europe rose fivefold to 230,000 units, with the region absorbing half of China’s total EV exports.

Exhibit 3

EV Exports by Country 2021

Source: Statistisches Bundesmat, China Association of Automobile Manufacturers

Not only will China innovate for China, but China will also be innovating for the World. China dominates the global supply of EV batteries and is leading new innovations in battery technology. NIO has announced it is planning to launch EVs that shall have a driving range exceeding 1000km. This will be based on innovative solid-state battery cells which, per rumors, are to be supplied by Beijing based WeLion.

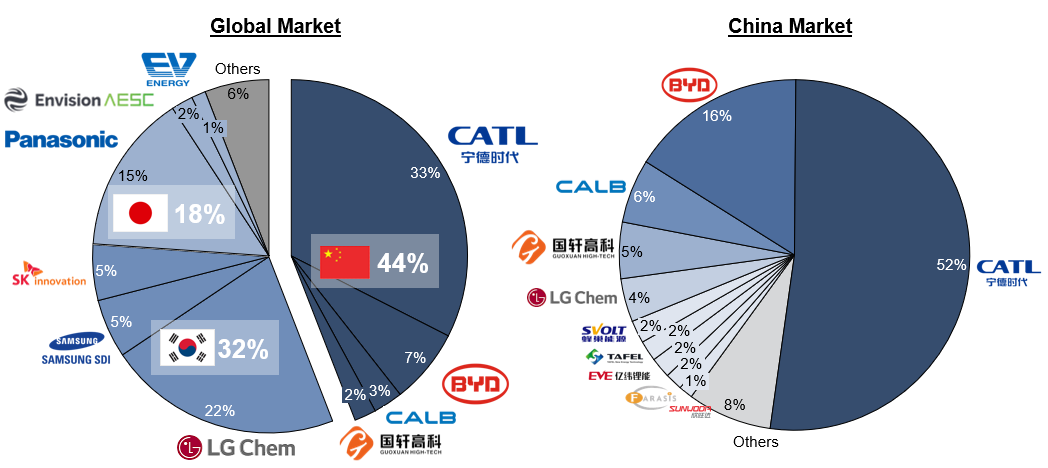

CATL has a commanding lead in global EV battery supply, and has become the first company in the world to obtain UNECE Access Certification for EV Batteries, paving the road for further growth in Europe. Having expanded manufacturing into Germany, CATL has also announced an investment of US$6 billion in the battery industry in Indonesia, to further establish a foothold in South East Asia. CATL recently unveiled its next generation EV battery Qilin with a one-charge range of 1000km, which is more efficient than currently available batteries and enables electric cars to travel longer. According to CATL, the Qilin battery achieves a new record for volume-based utilization efficiency at over 72%, and is expected to be mass produced and come on the market in 2023, aiming to promote replacement of fossil fuel vehicles by electric ones.

BYD, the second largest Chinese player in battery supply, introduced new bladed battery cell technology in 2020, which features greater energy density as well as greater safety. Also emerging players such as CALB, Gotion High-Tech and others are trying to capture market shares.

Competitors such as South Korea’s LG Chem, Samsung SDI and SK Innovation and Japan’s Panasonic are also riding the wave of growing demand for EV batteries (see Exhibit 4). As the current boom in battery demand continues, battery players will continue to innovate and compete for raw materials. More movers will emerge from the US and Europe to vie with the Asian dominant incumbents.

Exhibit 4

Top 10 EV Battery Manufacturers in the World and Top 10 EV Battery Manufacturers in China

Source: SNE Research, China Automotive Battery Innovation Alliance

Revolutionizing Relationships between OEMs and Suppliers

With technology commercialization becoming increasingly critical as the automotive industry moves aggressively towards electrification, the customer-supplier relationship becomes even more critical. While the China and the global market will continue to expand, we expect some consolidation to take place. Along the entire value chain, the relationship between OEMs and their suppliers is being fundamentally redefined. Going forward what does it mean?

Changing demand patterns and new innovation fundamentally redefine the relationship between OEMs and suppliers. In the past, OEMs and suppliers followed a linear and hierarchical relationship as suppliers supply parts and components to the OEMs according to specifications designed by the OEM. In contrast, now OEMs and suppliers have to start working together at the ideation or conceptualizing stage of a new product, making the relationship increasingly symbiotic.

Thus, OEMs have begun to shift the approach toward management of suppliers from short-term control to long-term control, from technical quality control to financial and operational control. There’s a trend of increasing cooperation and integration between upstream and downstream players. For example, OEMs now often require their suppliers to proactively offer their financial data, cooperate with OEM inquiries, and adopt internal control measures promoted by OEMs. Due to their active cooperation with OEMs, components suppliers are adopting advanced management tools, leading to win-win situations for both OEMs and component suppliers and a more robust ecosystem.

Implications

With the aim to establish itself as a global innovation leader, China has made great progress in technology innovation. China’s digital economy is now one of the largest in the world. As part of its transformation from a low-cost manufacturing hub to be a higher value-added innovation-led economy, more innovations are coming from China and these will spill over to many other parts of the world. Innovations in areas such as 5G, autonomous driving, cloud computing, AI, and IoT, are reshaping various sectors, especially in the automotive industry.

Supported by advanced technological developments, some of Chinese EV OEMs will become bona fide global competitors with innovative products, global strategies and government support. As Chinese manufacturers move up the value chain, various OEMs now produce desirable, safe and technologically advanced EVs. A few Chinese brands have a fair shot at being ranked among the world’s most successful brands. Chinese OEMs are actively participating in overseas investments and partnerships to expand their global footprint, making them global competitors.

Both the central and local governments in China have continued to provide substantial support to the industry, including subsidies, and direct sponsorship of new production plants, R&D centers and overseas acquisitions. We anticipate more fierce competition among different players in both domestic and global EV markets in the near future. Consolidation and emergence of new players will happen at the same time, resulting in the industry landscape remaining complicated until the dust really settles down. Everyone needs to think about its strategy for growth and for protection. There is no time for self-indulgence.

About the Authors

Dr. Edward Tse is founder and CEO, Gao Feng Advisory Company, Adjunct Professor of School of Business Administration at Chinese University of Hong Kong, Professor of Managerial Practice at Cheung Kong Graduate School of Business, and Adjunct Professor at the SPACE program of University of Hong Kong. He is a member of Global Future Council on China at the World Economic Forum, as well as a member of advisory boards for private equity and venture capital companies. He started his strategy consulting career at McKinsey’s San Francisco office in 1988 before returning to Greater China in the early 1990’s. He became one of the pioneers in China’s management consulting industry, by building and running the Greater China operations of two leading international management consulting firms (BCG and Booz) for a period of 20 years. He has consulted to hundreds of companies, investors, start-ups, and public-sector organizations (both headquartered in and outside of China) on all critical aspects of business in China and China for the world. He has also advised the Chinese government organizations at different levels on strategies, state-owned enterprise reform and Chinese companies going overseas, as well as to the World Bank and the Asian Development Bank. He is the author of several hundred articles and five books including both award-winning The China Strategy (2010) and China’s Disruptors (2015), as well as 《竞争新边界》 (The New Frontier of Competition), which was co-authored with Yu Huang (2020). He holds a SM and a SB in Civil Engineering from the Massachusetts Institute of Technology, as well as a PhD and an MBA from University of California, Berkeley.

Rachel Hu is a Senior Consultant at Gao Feng Advisory Company based in Shanghai. She has consulted many clients in both China and Australia, focusing on growth strategy, new market entry and business model design. She has worked with clients across many sectors including automotive and connected mobility, semiconductor, healthcare, industrials and technology.

Zoey Zhang is a Senior Consultant at Gao Feng Advisory Company based in Shanghai. She had provided consulting services to many multinational companies and local clients in both China and U.S, across many sectors including financial services, automotive, semiconductor, technology and industrials. She specializes in new market entry, strategy formulation and business model development.

Gao Feng Advisory

Gao Feng Advisory Company is a professional strategy and management consulting firm with roots in China coupled with global vision, capabilities, and a broad resources network

Wechat Official Account:Gaofengadv

Shanghai Office

Tel: +86 021-63339611

Fax: +86 021-63267808

Hong Kong Office

Tel: +852 39598856

Fax: +852 25883499

Beijing Office

Tel: +86 010-84418422

Fax: +86 010-84418423

E-Mail: info@gaofengadv.com

Website: www.gaofengadv.com

Weibo: 高风咨询公司